Tuesday was witness to incredible events which I believe will have, as bond traders would put it, very long tails. From the British Supreme Court overturning centuries of precedent in disputes between the government and Parliament to the Democrats’ decision to commit hari kiri in pursuit of President Donald Trump for Joe Biden’s alleged crimes, Tuesday, Sept. 24 is one for the history books.

From my perspective it looked like a coup of the establishment against the popular uprisings across the West that prompted these extraordinary events.

But what really got my attention was the attack on Bitcoin the same day. Just hours before another major flash crash there was a 40% drop in the Bitcoin hashing rate. Now, in the port-mortem analysis there are a lot of theories as to why this happened, many of which have a lot of merit.

But as an observer of things political and economic, I live by the postulate that states ‘There are no coincidences in politics.’ And, to me, this was a stern message during a time of increasing chaos, that our leaders are in control and, by hook or crook, they will maintain it.

They waited until Wednesday to whack gold in the head a couple of times to keep the precious yellow metal from throwing a strong bullish technical signal at the weekly level.

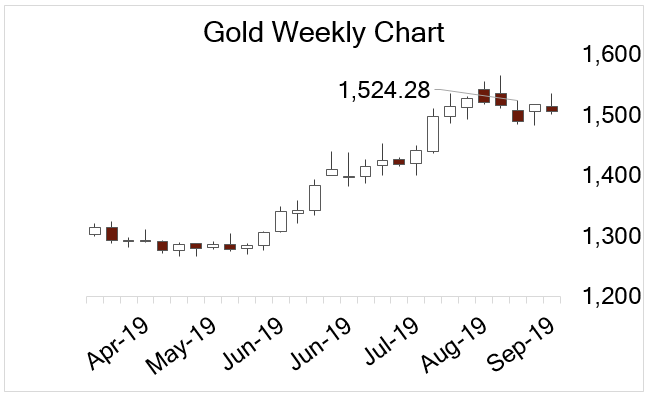

On Wednesday mornings I record a private video podcast for my Patrons where I go over gold and other markets. When I did that, Gold was trading around $1,530 in the spot market. It was in a position to throw a two-bar weekly reversal on a close this week above $1,524.28.

That is the level which gold must close above this week to confirm the recent bottom and set the stage for a renewed attack on the recent high at $1,557.

Not an hour after posting that update, gold was whacked for a solid $20 on no news whatsoever.

So, the confluence of events this week should come as no surprise when viewed against the backdrop of daily emergency repo operations by the Federal Reserve, scheduled to continue through Oct. 10. There is still no good explanation as to why this was needed but it doesn’t matter.

The plumbing of the global financial system is seizing up. The demand for U.S. dollars has been relentless and no amount of dovishness by the Fed will quell it because the problem isn’t the dollar itself or the U.S. economy at this point in time.

The problem, as I’ve been saying for months, is Europe. The European economy is collapsing quickly, and Mario Draghi at the ECB acted last week over staunch internal opposition to his lowering interest rates and unleashing his QE bazooka. He threw over the EU’s fiscal policy and ignored the protestations of the austerity-minded German, French, Austrians and Dutch.

Draghi’s move was so obnoxious it caused one member of the ECB’s governing board, German Sabine Lautenschlaeger, to resign in protest two years before her term was up. You know things are bad when a German eurocrat resigns a cushy, taxpayer-funded gig over a policy decision.

It also signals that things will continue this way under incoming ECB chief Christine Lagarde, who will absolutely usher in the era of helicopter money because “deficits don’t matter” when the banks need bailing out.

This is all the proof you need that there is a serious need to support the European bond markets Draghi ruined with his relentless pursuit of inflation via negative interest rates.

Look, I’m not whining because gold dropped a few bucks here. The bull market is nothing if not healthy. If there is a sincere dollar shortage, there will be periodic weakness in gold, as we’ve seen in recent weeks after a major bull move this summer.

But this week’s political events against the background of increasing troubles in the oil patch, Fed repo manna from heaven, the collapse of the WeWork IPO, the delay of the Aramco IPO and impeachment proceedings beginning against President Trump, it’s all just too strong a coincidence for my taste.

Gold and Bitcoin were making too many headlines as safe haven assets. And some well-timed interventions with a couple billion of fresh Fed-granted liquidity wouldn’t be outside the realm of possibility, even it JPMorgan & Chase is now finally under investigation for rigging the precious metals markets.

The message is becoming very clear. Don’t put hope into these safe havens that are outside of government control. Gold and Bitcoin represent material and, dare I say, existential threats in the short and long run, respectively, to central banks and governments facing a dramatic collapse in confidence.

If the plumbing of the global financial system is clogging up and generational political projects like the EU are in serious trouble, then desperate times call for big moves — subverting 800-year-old governments, impeaching presidents, rigging markets. It means that the political headlines will get crazier from here, not calmer.

Since the Brexit vote of 2016, the unelected oligarchs and financiers I call “The Davos Crowd“ have been in a blind panic. Revolts against their rule keep coming from the ballot box and as a result of technology.

And as those revolts shrug off attempts at censorship and gaslighting, the old means of narrative control don’t work anymore. The next steps will be openly authoritarian — capital controls, cancelling currency, bail-ins of depositors of failing banks.

It is becoming impossible to hide or spin away and Germany’s economy is quickly contracting. Merkel’s refusal to give up fiscal discipline means there will be no sugar-coating put on GDP in the fourth quarter via deficit spending. That will hit the markets like a ton of bricks, especially if they lose the showdown with Boris Johnson over Brexit.

The same thing is happening in the oil space: From shale driller “anxiety” translating into rapidly contracting economic activity in Texas and New Mexico to the war premium coming off the price, oil should resume its bearish trend.

The Saudi War in Yemen may be drawing to a close, for now. Trump may finally be willing to lift sanctions and talk with Iran. Oil has already retraced all of the gains after the Houthi attack on Sept. 14. These reports, if true, will send it lower.

But all that means to me is that the safe haven investing thesis is the correct one. Deflation is here, which will pressure valuations of financial assets. The central banks have spoken: More liquidity, to infinity and beyond.

From an investor’s perspective, whatever markets they are attacking are the ones they are most afraid of. Therefore, keep accumulating gold and Bitcoin. Monday marks the end of Q3.

Stay long U.S. assets as the hundreds of billions in emergency repos attest to the demand for and, most importantly, stay calm. When you’re taking flak, you’re over the target.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.