It’s time to get on the fast-track to stock profits — with the 5 things you need to make money this week … in just 5 minutes.

Let’s get started…

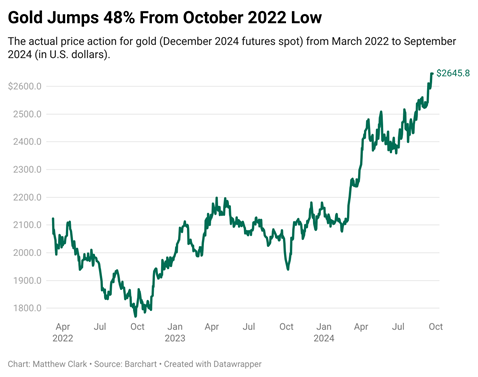

Gold Continues to Run

Stocks flip-flopped to close the week after the Federal Open Markets Committee (FOMC) elected to cut the Fed Funds rate by 50 basis points on Wednesday.

Futures pointed to a slightly higher open to start this week, but there’s been one beneficiary to the Fed’s policy shift: gold.

From their October 2022 low, gold prices have jumped 48% and opened Monday at a fresh high.

This week promises a fresh set of data for the Fed to chew on, including personal consumption expenditures and jobless claims. Both of which will indicate whether the Fed’s most recent rate cut will be the first of more aggressive moves.

Gold has moved higher in 2024 as geopolitical tensions in the Middle East and Eastern Europe continue to rise and increased stock market volatility pushing investors to diversify their portfolios.

The Intel on Intel

Shares of Intel Corp. (Nasdaq: INTC) jumped as much as 4% in Monday premarket trading on news that Apollo Global Management submitted a $5 billion equity investment bid for the chipmaker.

Apollo isn’t Intel’s only date at the party. CNBC confirmed that Qualcomm (Nasdaq: QCOM) has also approached Intel about a potential takeover bid.

INTC shares have lost 57% of their value since hitting a high of $50.77 in December 2023 and more than 67% from their all-time high set in 2020.

The stock currently rates a “High Risk” 1 out of 100 on Adam’s Green Zone Power Ratings system, with lower ratings on Size (1), Growth (2) and Volatility (6).

Apollo’s bid is less takeover and more equity investment as Intel continues its attempt to expand its product offering to attract new customers.

If accepted, the equity investment would not be the first partnering of Apollo and Intel as the latter agreed to an $11 billion sale of a stake in its Ireland plant to Apollo that infused capital into Intel’s factory network.

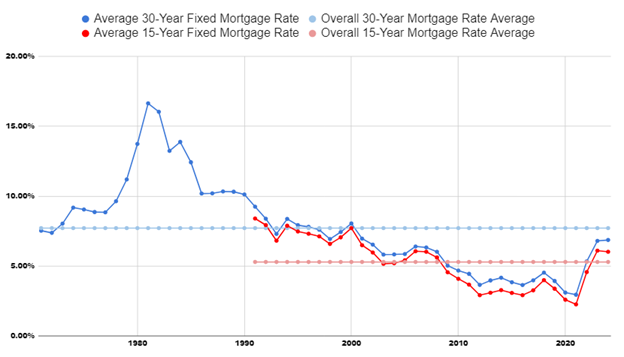

Putting “High” Mortgage Rates into Perspective

High inflation over the last two years has driven up the cost of living across the board, with mortgage rates often cited as a major hurdle for new and existing homeowners.

But are today’s mortgage rates really all that high?

As you can see in the chart above, we’ve recently seen some of the lowest mortgage rates in the last half-century. They’ve certainly picked up since 2022, but 30-year mortgage rates are technically still well below the historical average.

It’s true that mortgage rates have risen. But home prices are the real factor here. Just 20 years ago, the average American home cost just $140,000. Today, American families can expect to spend more than twice as much at $340,000 for the average home.

Bitcoin Options?

On January 10 of this year, the SEC approved a batch of new ETFs that track the spot market performance of bitcoin.

These ETFs are as close as investors have ever gotten to owning the world’s most popular cryptocurrency right in their brokerage account. It’s an unparalleled level of access and accountability, with investors buying up billions in shares as a result.

And now, investors will be able to trade call and put options against these shares as well.

Last Wednesday, the SEC unanimously approved a proposal for options trading on BlackRock’s iShares Bitcoin Trust (Nasdaq: IBIT). They selected this specific bitcoin ETF because, “IBIT is the most liquid spot Bitcoin ETF and the 11th most liquid ETF in the U.S. by average volume (34,825,921 shares) and 18th largest by average notional ($1,246,060,738).”

The SEC also pointed out that this move would finally allow crypto investors to hedge their positions, potentially improving stability in what’s been an intensely volatile marketplace since crypto’s inception in 2009.

Nike: Is that A Swoosh Logo … or A Stock Chart?

Nike (NYSE: NKE) is a household name with an iconic swoosh logo, and an eminent catchphrase that springs to mind (“Just do it.”)

But Nike hasn’t really been “doing it” for quite a few years now. Between questionable marketing campaigns, increasing competition from breakout brands like Under Armour, and the company’s failure to nurture its overseas business, Nike is in decline.

Following a dismal earnings call on June 28, the stock crashed by 20% — wiping out $28 billion in market capitalization before the next day’s opening bell.

Then on Friday, shares rebounded with the announcement that veteran marketing head Elliott Hill would be returning to take over as CEO. NKE shares saw their best day in nearly two years as a result.

Could it be a classic comeback story for one of the biggest names in sportswear? Possibly. But with a Green Zone Power Rating of just 23/100, you’re likely better off watching this one from the sidelines:

— Money & Markets Team