The International Energy Agency says natural gas generates nearly a quarter of global power.

Natural gas, burned at high temperatures, creates heat that powers turbines.

These turbines spin a generator that creates electricity.

And the world will rely on this critical resource even more in the decades to come.

The chart below shows the growth of natural gas power generation worldwide:

From 2020 to 2050, the Energy Information Administration projects global natural gas power generation to grow by almost one-third!

That means more turbines.

Because natural gas burns at such a high temperature, manufacturers need special metals to produce turbines that can withstand extreme conditions.

Today's Power Stock specializes in producing these high-performing metal alloys: Haynes International Inc. (Nasdaq: HAYN).

Haynes creates metal alloys designed to resist oxidation and withstand extremely high temperatures.

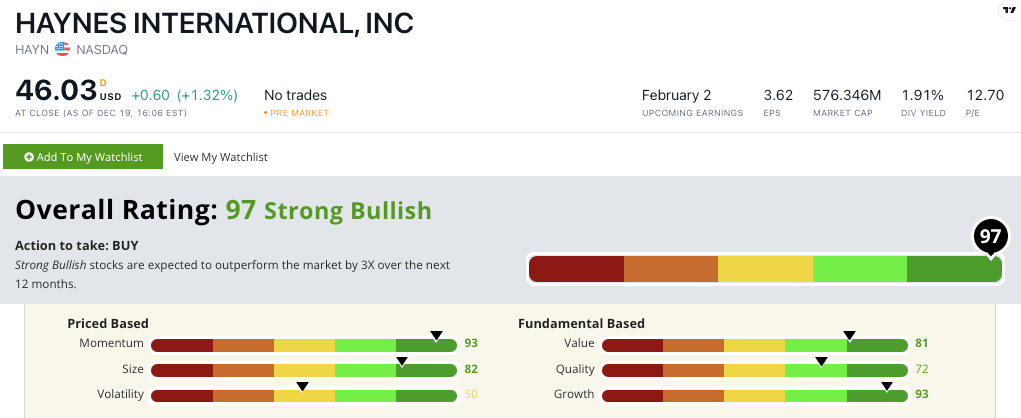

Haynes stock scores a "Strong Bullish" 97 out of 100 on our Stock Power Ratings system.

We expect it to beat the broader market by 3X in the next 12 months.

Hayne Stock: Strong Growth + “Maximum Momentum”

HAYN just closed out an outstanding quarter:

- Net income was $16.3 million — a 526.9% hike from the same period a year ago!

- Its net revenue for the quarter was $143.8 million — up 50.9% over the same quarter last year!

Those numbers show why Haynes stock scores a 93 on our growth factor.

It’s also a fantastic value stock.

HAYN’s long-term price-to-earnings ratio is less than half the industry average — earning it an 81 on value.

The company’s return on assets is three times higher than the metal products industry average.

All of this tells us the stock is a strong value compared to its peers and company management continues to turn profits.

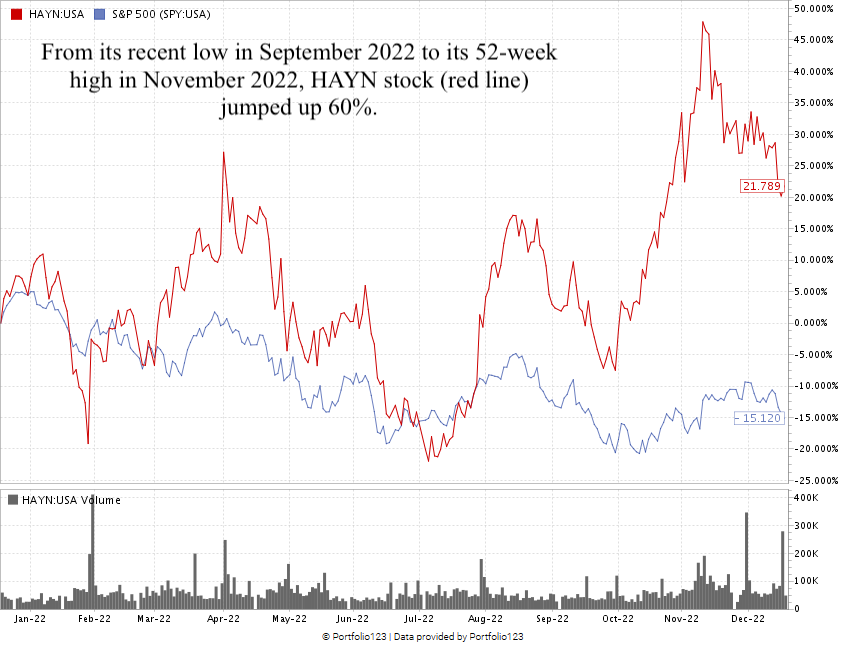

From its low in September 2022 to its high in November 2022, HAYN raked in a 60% gain.

Over the last 12 months, the stock is up 21.8% … beating the S&P 500’s 13.8% loss over the same time.

That’s the “maximum momentum” we love to see in stocks.

Haynes stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we're “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

The world is generating more and more power from natural gas.

To do it efficiently, turbines need to be able to withstand extreme temperatures.

HAYN is a great addition to your portfolio as a leader in providing high-performing alloy metals used in these critical components of power generation.

Natural gas demand isn’t going anywhere, but I wanted to mention another development within the energy sector…

My colleague Adam O’Dell is watching the oil market closely. He sees a “super bull” forming in the coming months. And when it hits, he expects his No. 1 stock to soar 100% higher in just 100 days.

Adam and the rest of the team are putting the final touches on a presentation that will show you everything you need to capitalize on the next oil super bull market. Click here to put your name on the list for his December 28 presentation.

You don’t want to miss this.

Stay Tuned: Something a Little Different

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

In Thursday’s issue, I’ll pit two of the biggest oil companies against each other to see which is the better investment, according to Stock Power Ratings.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets