With the S&P 500 hitting new all-time highs last week, we can say with certainty that the bull market rages on!

Last week’s push was driven by both tech news and Fed watchers …

On the tech front, Apple (AAPL) reported much better than expected sales in China on Monday. But the biggest tech news came at the end of the week.

Quantum computing stocks jumped on Thursday on reports that the Trump Administration was considering making direct investments in the sector. And on Friday, news broke that IBM had made a major breakthrough in quantum error correction… meaning that quantum computing may soon move out of the lab and into the real world.

And then we got good news from the “macro” world as well …

CPI inflation came in slightly less bad than feared, and Wall Street saw that as confirmation that the Fed will be delivering additional rate cuts this week.

We’ll see what Chair Jerome Powell has to say in his post-meeting comments on Wednesday. CPI inflation was lower than the 3.1% expected by economists, but at an annualized 3.0% it’s still fully 50% higher than the Fed’s stated target of 2%.

So, it’s possible that investors are putting a little too much faith in aggressive rate cuts… and that Powell might throw a wet blanket on the market on Wednesday. But for now, another rate cut looks likely, and stock market bulls are loving it!

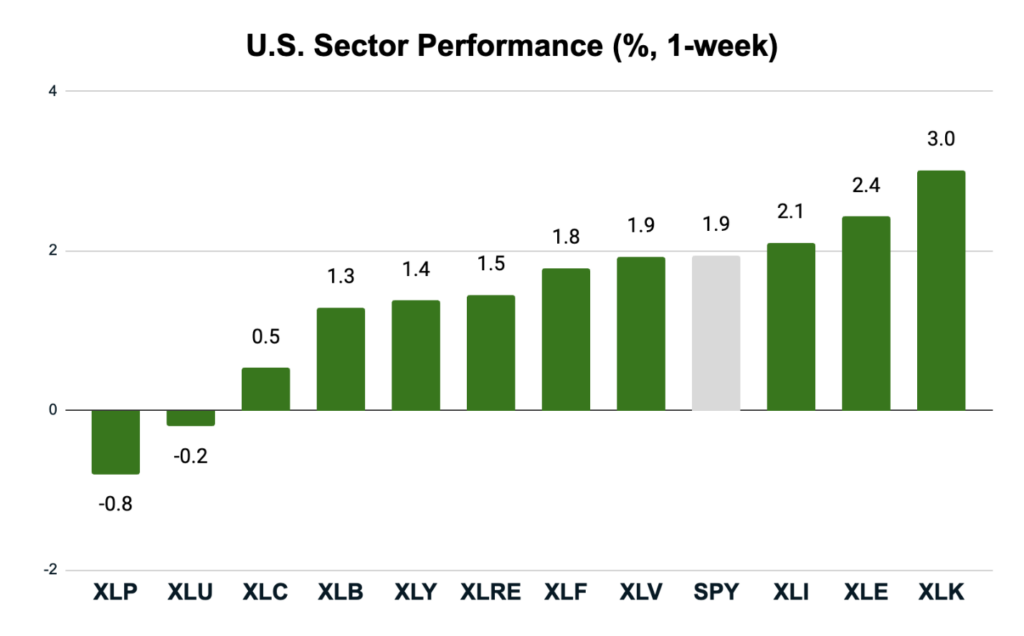

Let’s take a look at how each of the S&P 500’s 11 sectors did last week. Can you guess which sector led the market to new all-time highs? …

Key Insights:

- The S&P 500 (SPY) had a solid week, closing 1.9% higher.

- Three sectors beat the S&P 500, while eight lagged the index.

- The returns were skewed to cyclicals, with technology, energy and industrials leading.

- Conservative sectors performed the worst. Utilities and consumer staples finished the week slightly negative.

The takeaway here is clear: Greed, not fear, is driving the markets higher. In fact, the only fear we can detect in the market is the fear of missing out, or “FOMO.”

A FOMO market will favor growth-oriented tech stocks. So, let’s review how some of these leading tech stocks look through the lens of my Green Zone Power Rating system.

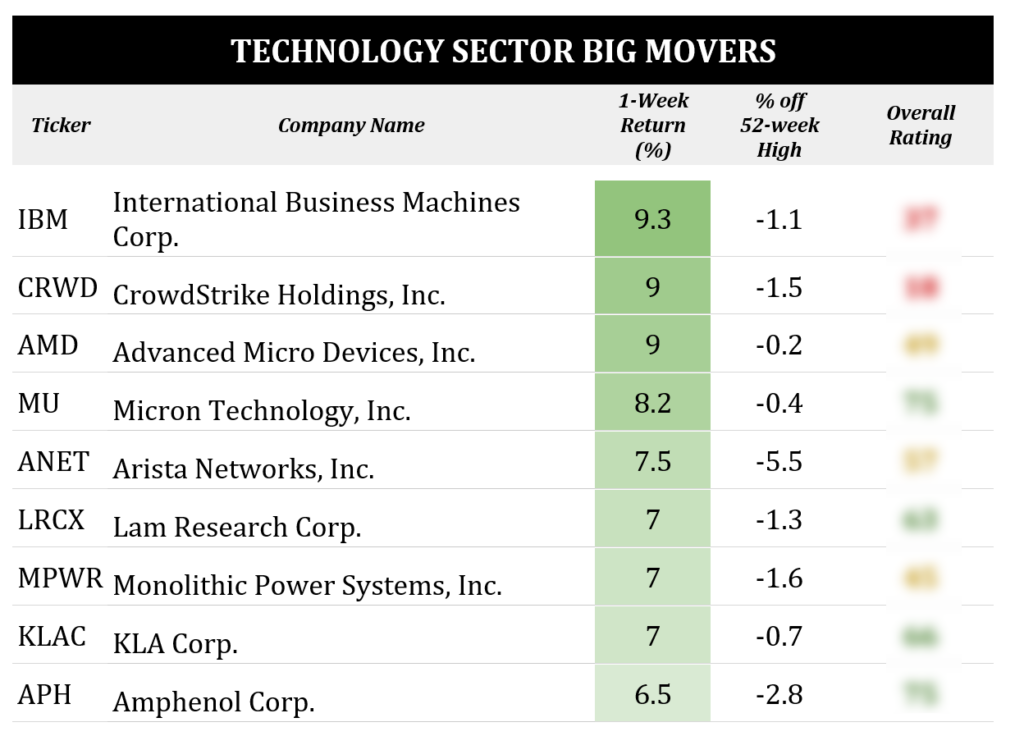

Tech Sector’s Big Movers

Below are the nine best-performing technology stocks that finished the week positive and closed within 10% of the 52-week highs.

International Business Machines finished the week on top, up a monster 9.3%. Virtually all of that move came on Thursday, following IBM’s report. The company reported strong growth in its AI book of business, and Wall Street is starting to view it less like a legacy old-tech dinosaur and more as an up-and-coming player in artificial intelligence and quantum computing.

But before you get too excited about Big Blue’s reinvention… the stock rates a bearish 37 in my Green Zone Power Ratings system. It rates particularly poorly on value and size, and its growth and momentum ratings are pretty average.

For potential gems on this list, you might want to take a harder look at Micron Technologies (MU) and Amphenol (APH), both of which rate solidly “Bullish.” Neither rate particularly strongly in size or value, which is typical for the tech sector. But both rate exceptionally strong on growth, quality and momentum.

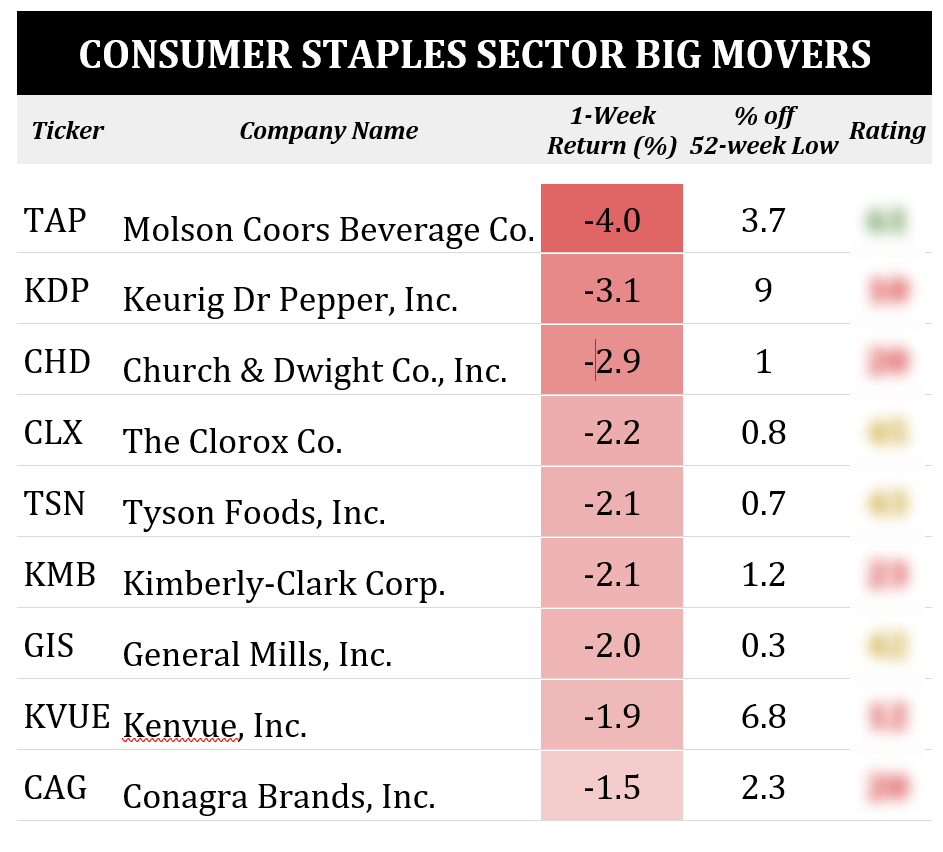

Consumer Staples Getting Left Behind

FOMO markets aren’t great for stodgy sectors like consumer staples. These are “boring” stocks that you buy when you’re concerned about volatility. They’re appropriate for the proverbial widows and orphans… and there’s not much demand for them when investors are looking for aggressive growth.

Let’s take a look at the laggards in the sector, all of which closed within 10% of their 52-week lows.

If you’re looking for any diamonds in the rough, Molson Coors (TAP) is worth a longer look. It’s the only stock on this list that rates “Bullish,” and it rates exceptionally well on growth and value and respectably well on quality and volatility.

Its momentum score is a train wreck, however, and the shares have been generally trending lower for the past two years. So, rather than buy today, you might want to put this one on a watchlist and monitor it for any sign it might be bottoming.

To see how any of these stocks rate overall, as well as on the six factors that drive my system, click here to join me in Green Zone Fortunes today. One of many benefits of joining is the freedom to look up any of these stocks (or thousands of others) with just a few clicks of your mouse.

To good profits,

Editor, What My System Says Today