The first five days of trading on the U.S. stock market were solid, and that means Wall Street may be in for a good — but wild — year, based on an old indicator.

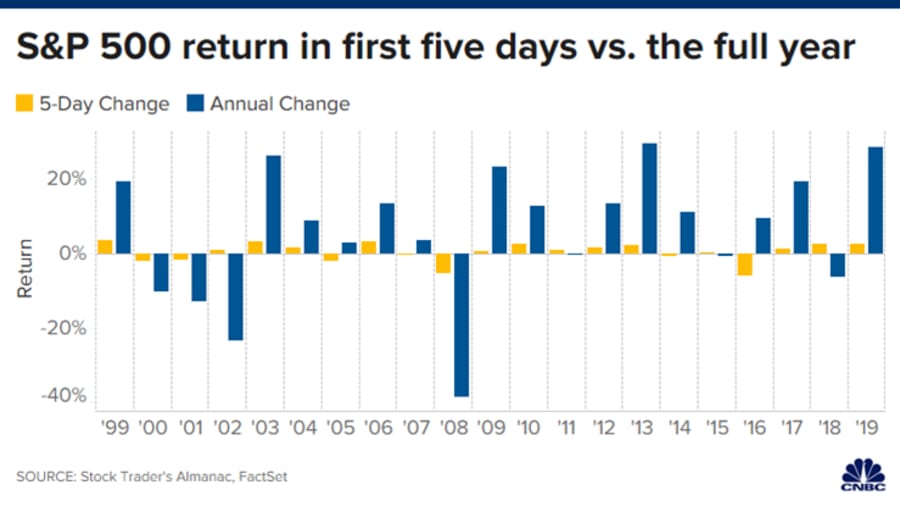

The indicator, known as “first five days” rule, shows that if the stock market trades up to start off a calendar year, the rest of year has a very good chance of following suit. This rule has been studied by the Stock Traders Almanac all the way back to 1950.

The data shows the S&P 500 was positive 82% of the time at the end of the year if the first five days were positive as well. What may be even better is that the average gain in those positive years was 13.2%, according to CNBC.

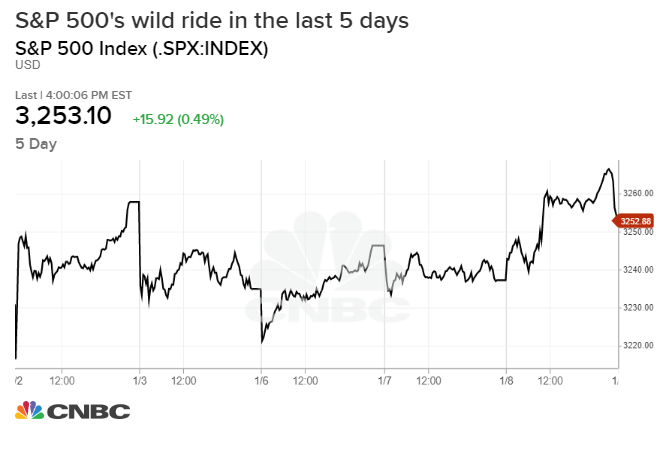

Despite one rough trading day that saw the S&P 500 fall 0.7% Jan. 3 after a U.S. missile strike killed Iranian Gen. Qassem Soleimani at the Baghdad International Airport, the index still managed to trade positively over the first five days, gaining around 0.7%.

Investors came back in force Monday after the dust had settled and boosted the S&P 500 back up 0.4%, but it was forced down again 0.3% Tuesday amid questions on whether the U.S. and Iran would further escalate the situation in the Middle East.

Iran retaliated for the assassination of Soleimani on Tuesday by firing multiple cruise missiles at two Iraqi bases housing American troops, which sent Wednesday’s futures downward.

But investors once again bolstered the S&P 500 to record highs during Wednesday trading after U.S. President Donald Trump confirmed that no casualties occurred during the Iranian strikes, and signaled that Iran was “standing down.”

So while the first five days have been positive for the stock market, there has been no lack of volatility, and LPL Financial Senior Market Strategist Ryan Detrick expects that to continue.

“No doubt worries over Iran have investors on edge,” Detrick said in a note. “Stocks could be volatile for a while, but the impact to stocks from geopolitical events historically has tended to be short-lived.”

Wall Street analysts see more volatility in 2020 as the U.S. and China continue to work out a new trade deal. The uncertainty of an election year is also something that will most likely jolt the market up and down.

So far so good, though, and positive trading in the first five days also sets up another seasonal gauge that traders love to track, the January barometer, which we’ll be sure to keep an eye on.

While the first five days have been a boon for traders, another reliable and simple tracker, the “Buffett indicator” shows that stock market caps are far outweighing GDP, which was precursor to the dot-com crash of the early 2000s and the Great Recession in 2007.

So far though, 2019’s bull market has continued charging into the start of 2020, so investors may be in for a good, but bumpy ride.

To our friends: A former hedge fund manager exposes how Wall Street is failing American investors and shows how to prepare for the end of the bull market.