Three CEOs in almost as many years is never a good sign.

At best, it shows a company going through a difficult transition. At worst, it means a company is unfixable and no one wants to go down with the ship.

I wouldn’t call Ford Motor Company (NYSE: F) unfixable. That’s too harsh.

But Ford announced this week it is handing the reigns over to Jim Farley. The current chief operating officer will become Ford’s third CEO in four years.

Automaking is a difficult business even when we’re not living through a world-stopping pandemic:

- It’s capital-intensive and labor-intensive.

- It’s oversupplied. Far too many competitors are chasing a finite pool of buyers.

- Demand is highly cyclical. People splurge on a new car when they feel confident and flush with cash, but they postpone buying one when the economy looks bleak.

That makes Ford a risky enough bet in normal times. And today is far from normal.

But Money & Markets Chief Investment Strategist Adam O’Dell is here to provide guidance with his stock rating system. It helps you figure out if a stock should be in your portfolio or not.

Let’s take a look under the hood and see how Ford ranks using Adam’s system.

How Ford Stock Ranks

It’s not pretty.

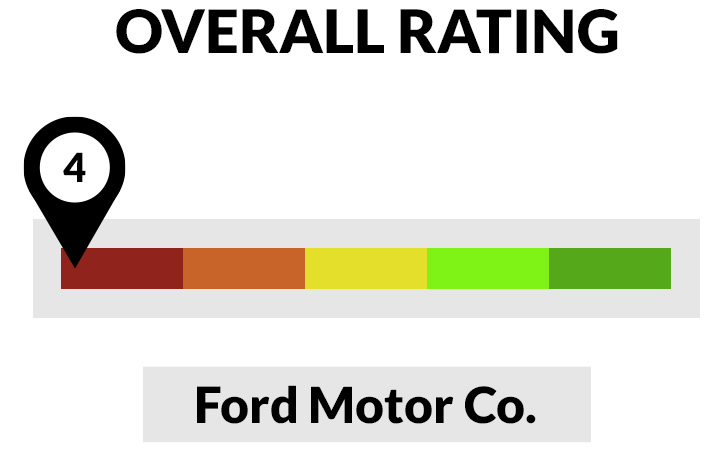

Ford has an overall rating of just 4, meaning that 96% of stocks rate higher.

That’s rough.

It’s also remarkable given Ford’s F-150 pickup is the most popular vehicle in America. Ford also discontinued low-margin car manufacturing years ago to focus almost exclusively on higher-margin trucks and SUVs.

It ranks as a 4 even after those shareholder-friendly moves.

Let’s dig into the details.

- Value — Ford ranks highest on value at 45, putting it in the bottom half even in its strongest metric. A lot of this comes from Ford’s depressed current-year earnings. Ford actually ranks high measured by its price-to-sales ratio (94) and its price-to-book ratio (87). But its price-to-earnings ratio rates at only a 15.

- Volatility — As a cyclical stock, Ford is volatile. It rates at a 37, meaning it’s more volatile than 63% of all stocks.

- Quality — Remember when I said that Ford was capital-intensive? This explains why the stock rates so low in quality at 23. The large amount of money the company needs to support sales pushes efficiency to a middling 57. And that capital equipment is financed by a ton of debt, pushing Ford’s debt ranking to 36. But worst of all is the company’s profitability. Its margins rate 15, meaning that 85% of stocks are more profitable.

- Momentum — Any stock not in the tech sector is going to rank fairly low on the momentum scale this year. Cyclical industrial stocks like Ford have really lagged, and we can see this in its momentum ranking of 17.

- Growth — Ford isn’t exactly a growth darling. Auto sales have been sluggish for several years, due in part to higher vehicle quality. The average age of vehicles on American roads is now 12 years. Add to this the effects of a slowing economy, and it’s not hard to see how Ford rates a 7 here. 93% of all companies rate higher on growth.

- Size — And to twist the knife one last time, we have Ford’s size. No, it’s not a tech company. But it’s still large. Ford rates a 0.7 here, meaning that it’s bigger than almost everything else there.

Ford Stock: Not a Buy

Ford managed to avoid bankruptcy following the 2008 meltdown. But surviving this downturn will be tougher. The company’s credit rating was downgraded to junk status by S&P back in March and by Fitch in May.

The recent bounce notwithstanding, Ford has been in a continuous downtrend since the end of 2013. Sure, the stock could bottom tomorrow. But buying this is like trying to catch a falling knife.

My advice? Let Ford roll on by.

- Money & Markets contributor Charles Sizemore specializes in income and retirement topics, and is a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.