General Electric’s stock is tanking after the release of a damming report claiming the company has been misleading investors and committing fraud.

Investigator Harry Markopolos accused GE Thursday of engaging in accounting fraud worth $38 billion.

“My team has spent the past 7 months analyzing GE’s accounting and we believe the $38 Billion in fraud we’ve come across is merely the tip of the iceberg,” Markopolos said in the 175-page report.

In an interview with CNBC’s “Squawk on the Street,” Markopolos said “it’s going to make this company probably file for bankruptcy.”

“WorldCom and Enron lasted about four months. … We’ll see how GE does,” he added.

There is now a website, www.GEfraud.com, that was created to disseminate the report. On the site Markopolos calls GE “a bigger fraud than Enron” and said he has found “an Enronesque business approach that has left GE on the verge of insolvency” after more than a year of research.

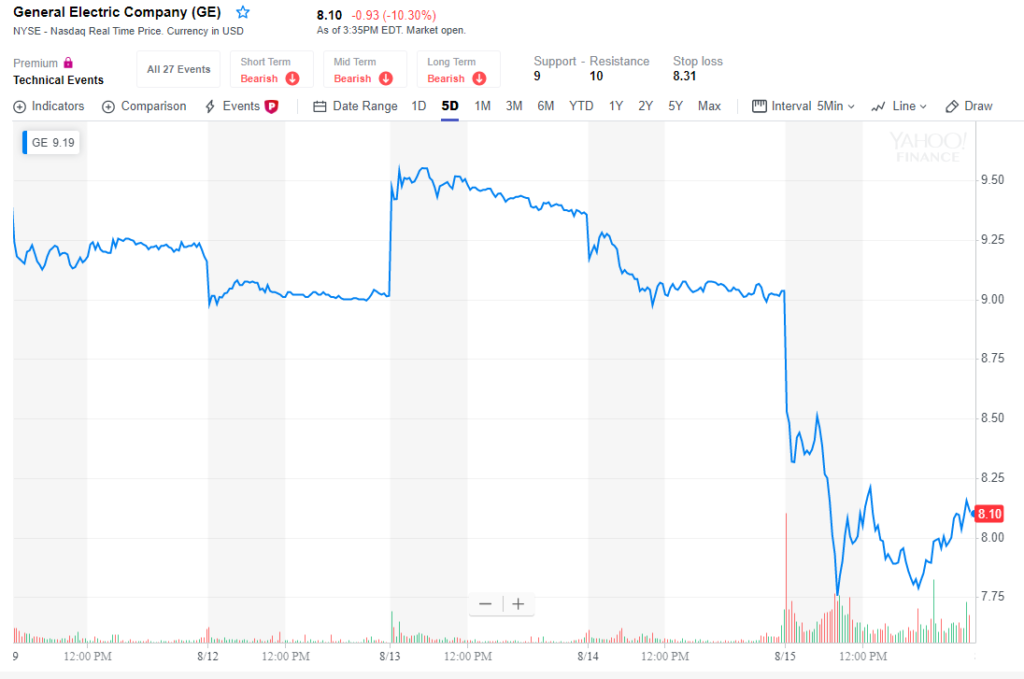

GE shares fell more than 13% at one point during trading Thursday. The stock had recovered slightly but was still down 11.4%, or $1.03 per share, around 2:45 EDT.

A look at the stocks’ five-day chart shows how quickly the shares collapsed before the opening bell Thursday.

GE says Markopolos’ claims are unsubstantiated and without merit, and the company stands behind its financial reporting. Lawrence Culp, CEO and chair of GE, said the report was purely “market manipulation.”

“GE will always take any allegation of financial misconduct seriously. But this is market manipulation – pure and simple,” Culp said in statement, according to CNBC.

“Mr. Markopolos’s report contains false statements of fact and these claims could have been corrected if he had checked them with GE before publishing the report. The fact that he wrote a 170-page paper but never talked to company officials goes to show that he is not interested in accurate financial analysis, but solely in generating downward volatility in GE stock so that he and his undisclosed hedge fund partner can personally profit.”

Markopolos disclosed that the unnamed hedge fund Culp mentions had paid him for access to the report before it was released. Asked about the potential conflict of interest, he told CNBC he needs to support his family.

Markopolos is known for his role as the whistleblower who warned the Securities and Exchange Commission about Bernie Madoff’s Ponzi scheme.

The Associated Press contributed to this article.