Editor’s Note: We work hard to provide insights into great stocks to add to your portfolio, but sometimes the financial world throws a curveball. About 24 hours after we published this story, Goldman Sachs announced it was buying the company Matt recommends within this story. Read on to find out what this means for this fintech stock going forward.

More than 4,000 years ago in Mesopotamia, farmers borrowed seeds for crops against a later payment.

It was the first recorded example of a loan.

Today, financial technology (fintech) has advanced how we loan and spend money — from establishing interest rates to credit cards.

And that technology is always evolving.

I used Adam O’Dell’s six-factor Green Zone Ratings system and found a fintech company transforming the way banks and merchants loan money to consumers.

We are “Strong Bullish” on this fintech stock, which means it is poised to outperform the broader market by at least three times over the next 12 months.

And a trend in alternative lending is going to push this company even higher.

Fintech Spurs Alternative Lending Growth

The days of going to your local bank and filling out reams of paperwork to get a loan are over.

What’s more, banks aren’t the only place to get a loan anymore.

Even retail stores can offer customers financing options for purchases (think financing materials for a home improvement project through the store, not the bank).

And fintech companies are expanding these possibilities.

In 2017, there were around 24.5 million loans issued through alternative financing globally.

This year, that number is expected to be close to 34 million. By 2025, there will be nearly 39.5 million loans made through alternative financing — a 60% jump from 2017.

The transactional value — the loan amount — of all alternative financing loans will go from $50 billion in 2017 to $99.8 billion in 2025 — a 99.6% increase in total value.

It means more people will be taking out larger loans via alternative financing.

This trend can give investors big profits by investing in one company.

An Alternative Financing Leader: GreenSky Inc.

GreenSky Inc. (Nasdaq: GSKY) has developed proprietary technology that supports a full range of loan functions for merchants, consumers and banks.

Its technology allows banks and merchants to make loans to consumers for things like home improvement, solar installation and health care.

The company partners with 14 banks, including Regions Financial Corp. (NYSE: RF) and SunTrust Banks Inc. Those banks make loans online or through GreenSky’s mobile app to customers of more than 12,000 merchants, including Home Depot Inc. (NYSE: HD).

The company’s total revenue in 2020 was $525.6 million.

GreenSky is expected to report revenue of $702.4 million by 2023 — a 34% increase in annual top-line revenue.

The company doesn’t sell loans or make loans using its own capital. Instead, it makes money by charging merchants and banks fees to service the loans it makes.

GreenSky Stock Beats the Specialty Finance Industry

GreenSky’s stock has moved up 115% in the last 12 months compared to just a 24.5% increase in the broader specialty finance industry.

Its stock price bounced up 38.3% between July 28 and Aug. 6 this year after the company reported a year-over-year earnings-per-share jump of 267% — $0.22 per share in Q2 2021 compared to $0.06 per share in the same quarter a year ago.

GreenSky’s Stock Rating

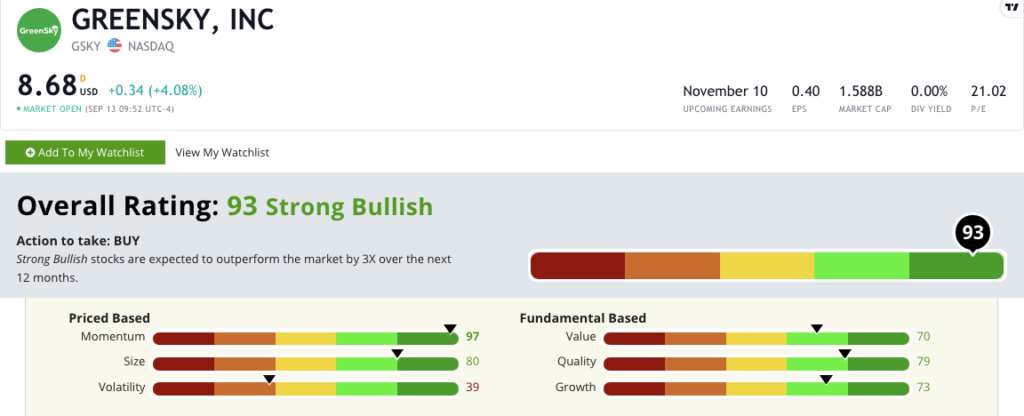

Using Adam’s six-factor Green Zone Ratings system, GreenSky Inc. scores a 93 overall. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times in the next 12 months.

GreenSky Inc.'s Green Zone Rating on September 13, 2021.

GreenSky Inc. rates in the green in five of our six factors:

- Momentum — GreenSky’s stock has steadily moved up after its 38% gain in early August. The company earns a 97 on momentum.

- Size — With a market cap of $1.6 billion, GreenSky Inc. is in the lower end of stocks we rate. It earns an 80 in this metric.

- Quality — GreenSky has strong returns on assets, equity and investments — including a whopping 1,544.6% return on equity — compared to the other specialty finance industry averages, which are at 10% or below. The company earns an 80 on quality.

- Growth — Annual sales for GreenSky went from $326 million in 2017 to $527 million in 2020 — a 62% gain. The company’s 3-year annual sales growth rate is almost 18%. It earns a 73 on this metric.

- Value — GreenSky’s price-to ratios (earnings, sales and cash flow) are at or below the industry averages. The company earns a 70 on value.

The company earns a 39 on volatility as its 12-month rise in stock price met resistance earlier in 2021 and flat trading from April to May.

Update: Goldman Sachs Acquires Fintech Co. GreenSky

Just a day after I recommended GreenSky to you, investment banker Goldman Sachs (NYSE: GS) announced it was acquiring the fintech company.

Goldman will pay $2.24 billion for GreenSky in the all-stock deal.

The acquisition will give Goldman Sachs access to GreenSky’s network of more than 10,000 merchants.

At $2.24 billion, the deal gives GreenSky a value more than 50% higher than its last closing price.

Since I recommended GSKY, it has climbed more than 52% after Wednesday’s opening bell.

Bottom line: Fintech is changing how we do business.

From how we bank and save money to how we borrow for things like home improvement, fintech companies continue to usher in new ways to provide alternative financing to customers.

The trend suggests we are going to keep turning to alternative financing more in the future.

It’s a far cry from borrowing seeds for crops.

This acquisition creates a tricky situation if you didn't buy in at the time I made the initial recommendation.

Goldman Sachs is buying GreenSky at a 50% premium. That puts the high price of the stock at around $15. However, the stock rose fast during Wednesday trading and it might not be the best time to execute a buy.

P.S. My colleague Adam O’Dell will release details of his new Wednesday Windfalls strategy live on September 23. During the live event, he’ll show you how a simple two-day trade has beaten the market by 51 times over the last six months. To sign up for the live event, click here.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.

Story updated on September 15, 2021.