Is the “fear of missing out” (FOMO) dead?

It might be a little too early to start planning a funeral, as the “FOMO” trade has proven to be remarkably durable. But we’ve definitely seen a marked shift in the market this year.

For instance, take a look at meme-stock darling Carvana (CVNA). Between the beginning of 2023 and the start of this year, the “car vending machine” stock shot higher by over 1,000% — delivering a 10X return.

But after reporting disappointing guidance for the first quarter on Wednesday, CVNA shares tanked after hours, dropping over 15%. Since its peak earlier this year, the stock is down nearly 40%.

At the same time, investors are rediscovering that “boring” industries in the real economy can produce fantastic returns. The top-performing sector so far this year has been energy, which is up a whopping 20%. Meanwhile, the S&P 500 Index is flat, and the technology sector as a whole is down.

Whether or not this trend continues remains to be seen…

So, let’s see what my system has to say about that.

We’ll take a look at what companies have recently popped up as “Bullish” on my Green Zone Power Ratings system, starting with the newly “Bullish” members of the S&P 500.

S&P 500 New Bulls

This year’s most dominant trend remains firmly in place.

With AI disrupting software companies – and the cost of building out AI infrastructure weighing on the “Magnificent Seven” – “old economy” stocks are thriving in 2026 while tech stocks are struggling.

The stodgier and more old-fashioned the company, the better it’s likely to perform this year. And this week’s list of newly “Bullish” S&P 500 stocks suggests that trend is likely to continue for a while.

At the top of the list this week is Kinder Morgan (KMI), which saw its rating jump almost 47 points to a “Bullish” 61.

Kinder Morgan is about as gritty and “old economy” as you can get. It owns a sprawling network of nearly 80,000 miles of pipelines moving natural gas, crude oil and assorted refined products. It’s not sexy, but it doesn’t need to be. Its pipelines are critical infrastructure that our economy cannot function without.

It’s worth noting that KMI shares also rate particularly well on my volatility factor with a factor rating of 81. (Remember, a high volatility score means that the stock price has low volatility, not fluctuating all that much.)

If the weakness we see in tech this year slides into a broader bear market, KMI could be a safe place to escape the worst of the volatility.

One more thing to consider: Kinder Morgan has been popular with income investors for years and currently sports a dividend yield of close to 4%.

While on the subject of low-volatility income stocks, conservative retail real estate investment trust (REIT) Realty Income (O) made the list this week.

Realty Income is about as close to a bond as you can get in the stock market. It owns a vast portfolio of high-traffic, “future proof” retail properties like convenience stores, pharmacies and “dollar” stores. The REIT pays a monthly dividend, which it has raised for 113 consecutive quarters, that currently yields about 5%.

The shares have rocketed higher by about 15% this year, which speaks volumes about investor sentiment. When arguably the most conservative stock in the S&P 500 is crushing the market’s return, it suggests investors are prizing safety above all else.

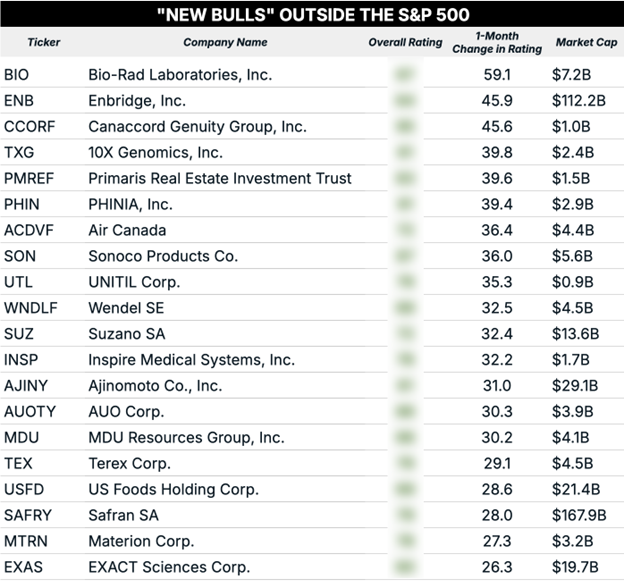

New Bulls Outside the S&P 500

Let’s cast the net a little wider and look at the newly “Bullish” stocks outside of the S&P 500. I ran a screen for the top 20 stocks that saw the greatest jump in their score over the past month.

A few companies here got my attention. Enbridge (ENB), like Kinder Morgan, operates a massive network of energy pipelines. In fact, its network is big enough to move about 20% of all the natural gas consumed in America.

Let’s be clear on one thing… “old economy” does not mean boring. Enbridge is a growth dynamo with a “Strong Bullish” rating of 95 on its growth factor. It also happens to have a rating of 91 on its volatility factor, so you’re getting growth and low-headache safety in the same package.

Perhaps not surprisingly, investors seem to have already taken notice. The shares rate a “Bullish” 68 on momentum.

Interestingly, several companies from our neighbors up north rated particularly well this week. Financial services firm Canaccord Genuity Group (CCORF), retail REIT Primaris Real Estate Investment Trust (PMREF) and airline Air Canada (ACDVF) all enjoyed massive bumps in their ratings over the past month and now rate as “Bullish.”

Keep in mind, Canada’s economy and stock market is highly dependent on commodities. So, the sudden rise of various Canadian stocks to the top of the list may be a byproduct of the powerful bull market we’ve seen recently in gold and commodities.

To good profits,

Adam O’Dell

Editor, What My System Says Today