Harvest Health & Recreation Inc. (CNX: HARV) just inked the largest pot deal in U.S. history.

Well … legal pot deal that is.

On Monday, the Vancouver-based cannabis company shelled out $850 million to acquire Verano Holdings. Based in Chicago, Verano is a dominant pot vender in Illinois, Maryland and Nevada.

What’s more, with Illinois lawmakers are currently drafting a bill to legalize recreational cannabis usage. Harvest’s near billion-dollar acquisition gives the company access to a new flood of potential customers should Illinois join the other 10 states (and the District of Columbia) in legalizing pot.

“We wanted to make sure we were participating in a meaningful way before those conversations were at a crescendo,” Harvest CEO Steve White told the Chicago Tribune. “As that conversation starts moving forward, the price of assets in Illinois goes up.”

The combined company will operate roughly 200 facilities in 16 states, including 123 dispensaries.

While cannabis remains illegal at a federal level, analysts still believe that the U.S. pot market will grow to $22.2 billion by 2022 — compared to the Canadian market at just $5.9 billion.

Clearly, Harvest Health is banking on U.S. legalization. And if it comes, the company will be positioned as a key market leader in the U.S. with 13 cultivation and manufacturing facilities already up and running at the end of 2019.

With a market cap of about $1.98 billion, Harvest is currently the No. 3 cannabis company in the U.S. Massachusetts-based Curaleaf Holdings is the largest U.S. pot company, with a market cap of just over $3 billion, while fellow Chicago-based cannabis firm Green Thumb Industries comes in at No. 2 with a valuation of $2.67 billion.

If you’re looking to invest in Harvest Health, the stock trades on the Canadian Securities Exchange under the ticker HARV. The shares are up more than 70 percent since their initial public offering on the exchange, riding the bull-wave in the cannabis sector.

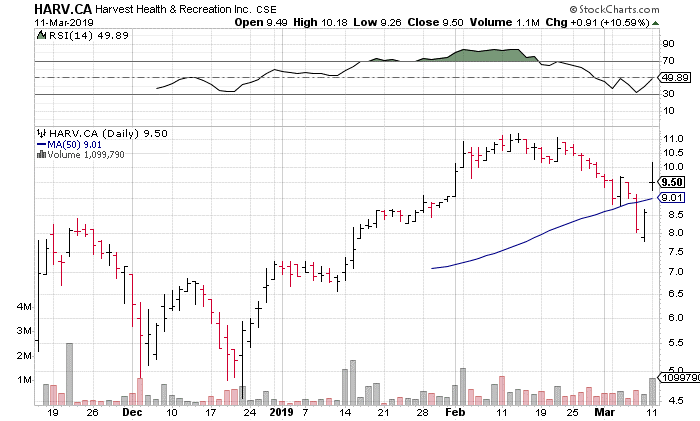

As you can see from the chart, HARV spent most of February in very overbought territory. Since then, the shares have sold off on a wave of profit taking, but the recent Verano acquisition news provided a pop on Monday. HARV is now holding north of price support at C$9.50, with potential short-term resistance near $10 and $11.

That said, you should see HARV stock surge past these short-term hurdles once Illinois passes legalization legislation. It’s clear that Harvest Health is a cannabis investment to follow closely.