In August, so far we’ve had “15 trillion reasons to buy gold.”

That $15 trillion was the amount of government bonds worldwide trading at negative yields …

An amount that has since risen to $16.4 trillion. In a little over a week. Really!

As bonds begin producing negative yields, gold begins looking good. How good? Gold recently hit its six-year high … and it’s projected to soar higher!

But that’s not the end of the story. Let me make a stronger case for gold AND silver — and how you should play it.

After all, negative yields on government debt is a bit hard to grasp. It goes against logic and reason. So, let me give you three logical reasons to buy precious metals. Reasons that an unemotional investor like “Star Trek’s” Mister Spock would agree with.

Reason No. 1: The Trend is Your Friend

We saw a day this past week when the Dow Jones Industrial Average closed down 800 points. Wow! And there were, in fact, multiple days that ALL the major market sectors closed down.

Broad sectors, but not select industries or commodities. Because there was one investment that was standing tall, and trending higher, despite the broad market carnage.

I’m talking about gold. Here’s a chart …

You can see that gold is in a very bullish uptrend. And it keeps breaking out higher. That’s exactly what you expect to see in a bull market.

And gold isn’t the only thing getting squeezed higher.

Reason No. 2: Silver is Surging

Silver ended this week over $17. That’s the highest level since June of last year. And just last month, it was testing support at $15.

That is a HUGE move in precious metals.

This is important because silver is the drama queen of the precious metals. It overdoes the percentage moves on the upside and the downside. In a real bull market, silver leads the way. And that’s just what we’re seeing now.

Reason No. 3: Gold Production Headed for a Precipice

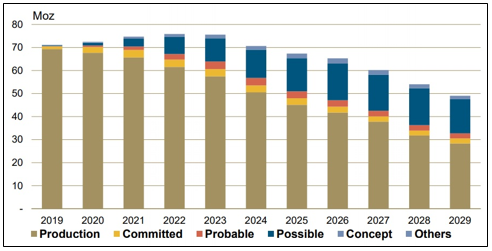

This chart from Barrick Gold shows the projected state of global gold supply …

You can see that even if all new projects work out, production peaks in 2022. And that’s very likely, because it takes years to start a new project.

Barrick calls it a “production precipice.” They’re not wrong. And what happens when the supply of something drops? Usually, prices go higher.

Add it all up and you’ve got three good reasons why gold and silver are going higher. In fact, the case for the move higher is — dare I say it — so logical that even Spock would love it.

Some good ways to play this include the VanEck Vectors Gold Miners ETF (NYSE: GDX) and the Global X Silver Miners ETF (NYSE: SIL). They’ve had a good run in the past two months. But they should go higher — and potentially much higher in a hurry.

And if you want to buy some individual miners rather than a fund full of them, my Supercycle Investor subscribers are sitting pretty in a basket of stocks that I hand-picked for them. Click here and fill out this form to tell me where to send you all my latest buy and sell instructions in gold, silver, miners and more.

All the best,

Sean