There’s a lot of action happening in the financial sector…

But also “mixed messages.”

On a positive note, big banks kicked off earnings season with a bang, reporting incredibly strong profits that surprised to the upside.

On the other hand, last week rekindled fears of another regional banking crisis like the one we saw in 2023 with the spectacular collapse of Silicon Valley Bank.

Of course, we don’t just follow the news or headline earnings numbers …

With my Green Zone Power Rating system in hand, we can cut through the noise to see how investable the financial sector actually is today.

Is it safe to “go wide” with a sector ETF, or should we get selective and hunt for individual stocks that are set to outperform?

Let’s start with my “X-ray” to see how things stack up…

Financial Sector Stocks Still Tilts to the “Bearish” Side

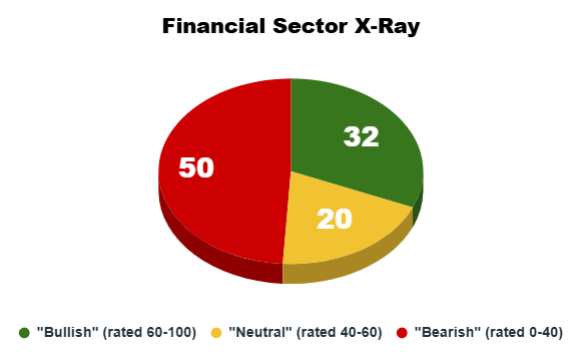

It’s been three months since we ran my Green Zone Power Rating “X-ray” on the financial sector. And one thing to recall is that this is a relatively large corner of the market, with 102 stocks, compared to some other sectors we’ve recently run analysis on.

As always, I’m looking for a quick snapshot of the sector’s overall health as each stock falls into one of three broad categories:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

There are two additional categories (“Strong Bullish” and “High-Risk”) that are reserved for the very best and worst stocks our system tracks, but this broader segmenting provides a great starting point.

And compared to my analysis of the financial sector back in July, things look a little more “Bearish” overall:

The number of “Bearish” stocks has increased from 42 to 50, while we still have the same number of “Bullish” stocks at 32.

Again, this is a perfect example of why buying into a fund that tracks the broader financial sector may not be the best move.

Sure, you’re getting exposure to 32 bullish stocks that should outperform the S&P 500 by 2X or more, but with that, you’re also exposing your portfolio to 50 bearish laggards and another 20 neutral stocks that should perform in line with the market’s performance over the next year. You’re essentially banking on (no pun intended) one-third of the portfolio to drag the rest of the bunch to bullish outperformance.

My friends, if you want to take the reins and start hunting for the very best individual stocks to buy, click here to see how to join me in Green Zone Fortunes. One of the many benefits is unrestricted access to look up thousands of tickers in my system — anytime you want. Within seconds, you’ll know if a stock is set to crush the market or be a potential drag on your portfolio over the coming months.

Now that we have a broad idea of the sector’s outlook from here, let’s look into how many stocks boast “Bullish” ratings on each of my individual factors…

Factor Breakdown of 102-Stock Sector

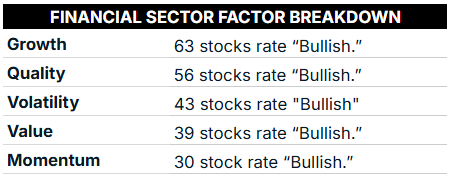

Below, you’ll see how things shake out based on our six individual factors (five, really, since we’ve cut Size from the analysis here due to the larger nature of these S&P 500 stocks).

We’re only looking for stocks that rate a bullish 60 or above on these individual factors because higher individual factor ratings are what drive that broader outperformance for the stock’s price:

And this again shows why discretion goes a long way when looking for new financial sector stocks to buy.

Just over half the stocks rate “Bullish” on Growth and Quality, while only a third boast “Bullish” Momentum.

There are still plenty of opportunities to find stocks that rate well on these factors, but it’ll take a bit more work.

I’ll do that now by focusing on the “Growth” factor to see if we can find some “Bullish” financial stocks worth buying…

High Growth Leads to “Bullish” Financial Stocks

I went ahead and pulled every financial sector stock that rates “Bullish” on my Growth factor in Green Zone Power Ratings. Out of the 63 stocks, 10 rate a 90+ (aka “Strong Bullish”).

To highlight why these stocks boast such a strong score on this factor, I pulled their quarter-over-quarter earnings per share (EPS) growth. This is just one of many submetrics I use to come up with that composite factor rating, but as you can see below, some of these stocks are exhibiting monstrous performance:

We’ve got double-, triple- and even quadruple-digit EPS growth for each of these stocks!

But even with Coinbase Global Inc. (COIN) and its 2,023.2% EPS jump between quarters, the stock still rates “Neutral” in my system overall. Its “Bearish” ratings on Value and Volatility are enough to be a drag on its performance from here.

Overall, I’d say this is a great list to start with, though if you’re looking for a financial stock to buy. Six of the stocks are set to beat the broader market by at least 2X over the next 12 months based on strong overall ratings … including an official Green Zone Fortunes portfolio position that, while already up over 300%, still has a long runway of growth and profitability ahead of it. Click here to join us today!

To good profits,

Editor, What My System Says Today

P.S. Keep your schedule clear for Thursday at 1 p.m. ET … Nvidia is gearing up to host a major technology event in Washington D.C. later this month that could shock the world, and I’m teaming up with a colleague to show you exactly what’s going on.

We’ll go over why the Big Tech and AI giant is hosting an event just minutes from the White House … what the Trump administration has to do with this historic development … and the one little-known company whose stock price could begin to take off soon after.

We can’t wait to see you there!