First, I hope you were able to step back from the hustle and bustle and enjoy your Thanksgiving.

Today is Black Friday — what used to be the busiest shopping day of the year.

In 2022, retailers face significant headwinds with high inflation driving prices higher. Americans are looking for deals beyond just one day out of the year.

Here at Stock Power Daily, we don’t buy based on hype or headlines.

Our proprietary Stock Power Ratings system helps you cut through the noise to find the smartest, highest-potential investments.

Today, in honor of Black Friday, I’ll share a popular clothing retailer stock to avoid.

The Gap Inc. (NYSE: GPS) is one of the largest clothing retailers in the world with a market cap of almost $5 billion.

But despite its size and global reach, this is a stock to stay far away from.

Here’s why.

Expansion Has Not Helped the Company

In 1969, the first Gap store opened in San Francisco.

The idea was to make it easier for consumers to find a comfortable pair of jeans.

Fast-forward to today and the company reaches beyond denim to include popular brands such as:

- GapKids (children’s clothes).

- Old Navy (low-cost apparel).

- Athleta (fitness apparel for women).

- Banana Republic (upscale clothing and accessories).

Despite this expansion, GPS stock tanked due to recent economic trends (inflation).

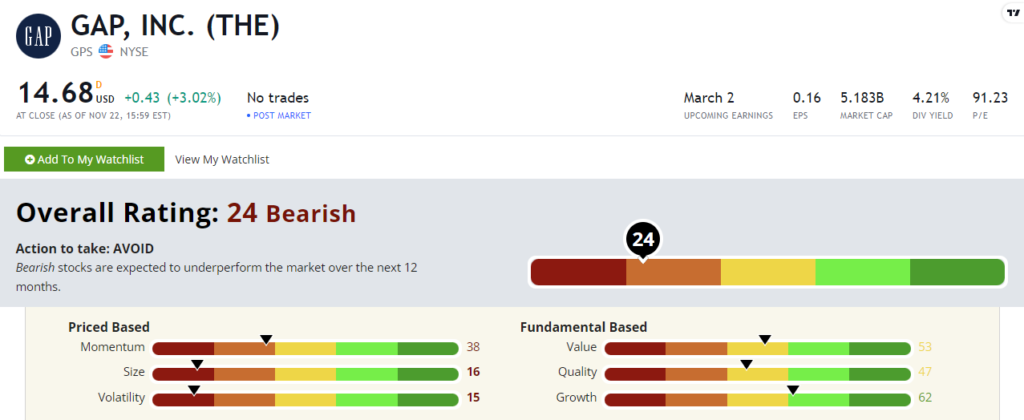

GPS stock scores a “Bearish” 24 out of 100 on our Stock Power Ratings system. We expect it to underperform the broader market over the next 12 months.

Gap Stock: Red Across the Board

I like sharing exciting findings about our Power Stocks.

But that’s not the case with GPS:

- Its quarterly net sales were $4 billion — only up 2% from the same period a year ago!

- The company’s merchandise margin — profits earned after covering production costs — fell 4.8%.

That shows you why GPS earns a 25 on our growth factor.

It also scores in the red on our other fundamental factors: quality and value.

Gap stock’s return on equity is lackluster at negative 14.2%. Its industry peers, on the other hand, average a positive 21%.

The company’s net margin is negative 2.4%. The apparel and accessories industry average is positive 2.4%. So GPS earns a 33 on our quality metric.

GPS has a negative price-to-earnings ratio. It’s losing money — earning it a 31 on value.

These numbers tell us GPS is overvalued on stock price and underperforming financials.

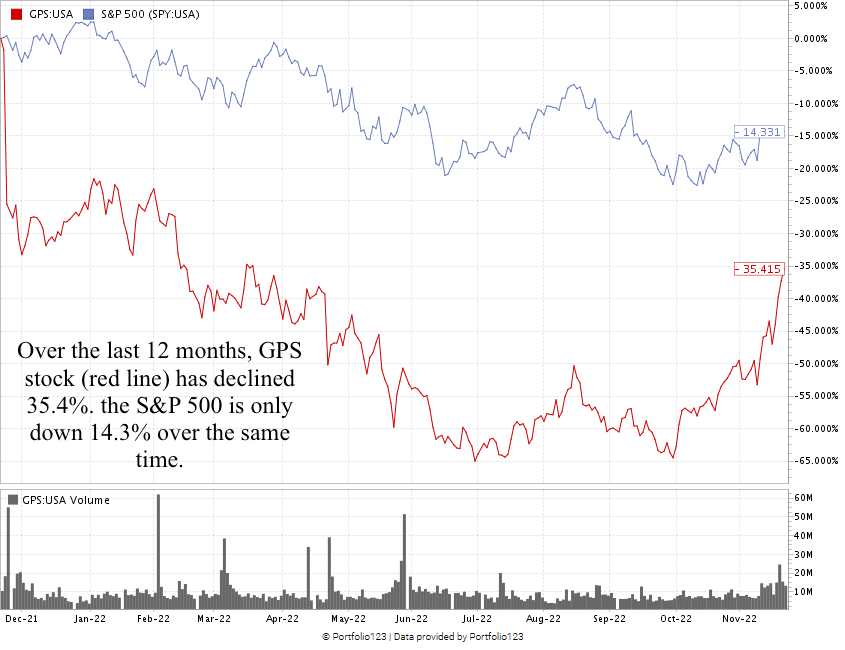

You can see GPS stock’s massive drop in the stock chart below:

Created in November 2022.

The stock is down 41.8% over the last 12 months.

The S&P 500 only declined 14.8% over the same time.

Gap Inc. stock scores a 24 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

Inflation is pushing consumers away from high-priced clothing.

Couple that with GPS failing to turn a profit, and you can see why it’s one stock to avoid.

Stay Tuned: Bright Business Solutions

On Monday, we’re returning to our original Stock Power Daily form.

Stay tuned — I’ll share all the details on a stock that, for many brick-and-mortar businesses, keeps the lights on.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?