In 2020, public and private cybercrime losses added up to more than $1 trillion.

One cyberattack can cost a company millions…

- In 2020, a ransomware attack cost SolarWinds $25 million.

- In 2021, an attack put Amazon out of commission for about an hour … costing around $75 million.

- Colonial Pipeline was hacked in 2021 and paid out $5 million in ransom.

All of these attacks hurt companies’ bottom lines, and they can’t fight these threats alone. They bring in experts to upgrade technology and teach staff the best practices to minimize cyberattacks.

And companies that bolster cyber defense are in a lucrative position…

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” technology stock:

- It advises companies on best practices in technology.

- The stock jumped 52% in the last 12 months … and it doesn’t show signs of slowing.

- This stock is in the top 2% of all stocks we rate.

Here’s why this technology consulting firm will rise through 2022 and beyond.

Cybersecurity Evolves Constantly

With new technology comes new threats to data and corporate information. (I recently talked about cybersecurity threats in a podcast episode. Check it out here.)

It’s why companies spend millions on hardware and software upgrades, information technology (IT) staff and proper training.

I see a trend where that spending will increase as companies face stronger cybersecurity threats.

Take a look:

In 2016, the value of the global IT consulting and implementation services sector was $47.6 billion.

After a brief downturn amid the COVID-19 pandemic in 2020, the sector expects revenue to hit $82.8 billion by the end of 2027 — a 74% increase from 2016.

This trend in technology consulting and implementation pointed me to a strong company with a ton of potential … now and in the future.

A High-Quality Tech Stock: The Hackett Group Inc.

According to CompTIA, Florida added 10,522 new technology jobs in 2021 — second in the country and more than double California.

So where better to look for growth in the tech sector than the Sunshine State?

Miami-based Hackett Group Inc. (Nasdaq: HCKT) operates as a strategic advisory and technology consulting firm — working with companies around the world to implement best practices in technology.

It partners with technology giants Amazon, Microsoft, Oracle, SAP and ADP to help ensure companies are using the best technology for their business operations.

Hackett’s revenues dropped 10% in 2020 as companies reined in spending due to uncertainty over the COVID-19 pandemic.

Sales and consulting numbers rebounded well in 2021 — increasing total annual revenue by 18.2% to $277.6 million — and setting a record for total revenue.

By 2023, HCKT expects to grow its revenue to $335 million — a 20% gain from 2021.

Now, let’s see how the stock has performed.

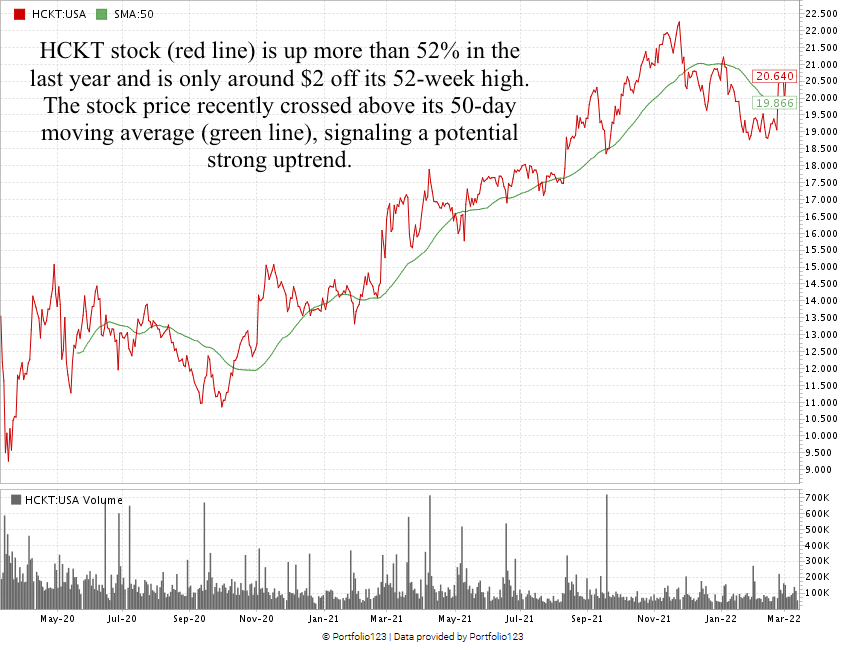

In the last 12 months, HCKT share price gained 52%. It is only about $2 off its 52-week high and recently crossed above its 50-day simple moving average.

The stock seems poised to break through its resistance at $21 and set a new high-water mark soon.

The Hackett Group Inc. Stock Rating

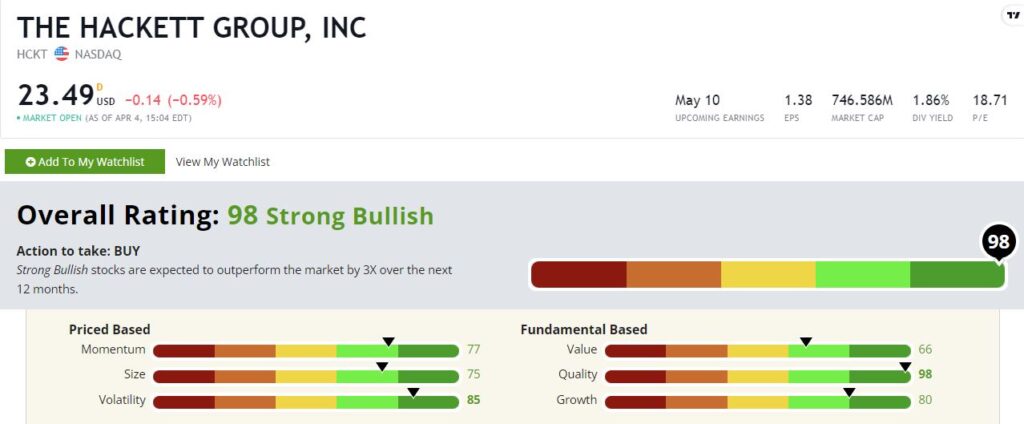

Using Adam’s six-factor Stock Power Ratings system, The Hackett Group Inc. stock scores a 98 overall.

That means we’re “Strong Bullish” on the tech consulting stock and expect it to beat the broader market by at least three times in the next 12 months.

HCKT rates in the green in all six of our rating factors:

- Quality — HCKT boasts double-digit returns on assets, equity and investment where the tech services sector’s averages are all negative. It also has a net margin of 15% compared to the sector average of negative-16%. HCKT scores a 98 on quality.

- Volatility — After trading sideways from April 2021 to August 2021, HCKT stock rose to a 52-week high with little resistance. The stock scores an 85 on volatility.

- Growth — With a one-year annual sales growth rate of 16.4% and a one-year annual earnings-per-share growth rate of 648%, The Hackett Group scores an 80 on growth.

- Momentum — It only took seven months for HCKT to reach a 52-week high. Gains pared back during the recent tech sell-off, but the stock is coming back in a big way. It rates a 77 on momentum.

- Size — With a market cap of $746.5 million, HCKT is a small-cap stock that gives us even more room to grow our gains. Smaller stocks tend to outperform larger stocks with similar ratings on the other five factors of Adam’s system. The Hackett Group scores a 77 on size.

- Value — Despite only scoring a 66 on value, HCKT’s price-to ratios are all well below the sector averages. Its price-to-earnings ratio is 18.7, compared to the industry average of 44.4. Hackett’s price-to-sales is 2.8, whereas the industry average is 3.3.

The Hackett Group Inc. also comes with a 1.86% forward dividend yield. That equals a $0.44 payout per share per year.

Bottom line: Companies need help protecting their — and their customers’— data as hackers find new ways to get through cybersecurity.

It’s a complicated process that requires analysis and customization. No two businesses are alike in their cybersecurity needs.

This sector of the tech industry will grow, and HCKT is well set to beat the market by three times over the next 12 months.

That’s why this cybersecurity company is a must-have for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.