This week, I want to talk about the ongoing spat between the state of Florida and Walt Disney Co. (NYSE: DIS).

When it comes to investing, I try my hardest to leave my political views, to the extent that I even have them anymore, at the door.

I want to be as objective as possible because whenever I insert my own political ideology, I stop looking at the data. I start thinking with my emotions. And at that point, I’ve already lost the game.

It’s why we have the Stock Power Ratings system.

But I want to talk about this because Disney is a huge company with a lot of investors. You might be wondering if DIS is still a stock worth owning.

Let’s break it down in this week’s Investing With Charles.

Take Politics Out of Your Portfolio

Let’s forget about all current events right now and start with the fundamentals: Should you engage in what used to be called “socially responsible” investing? We’ll just call it politically charged investing.

You do have to have a conscience and you have to invest in a way that doesn’t make you feel bad or doesn’t make you feel guilty.

But I would really recommend that you keep that to an absolute minimum and try to be objective when you look at companies. Look at the numbers. Look at our Stock Power Ratings, for example. It’s an objective system because whatever matters to you or me today, it may not even matter to you next week.

And you could have lost a great investment opportunity in the meantime. Or an investment could end up going badly because it fit whatever political narrative you’re wanting to fit.

What’s Going on With Disney

So Florida came out with a law that was fairly controversial about what can and can’t be taught in classrooms.

You almost have to feel bad for Disney’s CEO, Bob Chapek. He wanted no part of this. He did not want Disney to become a political punching bag. He was happy to sell Mickey Mouse ears, make movies, run his theme parks and not put his or anybody else’s political views out there.

He wanted to run his company and be left alone, and that was his original course.

Some of his employees were upset. They felt the law targeted them and they weren’t happy that Disney didn’t come out in opposition.

And so you had employee unrest. You had employees walking out, and Disney’s management had to deal with it.

Now, the responsibility of a corporation, in good old-fashioned, Anglo-Saxon capitalism is to maximize the value of its shareholders. Companies exist to make their owners wealthy. That’s the whole point.

But labor relations are part of that. You can’t make your investors wealthy if your employees are walking out. Managing your employees and keeping them happy and selling those Mickey Mouse ears … that’s a big part of creating that shareholder value.

And so Disney stepped in. It came out with some statements against the new law. Florida Governor Ron DeSantis came down with a hammer and successfully lobbied to have some of Disney’s preferential tax treatment stripped away.

So, the whole thing, to me, does seem a bit silly.

I don’t know what world we live in — where you go after one of your state’s largest employers, whatever its political views are.

To me, that just seems like a risky move, to go after the people hiring your state citizens. But that’s what happened.

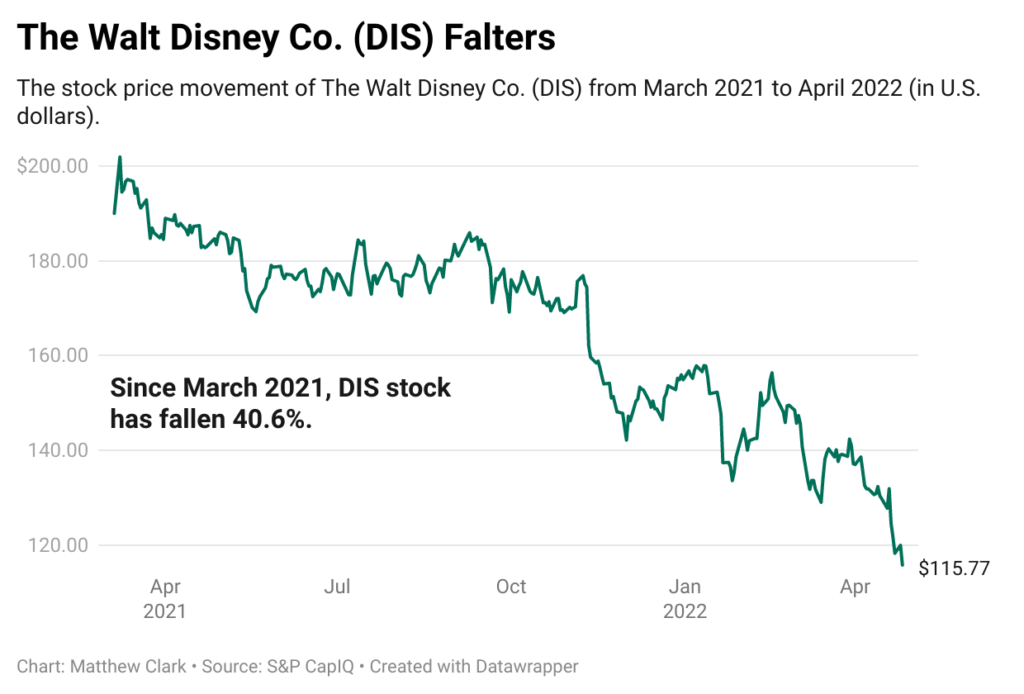

Now, Disney’s stock price has been in the doghouse now for a while, and this raises the question: Is it because of the situation in Florida? Or is there something else going on here?

Why Disney Stock Is Really in the Dumps

Disney’s stock price was already tanking, long before this little political scuffle broke out.

Now, the recent news accelerated the decline a little bit.

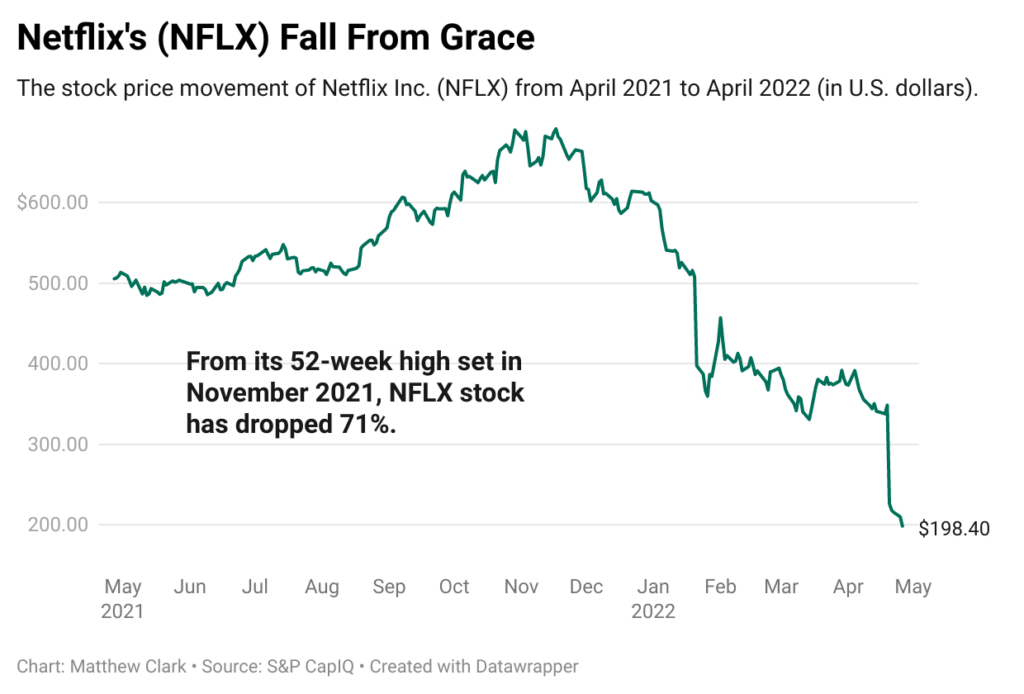

But if you compare the performance of Disney’s shares to Netflix Inc.’s (Nasdaq: NFLX), there are parallels because Disney and Netflix are direct competitors in the streaming space.

Netflix doesn’t run theme parks, make theater-presented movies or sell Star Wars action figures. But the two are major competitors in streaming.

And both companies were initial beneficiaries of the stay-at-home stock trade. During the pandemic, stocks that catered to the at-home experience did really well.

Netflix did well during the pandemic. Disney was a bit more mixed, but it has all these other businesses that were affected by the pandemic.

But the streaming space is more saturated today. It’s not growing as quickly as it was, and now that the world’s opened up again, the fear on Wall Street is that: “OK, this growth story is over.”

That’s what really drove Disney’s poor performance and the reason the stock is still suffering today. Disney will probably recover about the time Netflix does. The two are really getting beaten up by the same forces.

Is Disney Worried About Taxes?

There isn’t a good estimate out there right now of what Disney’s real liability is. In a worst-case scenario, the numbers I’ve seen thrown out for Disney’s tax liability at the local level may jump by tens of millions of dollars: $10, $20, $30 million perhaps.

That sounds like a lot of money, but this is a company that generates tens of billions of dollars of revenue every year. If you were to increase their tax bill by $10, $20, $30 million dollars … that’s a rounding error. It’s not going to have any meaningful impact on its earnings.

Even if it did, how hard is it for Disney to just raise the price of admission tickets another couple bucks? Those prices go up a little every year. People will notice, but it’s not going to stop them from paying.

Bottom line: This shouldn’t affect Disney’s bottom line too much.

To see where Disney stock might be headed next, Stock Power Ratings analysis and a comparison to another company that got in a mix-up with the government, click here to watch the rest of Investing With Charles.

Where to Find Us

Coming up this week, Matt will have more on The Bull & The Bear podcast, so stay tuned.  Don’t forget to check out our Ask Adam Anything video series, where Chief Investment Strategist Adam O’Dell answers your questions.

Don’t forget to check out our Ask Adam Anything video series, where Chief Investment Strategist Adam O’Dell answers your questions.

You can also catch Matt every week on his Marijuana Market Update. If you are into cannabis investing, you don’t want to miss Matt’s weekly insights.

Remember, you can email my team and me at Feedback@MoneyandMarkets.com — or leave a comment on YouTube. We love to hear from you! We may even feature your question or comment in a future edition of Investing With Charles.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.