During his 2020 presidential campaign, then-candidate Joe Biden made “green” energy a central focus.

He pledged to invest over $2 trillion into renewable energy infrastructure during his first four years in office, create millions of new jobs and put America on the path to cut emissions by half before the end of the decade.

Green and renewable energy were a central focus for millions of voters at the time. Electric vehicle (EV) sales were on the rise, and Tesla was quickly becoming one of the hottest car brands on the block.

Lawmakers even proposed a “Green New Deal,” designed to replicate the successful and massive infrastructure investment of Franklin D. Roosevelt’s massive Depression-era program.

Many, including Biden, believed that shaking off America’s addiction to foreign oil was only a matter of time and discipline.

In reality, Biden’s climate agenda stalled during his first year in office. His administration has approved even more new oil and gas drilling permits than former President Donald Trump’s.

It would be easy to blame Biden for this shortcoming, to slap an “I did that!” sticker on his green energy policy and call it a day.

But in reality, Biden’s track record on green energy is actually the byproduct of a much larger mega trend — one we’ve been following here at Money & Markets for years now…

The Ongoing Global Energy War

For most of the last decade, the prevailing wisdom has dictated that renewable energy sources (solar, wind, geothermal, etc.) will gradually replace fossil fuels.

This transformation will, in turn, help America’s economy wean off its addiction to foreign oil.

It’s a “big picture” idea that makes sense conceptually. But when it comes to the $6 trillion global energy industry, things are never that tidy…

For example, here are just a few of the truly Earth-changing events that have played out in the energy industry since the last presidential election:

- Russia invaded continental Europe (Ukraine) in February 2022, leading to a raft of sanctions and trade restrictions that have lasted more than two years now…

- Houthi pirates have continually targeted Red Sea trade routes with missile attacks, forcing oil tankers to redirect and add thousands of miles to their routes…

- America’s shale oil and gas industry is enjoying a miraculous boom, making America the world’s largest producer of crude oil…

- Major tech companies like Google, Amazon and Microsoft have begun inking deals for nuclear energy to fuel their power-hungry artificial intelligence (AI) research…

These massive geopolitical fluctuations have drawn a great deal of attention and interest away from renewable energy investing…

Instead, some of the Biden administration’s biggest spending bills have been directed toward bringing critical semiconductor production back to America (the CHIPS Act) or simply maintaining our country’s ailing roads and infrastructure (the Infrastructure Act).

And as we look forward to the next presidential term — be it Republican or Democrat — Wall Street has already decided what they’re expecting…

Wall Street Believes the “Green Energy Bubble” Has Already Popped

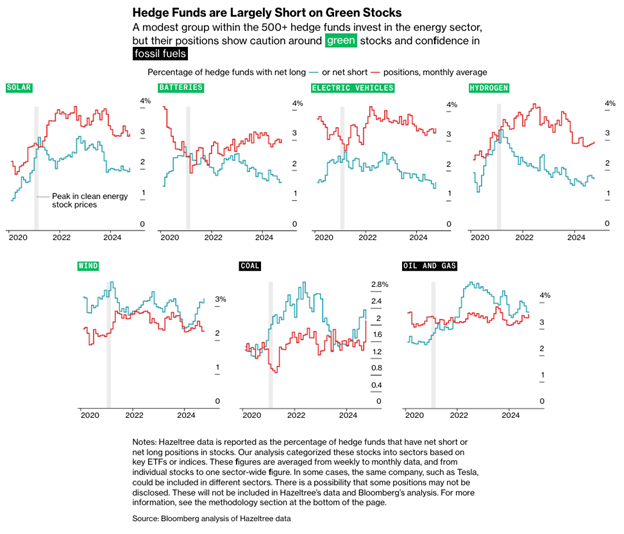

A recent Bloomberg study evaluated the portfolios of hedge funds that focus on the energy sector. While the funds were clearly mixed on oil and gas investing, they were bearish on green stocks.

As you can see in the charts below, a greater percentage of these funds were net short (red line) on green energy versus net long (blue line):

Bloomberg’s study highlighted one specific hedge fund, Impax Asset Management, which, with its clean energy transition-focused portfolio, previously reached a valuation of $50 billion.

Since 2021, Impax has seen its value collapse by more than half.

Fund managers point to a hostile political environment, the broader failure of ESG efforts, and a tense geopolitical environment as causes for the shortcomings of green energy stocks.

In other words, Wall Street is echoing the sentiment I’ve been sharing here for years now…

This “Energy War” isn’t going to be over tomorrow.

It won’t be over next year, and it likely won’t be over in the next 10 years.

In reality, we’re going to see the continuing transformation of the $6 trillion energy industry for decades to come.

That’s why it’s pointless to pick one side or the other. In recent years, I’ve led my subscribers into incredible opportunities on both sides of the energy “fight.”

Anyone choosing to invest in just one side of the energy sector is missing the big picture. Untold billions of dollars are pouring into both industries simultaneously. And the demand for any energy, no matter its source, is accelerating.

To good profits,

Adam O’Dell

Chief Investment Strategist