Of all the salty phrases used to describe investment banks, Matt Taibbi’s description of The Goldman Sachs Group Inc. (NYSE: GS) may be the most memorable. In a 2009 Rolling Stone piece, he referred to Goldman as:

A great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.

That’s not the most flattering description, but it’s not inaccurate.

At times Wall Street banks might look like parasites sucking the blood out of the real economy. They’ve certainly had their missteps. But every large money-making endeavor needs capital to get off the ground. Investment banks provide that capital. Good luck trying to run an economy without them.

Goldman Sachs lost some of its swagger over the past decade. Following the near-death experience of the entire financial sector in 2008, regulators forced banks to de-risk and deleverage. Even though its presence is somewhat diminished, Goldman is still one of the most important financial institutions in the world.

Now that we’re in the final stages of the pandemic, Goldman and its peers will be instrumental in financing the post-COVID-19 boom. Investors are already betting on that. Goldman shares have shot higher since October 2020. They are up about 30% year-to-date in 2021.

Let’s see where Goldman might head next as the economy continues to reopen.

Goldman Sachs Stock: Our Green Zone Rating

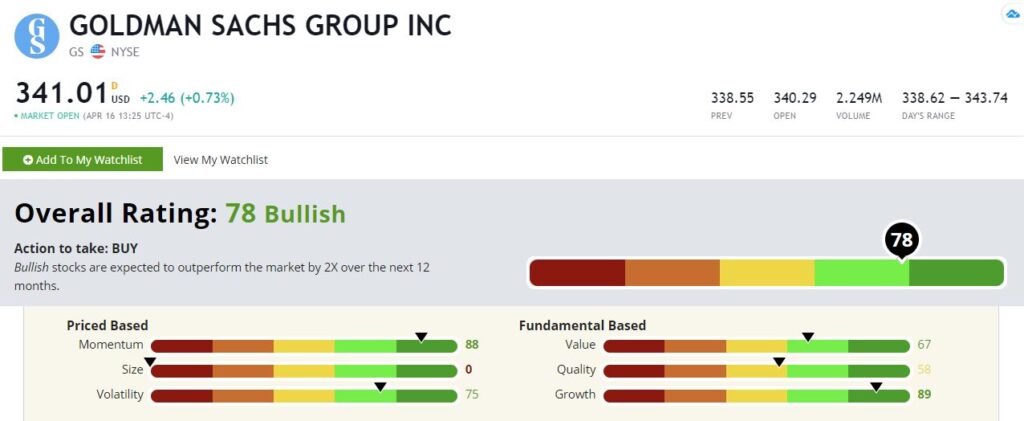

Goldman Sachs stock rates a 78 on Adam O’Dell’s Green Zone Ratings scale, putting it firmly in “Bullish” territory. It’s within a hair’s breadth of “Strong Bullish” territory. In Adam’s historical research, Bullish stocks outperform the market by two times on average over the following 12 months. Strong Bullish stocks are poised to outperform the market by at least three times.

Goldman Sachs’ Green Zone Rating on April 16, 2021.

Let’s do a deeper dive.

Growth — Goldman rates highest based on growth with a rating of 89 out of 100. Stop and consider how significant that is. The past decade has been difficult for financial stocks in general. Yet Goldman has managed to grow at a faster clip than all but 11% of the stocks in our universe. And its growth should accelerate as Goldman finances new capital within the reopened economy.

Momentum — GS also rates well based on momentum, with a score of 88. The numbers speak for themselves. Any stock up 30% year-to-date is a stock with serious buying pressure behind it. And there is no indication that buying pressure will slow down any time soon.

Volatility — Goldman Sachs stock sports a high volatility rating at 75. A high score here is indicative of a low-volatility stock. And that low volatility indicates how de-risked major investment banks are now.

Value — Despite scoring high on growth and momentum, Goldman also rates pretty darn good on value with a score of 67. The massive surge in the share price over the past six months has lowered this score by a good amount. But 67 isn’t bad.

Quality — Goldman Sachs’ quality score is average at 58. Profitability has been pretty muted in recent years. Even after their forced deleveraging, banks carry a lot of debt. GS is penalized for that here.

Size — Goldman is one of the largest and most influential financial powerhouses in the world. Due to its size, it rates a big fat zero on our rating.

Bottom Line: Overall, Goldman Sachs rates well, and I expect the stock to continue its trek up as the economy reopens. But there are a lot of smaller financial stocks I like even better.

In the April issue of Green Zone Fortunes, chief investment strategist Adam O’Dell and I share our favorite stock in the financial sector. We expect it to enjoy the best returns in 2021. And the best part is you still have plenty of time to buy into this stock. We just released this issue in the last week!

While big banks have some great profit outlooks, Adam and I know the best potential gains lie within small neighborhood chains as life returns to normal. Our April stock selection for Green Zone Fortunes rates a 99 out of 100 in Green Zone Ratings, and we believe it has the potential to gain 50% in as little as 12 months!

To find out how you can join our Green Zone Fortunes subscribers with this stock recommendation and many more, check out the details on Adam’s Millionaire Master Class here.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.