Gold stocks are going to continue to climb in 2020, and gold mining stocks are an avenue for diversified profits.

When it comes to safe havens, I’m bullish when it comes to gold.

As I mentioned in a recent piece comparing bitcoin and gold, the precious metal is considered a key component when it comes to diversifying your portfolio.

It’s hard to ignore the track record gold has had over the last 50 years.

You see, even when we were riding the longest bull market in history into 2020, gold was still pricing at more than $1,000 an ounce.

Just check out the price history of gold since 1970:

So even after gold prices spiked during the Great Recession, the following retreat wasn’t particularly bad for holders.

In fact, Money & Markets Chief Investment Strategist Adam O’Dell is extremely bullish on gold, and he thinks it’s going to $10,000 and ounce. Yes, $10,000 an ounce. Click here to check out his presentation on why — and how to make nine times the profit on top gold stocks.

Now gold is back on the upswing and I’m going to share with you how you can play the market for strong gains with gold mining stocks.

Gold Mining Stocks Are Beating the Benchmark

Contrary to what you might think about the economy, the stock market is behaving as if almost nothing is going on.

After crashing to lows in March, the benchmark S&P 500 has recovered nicely and is only down around 7% to 8% from its previous all-time record high set Feb. 19.

But there’s one sector that’s blasting the benchmark: gold mining stocks.

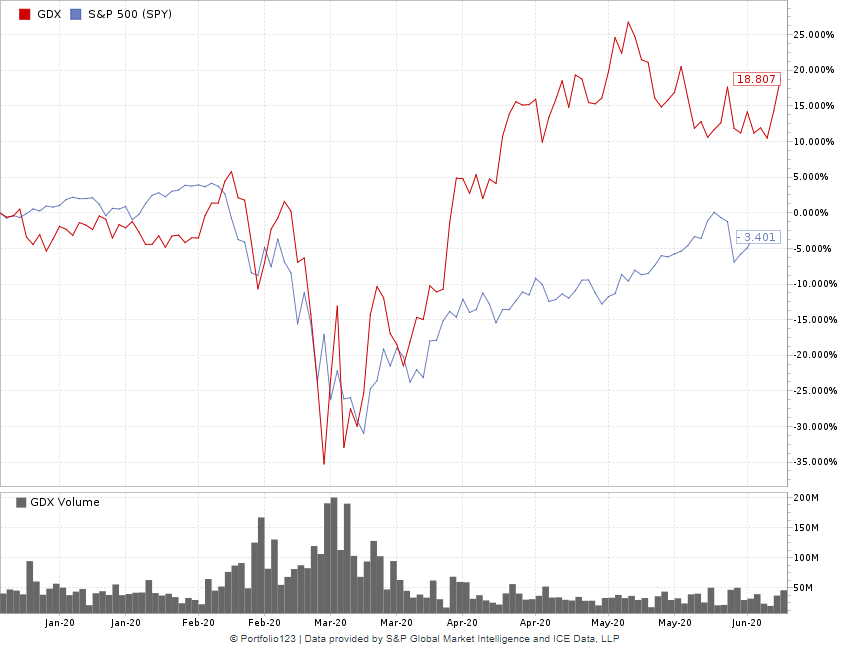

As you can see in the chart below, the VanEck Vectors Gold Miners ETF (NYSE: GDX) — an exchange-traded fund that tracks gold mining stocks — is up close to 19% this year.

Those gains are only going to get stronger as gold crosses its eight-year high.

Why Gold Mining Stocks Are Strong

Gold stocks are going to continue to climb in 2020, and gold mining stocks are an avenue for diversified profits.

But while the price of gold is moving up, it’s important to understand how gold miners work.

The biggest thing to know is that gold miners have a fixed cost for pulling the precious metal out of the ground.

So while it’s not necessarily tied directly to the price of gold on the market, the profit margin is.

Here’s an example:

- If gold miner A has a fixed cost to mine of $500 an ounce and the price of gold is $1,000, they can book a $500-per-ounce profit.

- If that same miner has the $500-per-ounce fixed cost to mine and the price of gold is $1,500 per ounce, the profit to the gold miner is $1,000 per ounce.

As the price of gold moves higher, the profit margin for gold miners also moves up. However, even if gold falls, miners still stand to profit because of the lower fixed cost to mine.

And higher profit margins mean higher gold mining stock prices.

We Nailed Our Gold Picks in March

Back in March we told you about three gold-related stocks we expected would take off before the market crashed.

And boy did we nail it.

Here’s a summary of how our picks have performed to date:

- Franco Nevada Corp. (NYSE: FNV) — This isn’t actually a gold miner but rather a company that owns royalties on gold pulled from the ground. Because it doesn’t mine or explore, its cost exposure is small. When we recommended FNV, the stock was priced at around $107 per share. Now it’s approaching $140. Tack on the $0.25-per-share dividend and you are looking at a 29% gain.

- Barrick Gold Corp. (NYSE: GOLD) — Barrick is one of the largest producers of international gold, with operations in North and South America. Of the top 10 gold mines in the world, Barrick owns half of them. It has a very low all-in cost, meaning even if gold prices fall, Barrick still has a strong profit margin. We recommended Barrick at $18.95 a share and it has jumped to nearly $26. With a $0.07-per-share dividend, Barrick has gained 37.1%.

- Newmont Mining Corp. (NYSE: NEM) — Newmont is a miner that not only mines gold but also silver, copper, lead and zinc. It has operations all over the world, including Australia and Africa. What made Newmont so attractive was its annual earnings per share. In 2019, those jumped 495.3%. In Q4 2019, that growth was 10,200%. We recommended Newmont at $44.28 per share. Its current price is more than $59 per share. Add in a $0.14-per-share dividend and Newmont has gained almost 35%.

So if you bought these stocks when we recommended them, congratulations on your big gains.

How to Play Gold Mining Stocks Now

It’s not too late to jump into any of the above-mentioned companies. I still expect them to see gains through 2020.

However, if that isn’t the direction you want to go and you still want to jump into gold mining stocks, try the VanEck Vectors Gold Miners ETF (NYSE: GDX).

This ETF is a great way to diversify your portfolio and get into gold miners at the same time.

As I said earlier, it’s beating the S&P 500 this year.

It’s trending up and approaching its previous high. I look for it to hit that high and break through it.