As markets drag lower, you might be eyeing safe havens to protect your wealth.

Gold has been king of this realm for centuries. But bitcoin is making a strong case in 2022.

Being an investor is tough right now.

The three major U.S. indexes are down between 8% and 15% since the start of 2022!

But it’s not time to panic sell or buy.

As Green Zone Fortunes co-editor Charles Sizemore and I said in a recent YouTube video, now is a great time to be tactical.

In times of market volatility, that means seeking out assets that will retain or even increase their value when things are rocky … these assets are known as safe havens.

In this episode of The Bull & The Bear, I compare two of the biggest safe-haven assets on the market today: gold and bitcoin.

And I share with you which one is the safer buy now.

Gold vs. Bitcoin: Timely Case Study

When the broader market tumbles, many investors flee to safe havens like bonds or precious metals.

They are looking to retain (or even increase) their hard-earned wealth.

For centuries, gold has been a major safe haven for investors.

However, over the last five years, a new player has joined the game: cryptocurrencies.

This is because cryptos aren’t linked to any macroeconomic factors or tied to a central currency. That’s why you’ll often see cryptos described as “decentralized.”

As markets turned down in the last several weeks, the argument over bitcoin versus gold as a safe haven has become more relevant.

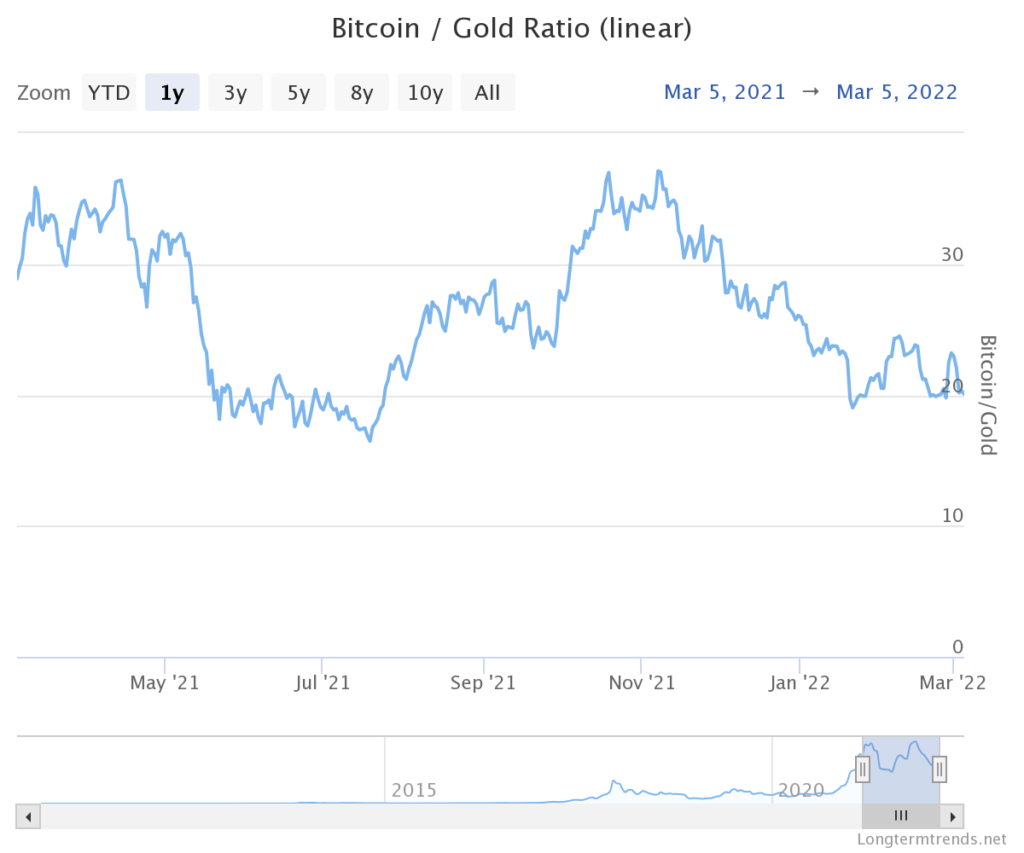

This is the bitcoin/gold ratio tracked over the last year. On the surface, it may not tell us a lot, but it has a compelling (and timely) story … considering current market conditions.

In this episode of The Bull & The Bear, I tell you what this chart tells us and how you can use it to find the right safe-haven asset between bitcoin or gold.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to make money in any market.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos like my weekly Marijuana Market Update.

Have something you want us to talk about? Email Feedback@MoneyAndMarkets.com and give us your thoughts.

Check out MoneyandMarkets.com, and sign up for our free newsletters that deliver you the guidance you need to make money — no matter what the market throws at you.

Also, follow me on Twitter (@InvestWithMattC).

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.