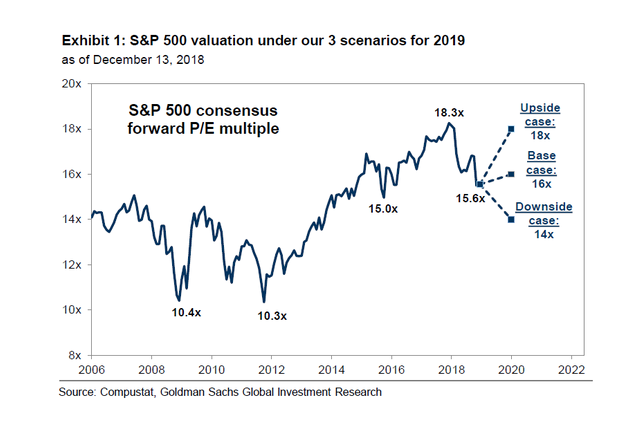

On the heels of the stock market dipping to 14-month lows, Goldman Sachs says the investment theme for 2019 is simple: Get defensive. Goldman also laid out three of the most likely scenarios for the S&P 500 in 2019, saying there is a 50 percent chance it rises to 3,000, but also a 30 percent chance it falls back to 2,500. There is a 20 percent chance it rises to 3,400.

Per Bloomberg:

“The path of the market next year will depend on investor perception of the longevity of the current economic expansion,” strategists led by David Kostin said in a note released late on Dec. 14. “Investors should increase portfolio defensiveness.”

The S&P 500 Index will probably climb to 3,000 by the end of next year, the Kostin-led strategists initially forecast last month. But they assign that outcome just a 50 percent probability, also seeing a 30 percent chance the gauge will drop to 2,500, and a 20 percent likelihood of a gain to 3,400.

“Our 2019 U.S. equity forecast has fat tails,” the strategists acknowledged in Friday’s note.

The benchmark closed Friday a smidge below 2,600, more than 11 percent off its record level reached in September. Kostin maintains a year-end target of 2,850 on the S&P 500, below the median 3,000 from projections compiled by Bloomberg. The median forecast for 2019 is 3,079.

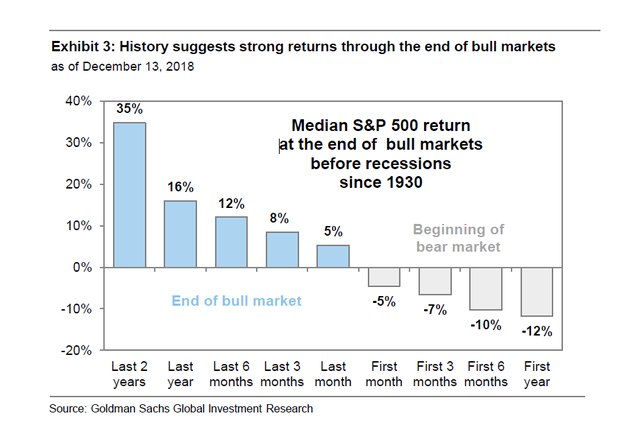

Goldman cites “scores” of recent meetings with clients in saying that many investors believe the U.S. economy will fall into a recession in 2020, and are concerned because the S&P 500 has fallen by more than 10 percent a quarter of the time in the year before a recession in years back to 1928.

READ: Recession Signs Hard to Miss If Stock Message Is Taken Seriously

“If an economic downturn begins in mid-2020, then stock valuations would likely peak during 2H 2019 and gradually de-rate into the recession,” the report said. “Our downside scenario of 2,500 reflects the possibility that investors begin to price a potential 2020 recession by the end of 2019.”

Risk in equities next year isn’t just to the downside, the strategists said. The S&P 500 has returned more than 10 percent in 61 percent of years prior to a year with no recession in data back to 1928, they observed. So if history is a guide, and if the U.S. economy staves off recession a bit longer, stocks could do well.

Goldman recommends increasing defensiveness in portfolios given the uncertainty, suggesting overweights in utilities, communications services and info tech sectors. The firm advocates underweighting consumer discretionary, industrials, materials and real estate shares.

Keep scrolling down to read more investment and stock market advice on Money & Markets.