In a week where rivals Amazon.com Inc. and Facebook Inc. both reported stronger-than-expected earnings, one tech giant was left out in the cold: Alphabet.

The parent company of Google reported its quarterly sales at $29.5 billion, which was off Wall Street predictions by about $500 million. Those sales excluded payments to distribution partners, according to a company statement.

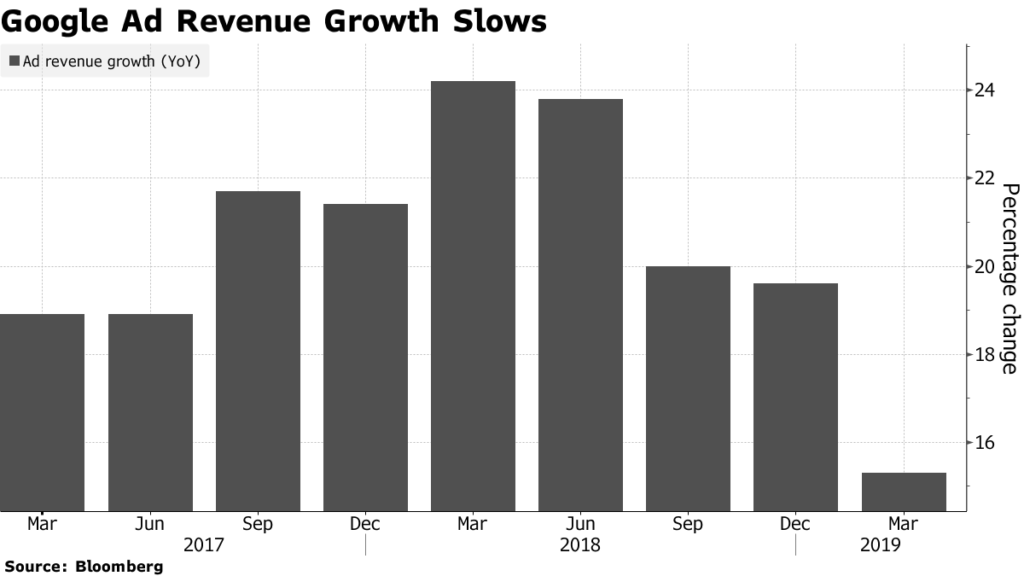

One stark indicator was advertising revenue.

The company reported its ad revenue grew by 15% during the quarter, but that was its slowest pace of growth per quarter for Google since 2015.

That slowdown in growth has opened the door for competitors like Amazon and Facebook — who, amid recent reports of scandal, reported a 26% jump in revenue for its advertising division.

Conversely, Amazon’s advertising revenue jumped 36%, which was slightly lower than the 38% growth in the fourth quarter of last year. In quarters before Q4 2018, however, Amazon’s advertising revenue jumped between 51% and 73%.

While advertising revenue is expected to grow at a faster pace next quarter for Amazon, some industry experts wonder how Google will be able to match the pace of growth for one of its largest competitors.

“It’s unclear how Google might be able to ramp growth back up on these device types,” Andy Taylor, the associate director of research for digital marketing agency Merkle, said to Bloomberg. “A lot of the low-hanging fruit has long since been plucked.”

Ad clicks on Google rose, but only at a clip of 39%, which was the lowest year-over-year growth since 2016. Cost per click dropped 19% over the same time.

Amazon and Microsoft also continue to surpass Google in terms of cloud growth. Both Microsoft and Amazon reported strong growth in that segment, while Google — which puts its cloud segment in the “other” category — rose just 25% to $5.45 billion.

Net income for Alphabet was reported at $6.66 billion, or $9.50 per share. That is a significant drop from the $9.4 billion, or $13.33 per share reported the same time a year ago. One big reason for the drop in revenue was a $1.7 billion fine from the European Commission for antitrust law violations. Taking that out, earnings per share was $11.90.

Following its earnings report late Monday afternoon, shares of Alphabet Inc. dropped 1.02% to $1,1,89.76 during afternoon trading, and shares had tanked more than 8% to $1,183.08 by 10 a.m. EDT Tuesday morning.