The U.S. economy is marching toward its longest period of economic expansion, and the Federal Reserve seems intent on keeping that expansion going for as long as possible. But Goldman Sachs doesn’t think everything is as rosy as it seems, according to a new report that the stock market may be in for a big crash soon.

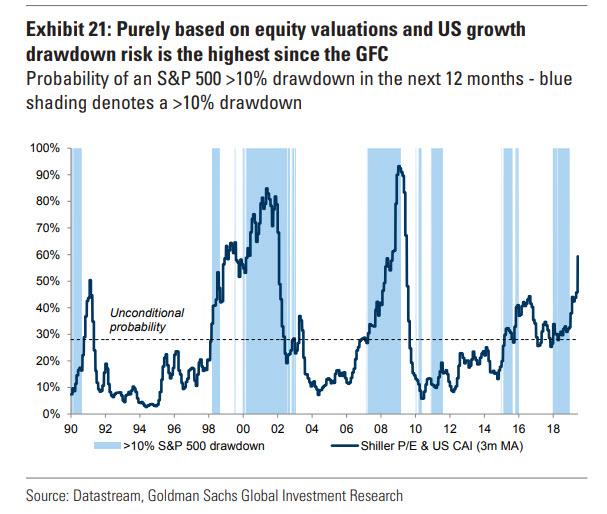

Goldman strategist Christian Mueller-Glissman’s report says that the probability of a market crash of 10% or greater has reached 50% and is closing in on 60%, which is the highest it has been since the global financial crisis of 2007-08 where it hit 90%.

The Goldman report notes, “purely based on elevated equity valuations, as measured by the S&P 500 Shiller P/E, and current growth, according to our US Current Activity Indicator (CAI), the risk of an equity drawdown of more than 10% is the highest since the GFC.”

But markets continues to climb, ignoring growing corporate imbalances, so what’s the deal? Goldman says that “after a small drawdown in May, central banks have helped buffer volatility in June.”

Markets are reacting to events like the Fed’s policy announcements and the ongoing trade feud between the United States and China, which has created a volatile environment.

Mueller-Glissman warns that “to stabilise risk appetite on a sustained basis and anchor volatility, better global growth is needed. Until then, markets remain vulnerable to monetary policy disappointments and political risks. And another buyback blackout period has started this week, which reduces a key demand for equities.”

The Fed’s monetary policy and the US-China trade war are only two events that could impact this market going forward. ZeroHedge lays out a laundry list of upcoming events as we near the start of the third quarter of the year:

Pending key EU appointments, the new ECB president, potential for more tensions in Italy budget negotiations into September and the Excessive Deficit Procedure (EDP) by the EU, rising tensions in the Middle East (Iran, Turkey), the upcoming OPEC+ meeting end of June and US Tech regulation. Also US budget discussions comments on October 1 and could again result in a government shutdown. And of course there are rising risks around Brexit — European implied volatility, as measured by the V2X future, is starting the price excess volatility for the October 31 deadline.