With some of Wall Street’s biggest names sounding the alarm about what an Elizabeth Warren presidency would do to the stock market — send it crashing and burning — someone is finally putting their money where their mouth is.

Soros Fund Management alum Scott Bessent, who runs a $4.5 billion hedge fund called Key Square Capital Management, is shorting the U.S. dollar in a bet to capitalize on the market reaction the big names have been crowing about.

“Intelligent people can argue whether Senator Warren’s numerous programs will be good or bad for American society, but they are unequivocally negative for U.S. asset prices,” Bessent wrote in a recent letter to investors.

Of course, the bet doesn’t come without risk — big risk, just looking at history. There were a large number of “experts” in 2016 that said the market and economy would collapse if Donald Trump was elected president.

That’s proven to be … decisively, laughably false as the markets have been setting record highs left and right of late.

But Bessent says there are a number of factors that support his bet and the further Warren rises in the polls, the better his wager will look.

“A Warren presidency, or the mere threat of one, will likely hasten the exodus of foreign and domestic capital to overseas markets,” Bessent wrote.

Bessent also wrote that the things that make the U.S. attractive to investors, such as a strong economy, tech advances and capitalism, have all started to sink while rising stock prices have made the market vulnerable to less business-friendly policies that would accompany a Warren presidency.

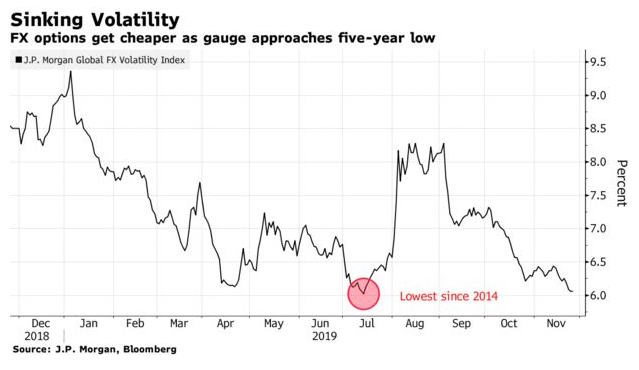

According to JPMorgan’s gauge of currency volatility, dollar put options, or the right to sell the dollar by a specific date, are “particularly attractive” due to the low level of implied volatility in foreign-exchange rates.

Warren shot to the top of many major polling services in October but she has faded somewhat, though, she remains a top contender for the Democratic nomination.

For Bessent, Warren’s policy plans would be a “dramatic rethink” of antitrust policies and worker empowerment that would be bad for business — and stock prices.

Warren also has called for “actively managing” the level of the dollar to boost jobs, according to Bloomberg.

“A dramatically weaker dollar, conveniently one of her policy prescriptions, is, in our view, the best way to play the rising chance of the Senator moving into the White House,” the report said.

While still working for George Soros, Bessent made a similar bet in late 2012-early 2013 that the yen would tank, and he made about $1 billion. And just the possibility of a Warren presidency in the lead-up to the 2020 election would bring markets down considerably before Election Day, Bessent wrote.

“We posit that if the U.S. equity markets are spooked by a Warren presidency, most of the decline may have occurred by Election Day.”