If you’ve been a consistent reader of What My System Says Today, you may have noticed a trend…

The technology, consumer discretionary, and industrial sectors have dominated the conversation due to their outperformance over the last several weeks.

Today, I’m flipping the script …

I want to dig into the health care sector, last week’s worst performer, to see what my Green Zone Power Rating system specifically says about the future outlook for these stocks.

Let’s get into it!

Health Care Sector X-Ray

As I showed you yesterday, the health care sector was almost flat last week with a mere 0.3% gain. Every other sector posted a gain of at least 1%, while the broader S&P 500 jumped 5.3% higher!

Sometimes, a laggard sector signals trouble for its component stocks … other times, it hands us an opportunity to buy just ahead of a shift to outperformance. The latter situation may be the case for health care stocks, which are now entering a part of the year when, based on seasonality, they tend to perform above par.

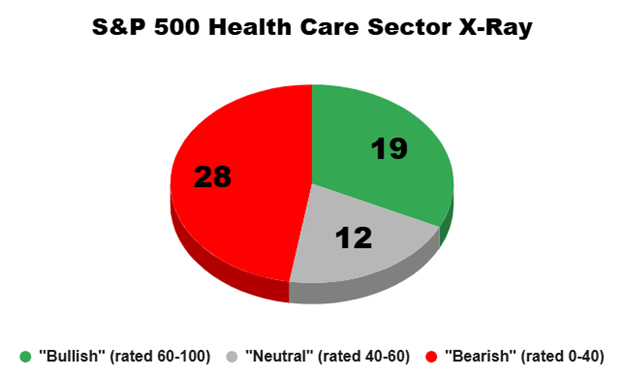

Nonetheless, let’s run our breadth analysis on the health care sector (XLV) using my Green Zone Power Rating system to see how many stocks rate bullish, bearish or neutral:

- Bullish (stocks rated 60 to 100).

- Neutral (stocks rated 40 to 60).

- Bearish (stocks rated 0 to 40).

Here’s how my system is rating the health care sector currently:

Right off the bat, we can see a bearish-to-neutral lean in the health care sector, with 28 out of 59 stocks (47%) rated bearish or high-risk, and another 20% rated neutral. Only 33% of the stocks are rated bullish.

This tells me we have to “get picky” and look for individual stocks if we want to target outperformance in this sector in particular.

Next, let’s look at individual factor ratings within my system to see what we can learn…

Health Care Sector Factor Breakdown

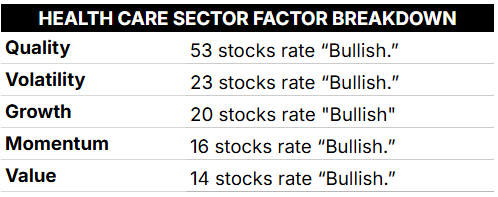

My Green Zone Power Rating system takes six individual factors into consideration when assessing if a stock is set to outperform or underperform the broader market over the next 12 months.

And looking at the mix of factor ratings, we can get a general feel for the sector as a whole.

Let’s do that now with the health care sector (Note: I left the size factor out of this breakdown because these are all generally mid- to large-cap stocks that trade on the S&P 500, so we can’t expect a “small-cap bump” like we might enjoy with smaller stocks.):

With 53 out of 59 stocks rated bullish on the quality factor, this tells me there’s almost no better place to be if you’re looking for solid businesses with strong balance sheets.

On the other hand, seeing only 14 stocks rated bullish on value suggests the sector’s stocks are priced richly. Share price momentum looks poor, with only 16 stocks rating bullish or better.

Once again, this confirms my thesis that we need to be more selective when looking for health care stocks to buy. While a high-quality rating tells us most of these businesses are in a strong financial position, if investors aren’t buying in, it doesn’t matter! We don’t want to be left holding a stock (or a basket of stocks) that isn’t going anywhere while the broader market rips higher.

Next, though, let’s dig even deeper and highlight a factor that has been a theme in this trade-war-driven market.

I’m talking about volatility…

Volatility in Health Care Stocks

My Green Zone Power Rating system looks at several volatility metrics.

These include risk-adjusted returns and average true range over various timeframes.

However, one of the most common measures of volatility is a stock’s beta.

Beta denotes a stock’s volatility compared to the market. In simple terms, beta measures the expected increase or decrease in a stock’s price for a given move in the market.

A stock’s beta is typically compared to that of the S&P 500 index, which has a beta of 1.

If a stock has a beta below 1, it is considered less volatile than the benchmark. A beta above 1 means the stock is more volatile.

Below, you can see the interplay between beta and my broader volatility factor rating. Reminder: A higher volatility rating indicates the stock is less volatile than the average stock.

This screen isolates five health care stocks with the lowest betas:

As you can see, the low betas of these five stocks validate the high volatility factor ratings my system is currently assigning to them.

These are, indeed, “low volatility” stocks.

But that doesn’t make them all well-rounded stocks poised to beat the market. While two of the five are rated “bullish” overall, and two are rated “strong bullish” … AbbVie Inc. (ABBV) manages an overall rating of just 29 out of 100, despite the low-volatility nature of its price action.

We’ll see if that changes at all over the next six weeks or so…

As I mentioned, one corner of the health care sector has just begun its seasonally strongest six-week stretch of the year. We don’t talk about it much, but Matt Clark and I maintain a seasonality-based “Apex Profit Calendar,” which shows us which sectors and industry groups have consistently outperformed during very specific five- to six-week stretches of the calendar year.

We don’t recommend buying the entire sector during these seasonal profit windows, but only the one or two highest-rated stocks in the sector, according to my Green Zone Power Rating system.

We’ve actually been beta testing this strategy with a small group of subscribers for the past year and a half … and frankly, the results have exceeded the expectations set by our initial backtest.

To learn more about this approach and gain access to the health care stock we just recommended yesterday, click here. We’re still in the early days of this trade, so there’s still a little bit of time to get in and maximize your potential gains during this profit window.

To good profits,

Editor, What My System Says Today