The U.S. produced 133.6 billion kilowatt hours of electricity from nuclear power in January and February 2025.

That’s enough energy to power 12.3 million homes for an entire year!

But powering our homes isn’t the main driver behind the resurgence of nuclear. No, it’s caused by the massive amount of electricity required to keep data centers running as they process mountains of AI data around the clock.

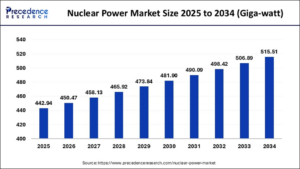

And, the demand for nuclear power across the globe is only getting bigger:

This year, nuclear power will account for 442.9 gigawatt hours of power. By 2034, Precedence Research expects that number will increase 16.4% to 515.5 gigawatt hours.

Note: One gigawatt can theoretically power 10 million standard light bulbs.

Last year, Big Tech companies like Alphabet Inc. (GOOGL), Amazon.com Inc. (AMZN), Oracle Corp. (ORCL), Microsoft Corp. (MSFT) and Meta Platforms Inc. (META) either sought proposals for nuclear power or entered into agreements with energy companies to produce nuclear power for data centers around the country.

And that continued this week, when Meta reached a deal with Constellation Energy Corp. (CEG), under which the latter will provide nuclear power for the next 20 years from its clean energy center in Illinois.

That got me thinking about the state of the energy market as nuclear-related stocks have gone gangbusters in the first half of 2025.

Let’s get to it…

Energy: The Market Laggard

The deal between Meta and Constellation pushed the SPDR Select Sector Energy ETF (XLE) 1.2% higher on Tuesday.

However, that is a small bright spot in an otherwise tough time for the broader energy sector.

Energy Lags S&P 500’s Returns

In the last 12 months, the S&P 500 index (the red line in the chart above) has risen by 12.8%, while XLE (the green line) has dropped by 7.7%.

The slumping price of crude oil has hit energy stocks the hardest.

Crude Oil Falls Under $65 a Barrel

West Texas Intermediate crude oil prices have dropped from a 52-week high of around $84 a barrel to just above $63.

Large energy companies have a tight relationship with the price of oil. XLE is weighted by market cap, so its largest holdings are Big Oil players such as ExxonMobil (XOM), Chevron Corp. (CVX) and ConocoPhillips (COP).

Those three alone make up more than 40% of XLE index holdings.

However, as I mentioned above, there is a nuclear “silver lining” within the broader energy space.

Nuclear to the Rescue

It’s been a busy year for Big Tech nuclear deals…

In addition to Meta’s deal, Microsoft also recently announced a 20-year nuclear power deal with Constellation. Amazon also inked an agreement with Dominion Energy, and Alphabet signed a deal with Kairos Power.

All of these deals aim to do one thing: provide more nuclear power for data centers.

The result has been a resurgence in nuclear-related stocks:

Nuclear Energy Index Up 23% In 2025

The Nuclear Energy Index tracks the performance of publicly traded companies in the nuclear energy sector and those businesses that provide goods and services to the industry.

Since the beginning of the year, the index has gained nearly 23% and is just 2.3% off its 52-week high set back in October 2024.

Furthermore, the index has climbed 64% off its 52-week low set during the tariff-driven sell-off.

The takeaway here is that certain energy stocks — especially those with a heavy focus on oil production — have languished for the last year.

However, nuclear stocks, specifically, are hitting their stride under the new administration. President Trump has even established a bullish stance on nuclear power’s future in the U.S. after signing an executive order last month. The order’s aim is “to expedite and promote the production and operation of nuclear energy, which is necessary to power the next generation technologies that secure our global industrial, digital, and economic dominance, achieve energy independence, and protect our national security.”

With the continued increasing demand for high-power data centers, and an administration that is embracing the alternative energy source, nuclear stocks look set to continue their outperformance in 2025 … and beyond.

That’s all from me today.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. If you want to see Adam’s highest-conviction nuclear stock recommendations in his flagship Green Zone Fortunes investing service, click here to see how you can join right now.