Inflation finally appears to be easing. This is good (but not great) news.

Prices are still rising. They are just going up at a slower rate than they were.

The October Consumer Price Index confirmed this trend as prices rose 7.7% compared to a year ago. That hurts less than the 9% increase reported in June.

Data from the trucking industry shows inflation should continue falling.

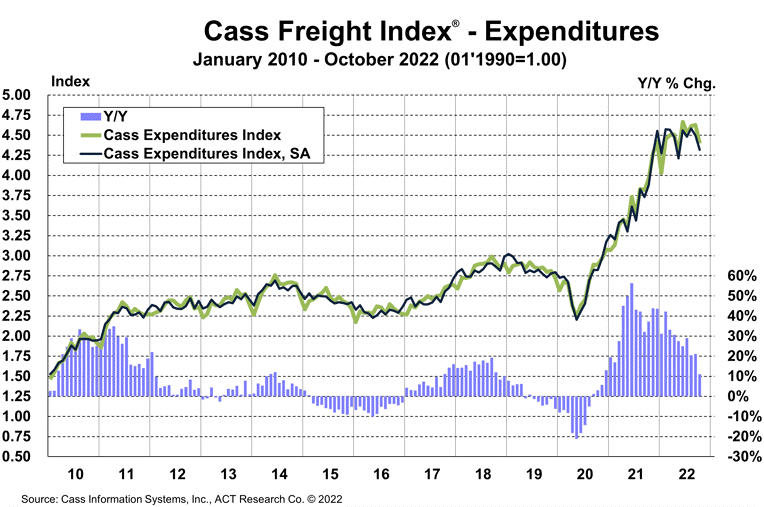

The expenditures component of the Cass Freight Index measures the total amount spent on freight. The Cass Transportation Indexes accurately measure changes in North American freight activity and costs based on $37 billion in paid freight expenses for the Cass customer base of hundreds of large shippers.

It fell 4.9% in October. This means industries are resolving supply chain issues since there is less money being spent to move products around the country. This index appears to have topped a year ago.

More Stories in Freight Index Data

The report also showed that shipments declined by a small amount — just 1.4%. But that shows the economy is slowing. Based on the combination of the data points, Cass notes that “…we can infer that rates overall were down 3.6%.”

The trend is expected to continue. Trucking companies are hiring fewer truckers and layoffs at some companies seem likely. This confirms the industry is returning to normal after the stress of the shutdown and reopening in the past two years.

The only negative news in the report is concern about fuel costs. Energy prices are moving higher again and should remain high.

But a surplus of drivers could act as a counterweight to fuel prices. To keep trucks moving, some companies will cut wages.

Cass concludes: “While shippers aren’t seeing any real savings yet, considerable cost relief is now highly probable for 2023, which we think will be welcome news for the broader inflation picture.” This is welcomed news for businesses and consumers.

P.S. Options are easier to trade than ever, and I’m glad more people are taking advantage of them.

However…

I want to make sure no one takes advantage of YOU.

That’s why I want to teach you how to trade options the right way.

And that’s what my Options Master Class is all about.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.