Business owners are reporting that jobs are hard to fill. Yet, millions of workers remain unemployed. While there has been some economic adaption, unemployment is a hotly debated problem. Some blame enhanced unemployment benefits that total $300 a week in many states. Others argue high unemployment is a sign that jobs don’t pay enough.

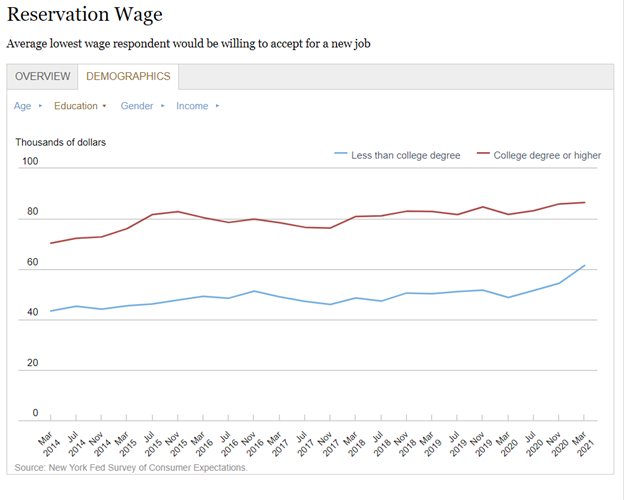

There is some evidence that jobs don’t pay enough to entice workers to accept them. That evidence is the unprecedented increase in the reservation wage.

The reservation wage is the lowest wage a worker will accept at a new position, according to the National Bureau of Economic Research:

Reservation wages appear to be of some consequence: workers are 24 percentage points more likely to accept an offer that is equal to or exceeds their reservation wage than to accept a job with a wage below the threshold.

Self-reported reservation wages decline at a modest rate over the unemployment spell, with point estimates ranging from 0.05 to 0.14 percent per week of unemployment. After a year of unemployment, the reservation wage is only 2.5 to 7 percent lower than at the start of the unemployment spell.

The research shows that the trend in the reservation wage has historically declined at a slow pace the longer someone is unemployed. But this time is different. The reservation wage increased sharply in the past year, especially among those without a college education.

Reservation Wage Increased Despite Pandemic

Source: NY Federal Reserve.

Until People Accept Reasonable Wages, Unemployment Won’t Shrink

The reservation wage is up 19% in the past year for those without a college degree. On average, those individuals want a job offer of $61,483. Many will turn down jobs that don’t meet their expectations.

It seems reasonable to ask if the expectation for wages of about $30 an hour is fair for many jobs that paid less than $15 before the pandemic.

Until the reservation wage declines, the unemployment rate is likely to remain high.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.