You know that feeling when something big is going on, but no one is paying attention?

All mainstream media can talk about is the government shutdown and the ongoing battle between Republicans and Democrats over funding.

However, if you look at the stock market, Wall Street doesn’t seem to care.

Maybe institutional investors care, but they just aren’t doing anything about it.

It’s partly because Wall Street can’t do anything about bickering politicians.

Another reason is that we’ve been here before and know the outcome, so why react?

Today, I’ll examine how government shutdowns affect markets, both in the present and in the past.

It will give some insight into what is in store as both sides hash it out.

Let’s dive in…

If You Can’t See It, It’s Not There

The U.S. government officially ran out of funding at midnight on October 1.

House members passed a short-term stopgap measure to fund the next few months, but the bill stalled in the Senate.

The battle line is pretty simple:

- Republicans want a “clean” bill, meaning no other legislation is attached. It’s mainly about securing funding for the next few months.

- Democrats are looking to extend health insurance subsidies that impact more than 20 million Americans. They won’t vote on a funding measure without guarantees that those subsidies will continue.

That’s the long and short of the issue.

In terms of what the shutdown looks like, all “non-essential” government employees are not working. Those deemed “essential” are working and not yet getting paid.

Agencies like the Social Security Administration are still operational, so benefit checks will continue to be mailed out.

However, the Bureau of Labor Statistics is not operating, so data such as jobless claims and employment figures are not being released.

It will be that way until a funding bill is passed.

At that point, the “essential” government employees working for free will receive all their back pay, and “non-essential” personnel will return to work as usual.

To the average American, nothing really changes unless you have intricate dealings with an agency that’s closed.

That’s exactly how Wall Street is reacting to this latest shutdown … like nothing has changed…

Government Out, Market Up

First, let me preface this by stating that government shutdowns are nothing new.

Since 1976, the government has shut down 23 times due to a lack of funding. This isn’t some new phenomenon the market isn’t used to.

Want proof that Wall Street is acting like nothing’s happening?

Just look at the performance of the benchmark S&P 500 since the government closed up shop on October 1. Since then, the index is up slightly (around 0.5% as of this morning).

S&P 500 In Positive Territory Since Shutdown

You have government contracts in limbo and thousands of workers at home who are not getting paid. Yet, institutional investors have maintained this recent market run.

What’s even more interesting is when you look at the history of market performance during and after shutdowns:

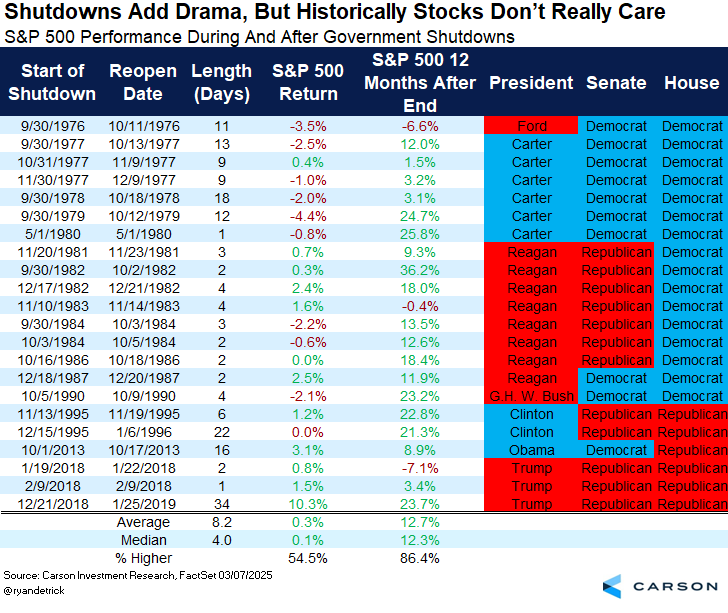

As I mentioned earlier, since 1976, there have been 23 different government shutdowns.

President Ronald Reagan presided over the most … eight, while Jimmy Carter contended with six different shutdowns.

The longest shutdown was during President Trump’s first term in office, lasting 34 days; however, the average length of a shutdown is just over 8 days.

What’s interesting is how the market reacted to those shutdowns.

The benchmark suffered a 4.4% drop during a 12-day shutdown in 1979, but a 10.3% gain during the 34-day shutdown in 2019.

In the 12 months following a two-day shutdown in 1982, the market gained 36.2%. In fact, the market has only suffered a pullback 12 months after a shutdown ends three times since 1976.

On average, the S&P 500 returns a 0.3% gain during a shutdown and 12.7% in the 12 months following.

So, again, if it seems like Wall Street is acting as if nothing is going on, that’s because history tells us the market keeps chugging along, with or without a functional government.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. Want to invest using an approach that adapts to the market’s ebbs and flows? Then you should check out our Green Zone Power Rating system. It constantly updates the ratings on thousands of stocks, telling you whether a ticker is “Bullish” and built for this ongoing bull market, or a “High-Risk” dud that will be a drag on your portfolio in the coming months. Click here to find out how you can gain full access to these ratings with a Green Zone Fortunes membership.