Wednesday afternoon, Federal Reserve Chair Jerome Powell announced that interest rates would be holding steady for the time being — which was exactly what the market expected.

The real came not from the message itself … but instead, from the way Powell delivered it…

Particularly when it comes to Powell’s newfound “dovish” tilt, and how that reflects a tough economic reality we’re now facing in the second half of 2025.

I’ll explain it all in today’s update, just click below to get started:

Video transcript:

Welcome to Moneyball Economics, I’m Andrew Zatlin.

You probably heard the news this week. The Federal Reserve Board elected not to cut interest rates yet. Not a surprise, perfectly in line with our expectations and the market’s expectations, but what was new and different was the way they positioned it.

“We’re not going to cut interest rates yet.” emphasis on yet, because that’s the key word here.

That’s a dovish tilt. It means very much that interest rate cuts are now firmly on the radar.

And it raises the question, what is going to compel the Federal reserve to cut interest rates? And I think I have the answer…

I think it has to do with our economy, which I perceive as weak and getting weaker if it continues to deteriorate the way I see it, that’s going to force the Fed’s hands.

Now, yes, I just said the economy’s weak, and that stands in sharp contrast to another piece of data that came out this week that the second quarter, GDP rose 3%.

3% does not indicate economic weakness. So Zatlin, why are you saying economic weakness today and tomorrow?

Well, the answer lies in how we got that 3%. That’s a quarter-over-quarter number. That’s 3% growth in the second quarter versus the first quarter, which was pretty soft, which was one point a half percent, one point a half percent, first quarter, 3%, second quarter. These are two halves of a whole.

These are both driven by the same issue, which is the tariffs.

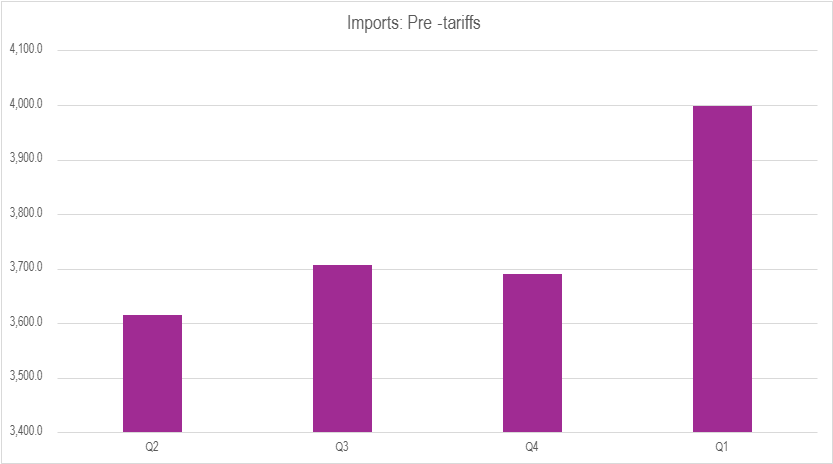

Let’s talk about tariffs, because that led to a lot of front running. For example, if you look at how businesses responded to the potential surge in costs, well, they stocked up inventory:

When you look at things like spending on it like inventories, you will see a huge surge in the first quarter. In fact, that surge, that demand for goods before the tariffs kicked in April led to a surge in imports.

And that’s the key to understanding why the first quarter came down so much, that surge in imports.

Well, that pulls down GDP. That’s why GDP fell to 1.5%.

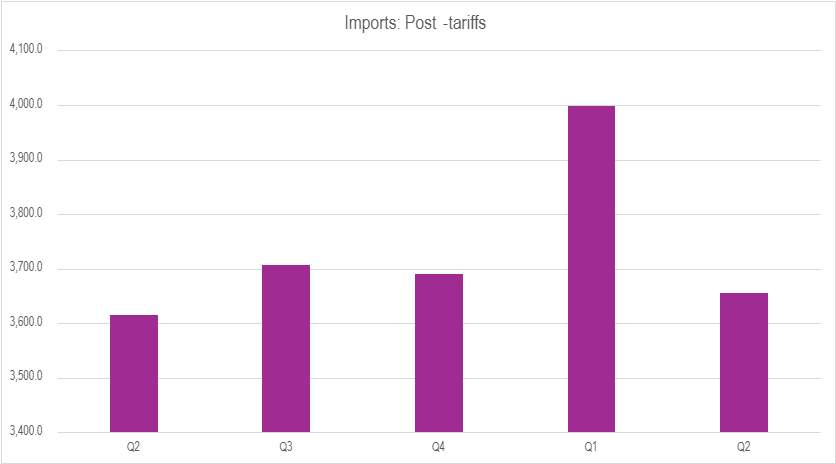

But the flip side is when we get to the second quarter, that demand disappears. Again, take a look at this chart:

IT spending private inventory spending, it collapses right back down.

And as a result, so do imports.

And again, when you import more, the GDP comes down. But when you import less, the GDP goes up.

So that 3% is just reflecting what happened in the first quarter.

We’ve got to get away from what the tariffs were doing, the way it’s distorting GDP, and we got to look at the underlying core issues. We got to look at household spending, which drives most of our economy. Let’s look at personal consumer personal consumption expenditures, PCE. That is the heart and soul of what’s going on with our GDP.

And guess what? It’s only bad news.

In the first quarter, PCE came down, it actually contracted in the second quarter. It went up a little bit, but really just kind of averaged out out. We have been flat for three quarters in a row.

Basically, households aren’t spending money and they’re not spending money for various reasons. And in fact, if we take a look at healthcare, that’s really all they’re spending on. That’s really the only place where there was spending growth. Why? Because healthcare is a tax.

If you look at everything else, you’ll see households pulled back in the first half of this year, and it’s likely they’re going to continue to take that position of pulling back on spending. Remember a couple months ago when I said if the stock market remains weak, if interest rates remain high home buying season’s going to be crap.

Well, guess what? It has been crap.

And so you see spending, for example, at the PCE level spending on homes and structures and things like that, it’s come down, but that’s not the only thing that’s contracted. Let’s get out of households and let’s look at two other sectors that contribute to GDP. Let’s start with the federal government, federal government spending.

Ever since Trump came to town, it’s been contracting. So again, that pulls the economy down and it pulls the economy down in a lot of different ways. There’s some downstream things. For example, nonprofit spending has also contracted why?

Well, the NGO spigot, all that money is running dry, and as a result, they’re having to pull back. Look, we’ve got three important trends here. We’ve got consumer spending pretty much flat to down, government spending down government spending going down and dragging others that are dependent on it down.

Why would we think this is going to reverse in the second half? Well, it could be a little bit more improved because people come back, the stock market’s up, they’re back from vacations, they start spending, but interest rates are still high. So that is what we’re facing in September.

I believe that we’re going to see further deterioration in the personal consumption expenditure data. It’s going to come out each month for the next two months.

I think it’s going to force the fed’s hands. They’re going to say, you know what? When we ignore the tariffs, we do see an economy that is lagging and a little taste, maybe 25 basis points, a little taste of an interest rate cut is justified.

This is bullish for the stock market in a couple of ways. Interest rate cuts always good. Boost the economy, stimulates the stock market. But at the same time, I see bullishness for the stock market for totally unrelated reason.

Yeah, the economy’s weak. It’s weak also because companies are laying off people. They’re not hiring, they’re not spending as much that is leading to better earnings. That is creating better margins. That is going to make the second half results look pretty darn good.

So we’ve got a combination of companies getting a little bit more lean and boosting their earnings together with interest rate cuts.

This is very bullish for the stock market. We are in it to win it, folks. Zatlin out.

Andrew Zatlin

Editor, Moneyball Economics