Matt Clark here, stepping in for Adam while he’s out of the office working on a project. (More on that soon…)

As Chief Research Analyst here at Money & Markets, I spend a large chunk of my day poring over market data and trying to make sense of it all.

This market in particular takes an extra critical eye, as news breaks every day concerning tariffs, inflation, global conflicts … you name it!

Luckily, we have Adam’s Green Zone Power Rating system to act as a guiding light through the madness.

Earnings season kicks off this week as Big Banks, among others, report quarterly numbers. With the financial sector lagging the rest of the pack last week, this is a perfect opportunity to examine the sector through the lens of our system.

So let’s do just that!

Financial Sector X-Ray

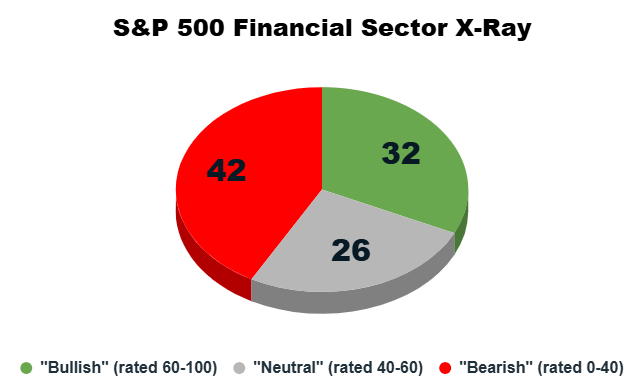

When Adam was designing his Green Zone Power Rating system, one of his goals was to get a “snapshot” of a stock’s potential in the current market by creating three buckets that a stock can fall into:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

There are two more categories (“Strong Bullish” and “High-Risk”) that are reserved for the very best and very worst stocks that our system tracks, but this broader analysis lets us get a rough idea of where a stock might be headed. It also allows us to widen our scope easily when looking at sectors or industries as a whole.

Here’s what our financial sector “x-ray” using Green Zone Power Ratings shows:

One thing you might notice is that the S&P 500’s financial sector is much larger than some of the other sectors we’ve looked at recently, with 100 stocks in total. All things considered, this is a fairly balanced distribution across “Bullish,” “Neutral,” and “Bearish” stocks.

But this is a perfect example of why buying into a fund that tracks the broader financial sector may not be the best move.

Sure, you’re getting exposure to 32 bullish stocks that should outperform the S&P 500 by 2X or more, but with that, you’re also exposing your portfolio to 42 bearish laggards and another 26 neutral stocks that should perform in line with the market’s performance over the next year. You’re essentially banking on that small batch of bullish stocks to offset the performance of the 68 other stocks in the sector!

Let’s shift our focus to the individual factors of the Green Zone Power Rating system to see what we can learn…

Factor Breakdown of 100-Stock Sector

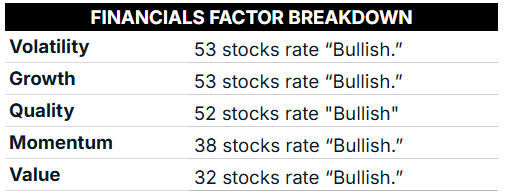

Below, you’ll see how things shake out based on our six individual factors (five, really, since we’ve cut Size from the analysis here due to the larger nature of these S&P 500 stocks).

We’re only looking for stocks that rate a bullish 60 or above on these individual factors because higher individual factor ratings are what drive that broader outperformance for the stock’s price:

These numbers show exactly why a little discretion goes a long way when looking for new financial sector stocks to buy.

Just over half of the sector’s stocks rate bullish or better on three of our factors (Volatility, Quality and Growth). Only 38 present bullish momentum, and roughly one-third of the stocks are trading at solid valuations.

That means there are plenty of stocks in the sector that don’t boast solid ratings on these factors.

To wrap up today’s analysis, I wanted to focus on Growth and Quality. High-growth stocks have driven this current bull market, and when you combine solid growth with a strong underlying business, you have a better chance of pinpointing stocks that won’t see the bottom fall out during a correction.

And since we’re dealing with such a large sector here, I drilled down to only target stocks that rate a “Strong Bullish” 80 or above on these two factors. These are the cream of the financial crop based on Quality and Growth:

That’s 15 stocks with incredible ratings on these two factors.

However, only three stocks on the list above rate “Strong Bullish” overall. The other 12 are either “Neutral” or “Bullish.” That’s not bad, but it tells me that investors are still cautious about investing in the financial sector. (If you want to look these stocks up in our system, click here to see how you can gain full access by joining Green Zone Fortunes today.)

One reason we haven’t seen broader bullishness is that interest rates have remained elevated, leading to higher costs for lenders across the board. I touched on this in last Friday’s earnings preview, and I’ll have more to report later this week as banks continue with their quarterly earnings calls.

Overall, though, our Green Zone Power Rating system proves that the financial sector has incredible potential, but being more selective is the way to go in this current market.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets