Editor’s note: Matt is enjoying some time away, but he didn’t leave us hanging. Below you’ll find more tips on how to use Green Zone Power Ratings to find the best stocks — and avoid the worst.

Adam’s system is at the core of everything we do here at Money & Markets. And to see how our newest team member, Chief Market Technician Mike Carr, has implemented the ratings system into his brand-new strategy, make sure to sign up for his free presentation that’s happening next Tuesday, October 24, at 1 p.m. Eastern time. You don’t want to miss it!

The stock market is a complicated place for anyone.

Lines, graphs, prices, ratios, percentages, etc. It can be overwhelming.

But it doesn’t have to be.

That’s why our chief investment strategist, Adam O’Dell, devised a nifty tool to take the guesswork out of trading. He walked you through his proprietary Green Zone Power Ratings system yesterday…

It’s a tool that helps me find companies with market-beating potential … as well as those companies to steer clear of.

Today, I wanted to show you how you can apply this system to your advantage with one of the market’s most popular stocks…

The Anatomy of the Ratings System

Adam’s proprietary system combines six key factors (both technical and fundamental) to give each stock an overall rating of 1 to 100. Ratings break down like this:

- “Strong Bullish” stocks (rated 81 to 100) are expected to outperform the broader market by 3X over the next 12 months.

- “Bullish” stocks (61 to 80) are expected to outperform by 2X.

- “Neutral” stocks (41 to 60) should perform in line with the market.

- “Bearish” stocks (21 to 40) are expected to underperform.

- “High-Risk” stocks (0 to 20) are set to vastly underperform.

These headline ratings are a great starting point. But the real value is what comes next — drilling down to the individual factors is how you’ll unlock the most potential in Green Zone Power Ratings.

These headline ratings are great for evaluating stocks at a glance.

But you also get a score for each of the six factors contributing categories — which can tell you a stock’s whole story in a matter of seconds.

For example, if a stock hasn’t moved much in the last six months, then its Volatility rating will look pretty low. If it’s not a great bargain, then its Value rating will show you that. And if it’s not a great business, Green Zone Power Ratings isn’t shy about giving it a lousy Quality score.

On the flip side, if a stock shows strong Momentum, then its score will steadily increase. If it’s got plenty of room to grow, then it will have a higher Size score. And if it’s growing revenues, you’ll know because of the Growth score.

Each of these six factors is independently calculated, then combined to give you the overall Green Zone Power Ratings score. As a result, it’s easier than ever to make informed investing decisions.

Let’s see what it can tell us about Google’s stock…

How to Use the Green Zone Power Ratings System

Our system is designed to be intuitive and simple to use. Just enter a stock ticker into the search bar here on the site.

You’ll get all the information you need to make the right investment decision in one snapshot:

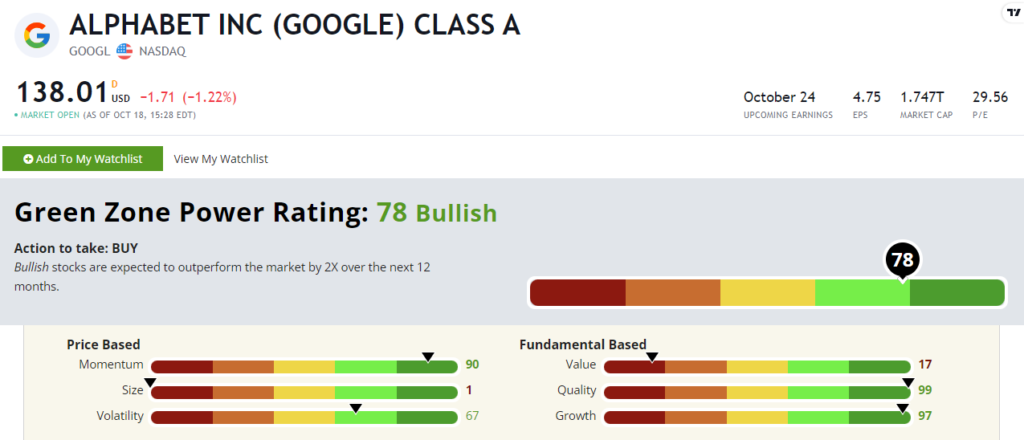

Our Green Zone Power Ratings system assigns stocks a 0 to 100 rating based on the criteria I mentioned above. Here, you can see Alphabet Inc. (Nasdaq: GOOGL) earns a 78 out of 100.

But you can dive deeper and see how the stock rates on all six factors.

In the case of GOOGL, it rates very high on Quality, Growth, Momentum and Volatility.

What this tells me is that the stock has been in a solid uptrend (Momentum) with very little whipsawing (Volatility). It also tells me the company has done a good job increasing revenue and earnings (Growth), and it turns investments, equity and assets into profits (Quality).

GOOGL scores low on Size and Value. This means Alphabet is a large company by market capitalization (Size) and its stock is considered “overvalued” when compared to its peers (Value).

The beauty of our Green Zone Power Ratings system is you can base your investment decision on the parts or the whole. You can invest based on the overall score of a stock, or you can break it down and use one or more factors.

If you wanted to buy a stock with strong sales growth that’s already in an uptrend, GOOGL would be a great pick. But if you were looking for a small, value stock, this wouldn’t be it.

Bottom line: The Green Zone Power Ratings system is a great tool to use when buying stocks because it provides guidance and increases your chances for success.

It’s one of the main reasons why our new chief market technician, Mike Carr, is using it as one of the chief components of his new, seasonal-based, Apex Alert premium investing service.

Mike’s goal is to find the absolute right stock at the absolute right time for maximum profit potential.

And the Green Zone Power Ratings system fits perfectly with that mission.

He’s putting the final touches on a presentation to share all the information about this new strategy, and he plans to unveil it during a special event at 1 p.m. Eastern time, on October 24.

Seating for this special event is limited, so click here now to reserve your spot!

Stay Tuned: Mike Has More on Seasonality

Tomorrow, Mike is back with a deeper dive into seasonality. He’s going to show you actionable trades you can make during the best three months of the year.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets