Many investors gain exposure to the S&P 500 through exchange-traded funds (ETFs) like the SPDR S&P 500 ETF Trust (NYSE: SPY). Others use futures markets, which are open much longer — and look shaky amid the Russia-Ukraine situation.

Futures trading opens at 6 p.m. Eastern time Sunday and closes on Friday at 4 p.m. ETFs do trade after hours on the exchange, but liquidity is limited, and futures market actions affect prices.

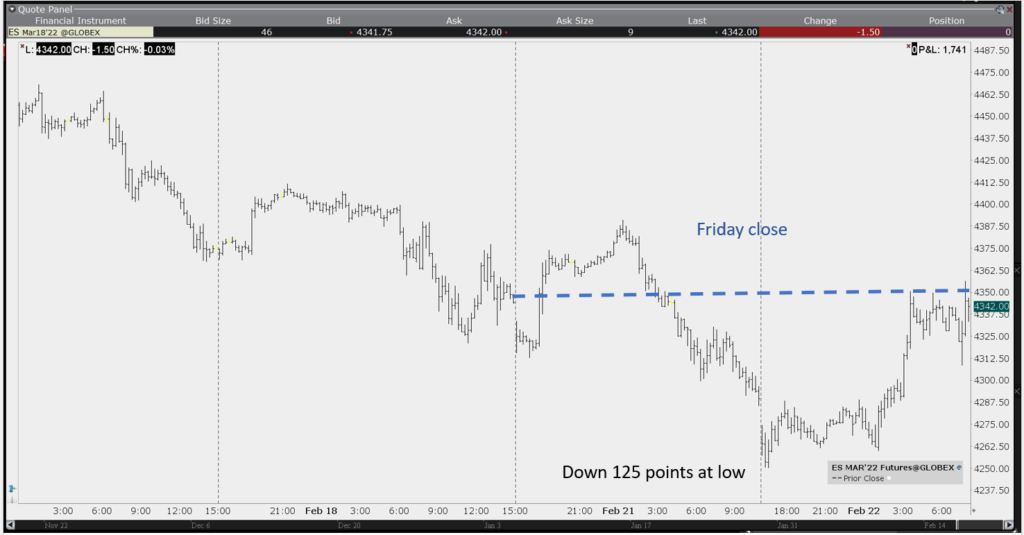

Over the long weekend, futures on the S&P 500 were unusually volatile. The chart below shows trading in the S&P 500 contract. This is an electronic market, where each one-point move equals $50. It’s also a high-leverage market. Traders need about $12,000 in margin to trade a contract offering more than $210,000 in stock market exposure.

Volatility Spikes for E-Mini S&P 500

The price dropped about 20 points when trading opened on Sunday. When news broke that France had brokered a deal for President Biden to meet with Russian President Putin, the E-mini jumped 40 points. That was a large move, but that was just the beginning of a volatile weekend.

Futures Traders Hurt by Russian Politics

U.S. stock markets were closed on Monday, but global markets were open. Russia’s actions in Ukraine impacted European countries first, and these futures markets were much more volatile than usual.

As Russian tanks crossed the border, the E-mini plunged 125 points below Friday’s close. When news announcing sanctions from European governments broke, the contract rallied sharply and almost hit Friday’s close.

Stock market investors missed all the excitement, but futures traders lost small fortunes over the weekend.

Futures may have been more volatile because many large traders were enjoying a long weekend. But volume was high in the market. It’s possible traders locked in profits as they had the chance to, knowing such large moves are rare.

But it’s more likely that the pros who were trading over the holiday recognized the high level of risk in the current market. Individual investors seem less concerned about risk and look to maintain exposure.

Large swings favor short-term trades. For now, it is best to consider trading short-term positions to benefit from large swings that news will create in the coming weeks.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters