When trying to uncover the kind of investor you are, sometimes it helps to determine what you are not.

For example, here’s what I’m not:

- As I mentioned to Banyan Edge readers a couple weeks back, I’m not the kind of investor to solely “listen to my gut.”

- I’m definitely not chasing the easy trade of 2023 — mega-cap tech stocks.

- But I’m also not a Fed-watching, table-pounding permabear waiting gleefully for the financial endgame, either.

This already makes me a little bit different than what you may be used to seeing out there.

It might even make me seem a little bit boring…

But you know what? I’m thrilled to be boring.

Because being boring has led my Green Zone Fortunes subscribers to a near 400% return in the past three years on a stock I’ll tell you about today.

You’ve probably never even heard this stock’s name before. Yet, it’s outperformed nearly every mega-cap tech stock that’s mentioned on CNBC every hour of every single trading day.

In fact, those same stocks are this company’s biggest customers.

I assure you, this isn’t going to be a full-bore brag piece (even though I’d say we’ve earned it).

Instead, I’ll share the “Strong Bullish” ticker that my subscribers are up nearly 400% on… Show you why I saw this gain coming almost three years ago… And the simple, three-point method you need to use if you want to find stocks just like this one.

How STRL Quietly Bested Its Own Customers

Sterling Infrastructure (Nasdaq: STRL) is a stock market outlier you’ve probably never heard of.

It’s best described as a “picks-and-shovels” play on both e-commerce and cloud computing. Though, you wouldn’t know it from reading the company description.

The company used to focus on the relatively low-margin business of fixing roads, bridges and sewage systems. These days, its chief focus is building warehouses and data centers for the large companies who need Sterling’s infrastructure expertise…

That’s everyone from Amazon, Microsoft and Google … to Walmart, UPS and Home Depot.

All of these companies go to Sterling when they need help building out their digital and real-world logistics networks.

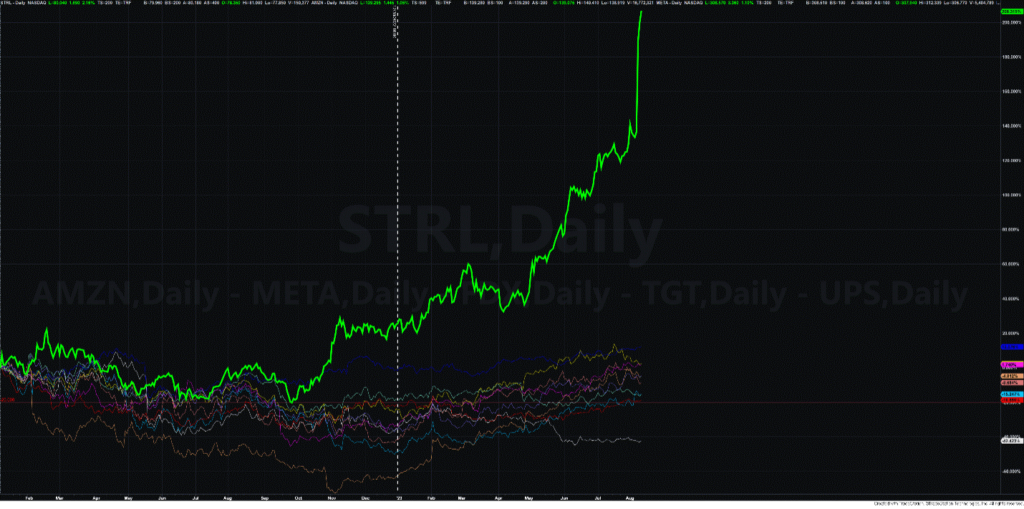

That’s why it should be no surprise STRL is up so big over the past few years. And up more year to date than all of its customers … save for META, which we’ll get to in a moment.

Even if we compare Sterling to its competitors in the infrastructure space, the returns from October 2020 hardly come close:

This outperformance doesn’t come from nowhere.

One big reason STRL is so head and shoulders above its competition (and customers) is that it’s one of just a handful of stocks that basically “skipped” the 2022 bear market.

STRL fell just enough to enter “bear territory” — a hair above 20% — but it’s nothing compared to the much deeper drawdowns mega-cap techs suffered.

You see, when a stock falls as much as some did during last year’s sell-off, you need an even bigger rally just to get back to breakeven. Less volatile stocks, like STRL, can recover much quicker.

And that brings me back to META…

META has outperformed STRL in 2023, by a smidge.

But, META was down 71% from January 1, 2022, to the worst point in November. Even though shares have rallied massively since, beating STRL’s year-to-date return, META is still down 4.4% from where it started last year. To contrast, STRL is up over 200% over the same time.

It’s the long-term returns that count. And here, STRL provides in spades.

Just look at this chart comparing STRL to all the other stocks in the first table above.

STRL’s Long Run Crushes Its Tech Peers

STRL has broken from the pack in spectacular fashion.

But why exactly is that the case?

Find the Golden Trifecta

There are lots of ways a company can generate positive returns for its shareholders. But few of them are as consistent as these three methods:

- Grow revenues.

- Expand profit margins.

- Earn a higher multiple on earnings.

It’s possible to make good money on a stock when even one of those three things happens. But the remarkable returns come when all three occur at the same time — something I call a “Golden Trifecta.”

Sterling has achieved this exact combination of return-driving qualities. And it didn’t do it because it’s simply a large-cap tech company coming out of a bear market.

It did it in spite of that … as a construction company that seems boring on its face, but screams value as soon as you look at its customer Rolodex.

In fact, the company’s value and growth were its biggest draws when I first recommended it. Its rating in my Green Zone Power Ratings system at that time was a perfect 100 on the Growth factor and 97 for Value. I put it to my subscribers like this…

A company can control how much it earns. But it can’t control how much investors are willing to pay for those earnings.

Through the price-to-earnings (P/E) ratio, we can see how much investors are willing to pay for each dollar of company earnings.

A high ratio — say, 30 times earnings — indicates investors will pay up to get in on the action. A low P/E ratio — say, 10 times earnings — shows either a lack of interest because earnings aren’t growing … or a blind spot.

In STRL’s case, it was a blind spot. I saw three years ago that the company was set to fulfill a need of the world’s biggest tech companies. And it was clear to me that not many other investors saw the same thing.

When I recommended it, the stock was grossly undervalued compared to its peers. In my original write-up of STRL, I said:

We’re buying into Sterling today at a price-to-earnings (P/E) ratio of just 8.3. That’s less than one-third of its competitors’ average valuation.

That means Sterling’s share price could triple — from $15 to $45 — and it would still be a better value!

As we see today, Sterling’s share price did triple … and then some.

And that’s precisely because it was a “boring” company that most investors never heard of … and is now one many investors are very much aware of.

If you’re a paid-up Green Zone Fortunes subscriber, I urge you to reread my original October 2020 recommendation on Sterling. You can access it here. There I go into the nitty-gritty of why STRL was such a clear success story in the making even back then.

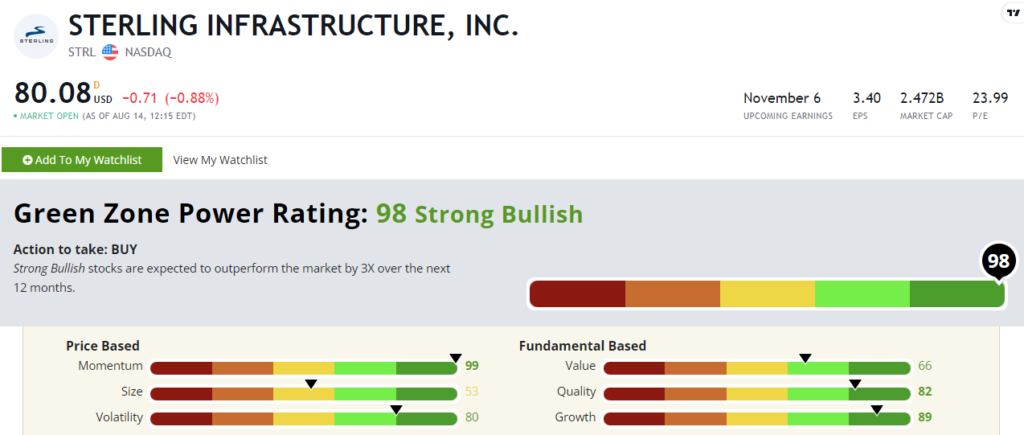

As for what to do with STRL now, my Green Zone Power Ratings system still flags it as a strong buy. It rates a 98 overall today — even higher than when I first recommended it:

I have a price target that I shared with Green Zone Fortunes readers, setting us up to capture a much bigger gain in what I hope is the near future.

If you want to learn how to join us, and get an alert to your email inbox when it’s time to sell, click here.

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets