There are a lot of flaws with the traditional banking system.

It’s expensive, it’s risky and it involves a ton of regulation to make sure it doesn’t fall apart. Even then, it still falls apart every 10 to 20 years.

Nobody would have created this Frankenstein’s monster. It just sort of evolved over the centuries into what we have now.

Financial Technology, aka fintech, gives us a way to rethink the whole system. And two companies have been wildly innovative within the fintech space: PayPal Holdings Inc. (Nasdaq: PYPL) and Square Inc. (NYSE: SQ).

Is one of these high-growth fintech stocks better for your portfolio?

Let’s find out in this week’s edition of Investing With Charles.

Here are some of the highlights of my conversation with Money & Markets research analyst Matt Clark:

Fintech Innovations: PayPal and Square

Charles: When PayPal came out in the ’90s, it was like: “Wait, what? I don’t have to write a check and put a stamp on the envelope and send it? I can just send people money via email, but is that safe? How does that work?” That seemed so edgy and different back then, and now it’s standard.

Everything else has been an evolution of that.

Square has done wonders for small businesses. The babysitter, for crying out loud, can take credit cards now with Square. That’s how easy it is.

Both companies are establishing their second generation of products. PayPal’s Venmo has become the standard for easy transactions. You go to dinner with your friends, and the bill comes. It’s a lot easier for one person to pay the bill and everybody Venmos them the cash. I pay my yard guy with Venmo. I pay my kid’s soccer coach with Venmo. It’s an easy way to move money around.

Square’s competing product, Cash App, is similar to Venmo. One’s as good as the other, so it boils down to what your friends use.

This is what you get through incremental evolution. When you look at these apps, this is more like what a proper financial system would look like if you were inventing one from scratch. And for a lot of the world, that’s what’s happening.

Matt: Yeah, for all intents and purposes, you can receive the same basic services with Cash App or Venmo that you can get with Wells Fargo or Bank of America.

Charles: It’s a big deal, particularly for struggling consumers that are having a hard time getting onto the ladder. This is a nice stepping stone for them.

These companies are domestic in focus. The big growth potential here is just unrolling similar services around the world. That is the future of finance.

Fintech Stock to Buy: PayPal vs. Square

Charles: Both of these stocks are fintech. They’re fishing in the same pond. Their overall market is slightly different, but it’s still fintech. If you’re bullish on one, you would likely be bullish on both.

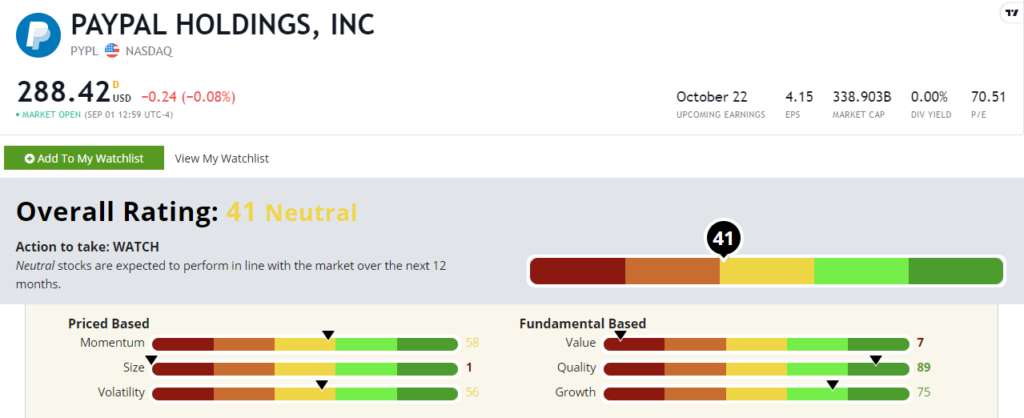

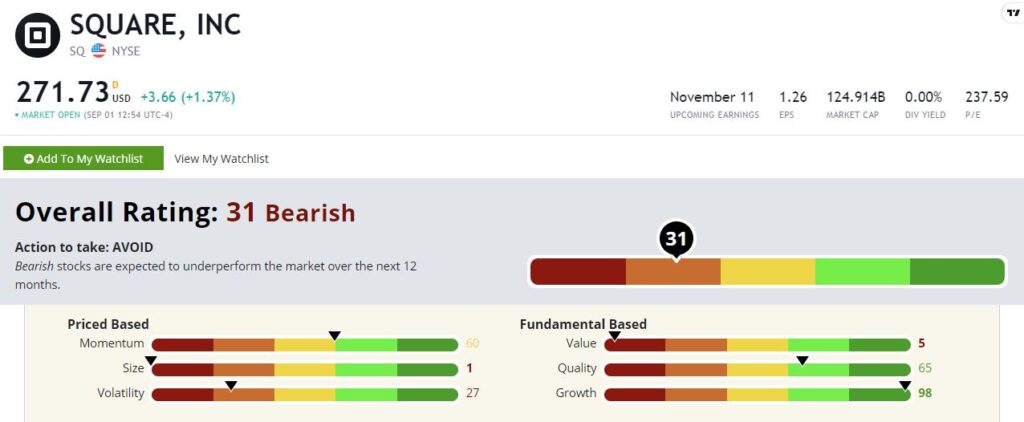

Breaking it down, we look at Adam O’Dell’s Green Zone Ratings system. It measures stocks by six factors.

PayPal Inc.’s Green Zone Rating on September 1, 2021.

Cons

Both PayPal and Square rate poorly on size because they’re large. All else equal, smaller companies tend to outperform larger companies over time.

Both stocks are also expensive. They rate low on our value factor. Part of that is these are fast-growth companies, and so, because they’re fast growth, people bid up the prices.

They’re also volatile. These stock prices move around a lot.

Pros of These Fintech Stocks

These are both extremely high-growth companies. They’ve been growing like weeds for years, and there’s no end in sight to that. Their growth prospects look fantastic. They also have a decent amount of stock momentum.

Finally, these are high-quality companies. These are tech companies first and foremost. They have very healthy balance sheets because they are capital-lite. They have infrastructure, of course, but they don’t involve managing a huge network of banking branches.

They’re also highly profitable. They have high returns on equity, assets, etc. That’s part of the reason why these stocks are expensive. They’re high-margin, high-quality businesses that are growing like weeds. Both of them are similar in that respect. I liked them both. I think both are good long-term holdings.

To find out which of the two stocks Matt and I like more for a portfolio, click here to watch the rest of Investing With Charles.

Free Money & Markets Gear!

We still want to send you Money & Markets swag.

We tailor our content to what interests you. That’s why we feature your questions in our videos, including Investing With Charles, Ask Adam Anything and the Marijuana Market Update.

Just send your question to feedback@moneyandmarkets.com, and if we plan to use it in one of our segments, we’ll send you a free Money & Markets hat! (Sorry, but this is limited to our U.S. audience only at the moment.)

Click here to send us a question now!

Stumped on what to ask? Questions we’ve featured in the past include:

- Should I invest in some psychedelics now, just like cannabis from a few years ago?

- Should I trade ahead of a company’s earnings call?

Where to Find Us

Coming up this week, Matt will have more on The Bull & The Bear podcast, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where chief investment strategist Adam O’Dell answers your questions.

You can also catch Matt every week on his Marijuana Market Update. If you are into cannabis investing, you don’t want to miss Matt’s weekly insights.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you! We may even feature your question or comment in a future edition of Investing With Charles.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.