Gold is getting ready for its moon shot moment. Bullion is on the launch pad, but junior miners and explorers aren’t waiting. Select stocks in the gold and silver space are already blasting off.

I’ll give you three reasons why …

Reason No. 1: Surging Precious Metal Prices

Gold is back above $1,500. It’s the best weekly gain in two weeks. Meanwhile, silver is making its best weekly gain in four weeks.

Why? The talking heads point to the fact that Britain is sliding into a Brexit quagmire, with new elections called (again!).

But the elephants in the room are the U.S. deficit widening like the Grand Canyon … the massive surge in negative-yielding debt around the globe … and the slide in real interest rates here in the U.S.

All these together lift the weight off precious metals. They open the door to $3,000 gold and beyond. Higher gold, and high-ho, silver!

Reason No. 2: Gold Miners are Breaking Out

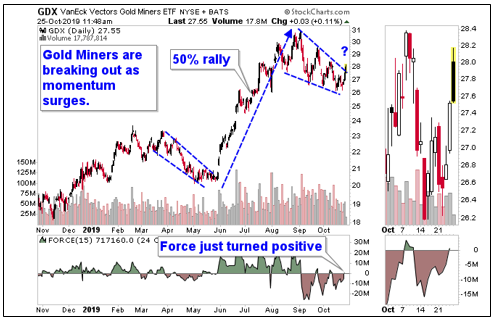

Look at this chart of the VanEck Vectors Gold Miners ETF (NYSE: GDX), a basket of leading miners.

We can see a similar consolidation pattern compared to what happened in April and May. That was followed by a 50% rally. And now … now gold miners are breaking out in both price and momentum.

You can see how gold miners broke out of consolidation. And the momentum indicator on the bottom of the chart, called The Force Index, just turned positive. That shows more buyers are showing up and willing to pay higher prices. And that opens the door to more gains.

Sure, miners could zig and zag. So could gold. But pullbacks can be bought.

And man, this is lighting a fire under our Supercycle Investor and Gold & Silver Trader portfolios!

Heck, the first three picks for Gold and Silver Trader are soaring straight out of the gate. And you can bet I’m itching to give Gold and Silver Trader subscribers MORE picks this week. So, stay tuned for that.

Reason No. 3: Central Banks Hoover Up Gold

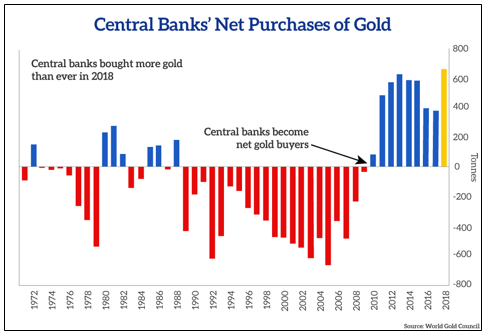

Central banks’ net purchases of gold are surging. Look at this chart made with data from the World Gold Council.

For years, central banks SOLD gold into the market. That changed in 2010. And boy, is buying intensifying.

An aggregate 651 metric tons was amassed by central banks last year, 74% more than 2017 and the highest amount since the end of the gold standard in 1971.

That might seem like a lot. But this year, central banks are buying gold like it’s a blue-light special! According to the World Gold Council, a dozen central banks increased gold holdings by at least one ton through the first eight months of 2019.

Gold buying in the first half of the year jumped to a three-year high of 2,181 metric tons. It was also the largest H1 increase in global gold reserves that the World Gold Council has seen in the 19 years of its existence!

Just to give one example, China just added another 190,000 ounces. That’s the tenth straight month Beijing has increased its gold reserves. And that brings its bullion haul to 62.64 million ounces. Russia, India and others are buying like crazy, too.

This massive increase in gold-buying is most likely also driven by the fact that China, Russia, Iran and other countries would like to de-dollarize their financial networks as much as possible.

See, central banks purchase U.S. Treasuries to bulk up their foreign exchange reserves. They do this especially during periods of unrest, or when the economic forecast is bleak.

The aforementioned countries have an ax to grind with the U.S., and feel we use our currency as a club to punish them (Hint: We do).

At the same time that they’re buying gold, 31 central banks around the world have lowered their benchmark rates. Some below zero. It’s almost like they’re pounding the table and shouting that they want higher gold prices.

The Money Cannons Will Fire Until Morale Improves

Now add to all this the fact that the Fed and other central banks are starting to intervene massively in the markets, firing off the equivalent of “money cannons.”

Let’s single out the Fed: It went from doing repos, to doubling and tripling those repos, to expanding the overnight repo offering from $75 billion to $120 billion — a 60% increase — and throwing in $60 billion a month of bond buying.

Fed watchers say this “Not-QE” could last through the second quarter of 2020. Where will the gold price be then?

I don’t know for sure … but I do know what gold miners are telling us. The price is going much higher. And select stocks, leveraged to gold and silver, are on that launch pad that I told you about earlier.

I recommend get into gold now. If you want more details about these select stocks — and the forces pushing gold, silver and miners ever higher — then watch this video.

The countdown is underway.

The next rally in miners could be a moon shot.

Don’t be left behind.

All the best,

Sean