I’m picky when it comes to adding new stocks to our Cannabis Watchlist.

I search for different ways to invest in the cannabis sector. I don’t want to just follow the crowd into the biggest names and hope for the best.

After digging through the data, and reading your comments, I think I’ve settled on our next Cannabis Watchlist winner.

Shilo M. wrote on YouTube:

Do a video on High Tide.

Short, sweet and to the point. Thanks for writing in, Shilo.

In today’s Marijuana Market Update, I analyze High Tide Inc. (OTC: HITIF), a Canadian, vertically-integrated cannabis company.

Let’s see why HITIF deserves a spot on the Cannabis Watchlist.

High Tide’s Rapid Growth

High Tide distributes cannabis accessories and sells cannabis products at a long list of retailers.

As of February 2021, the company operates 70 Canna Cabana retail stores and has several brands under its banner:

- Canna Cabana.

- Meta Cannabis.

- NewLeaf Cannabis.

- Kushbar.

- Grasscity.

- CBCCity.

- Valiant Distribution.

- Famous Brandz.

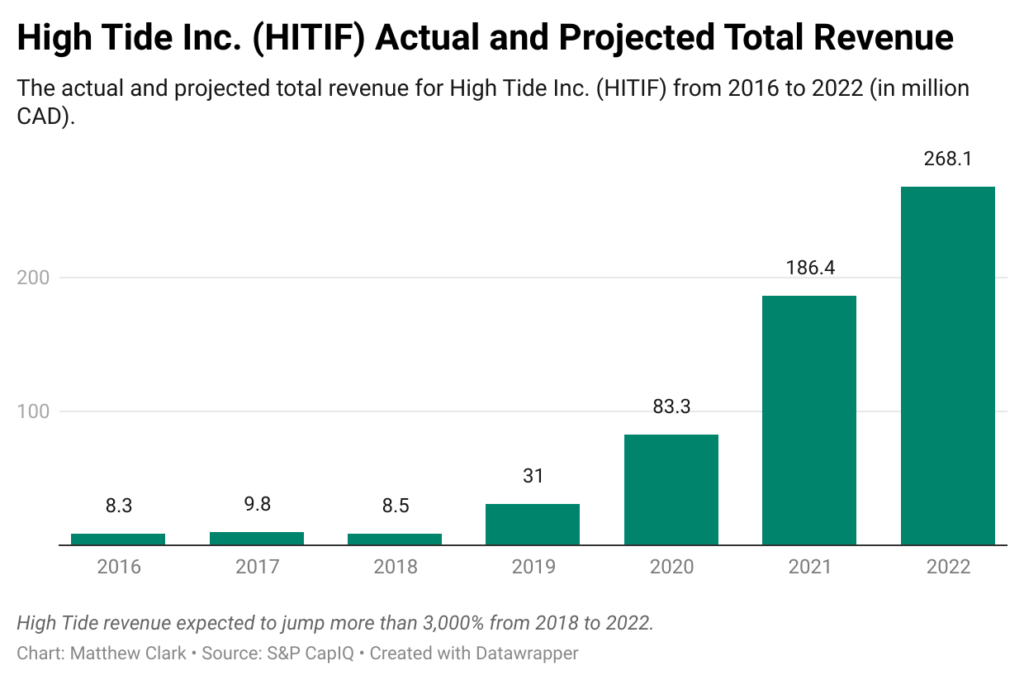

In 2018, High Tide’s revenue went from $8.5 million CAD (about $6.7 million USD) in 2018 to $30.9 million CAD ($24.4 million USD) in 2019.

And its growth isn’t projected to slow down any time soon.

High Tide released quarterly earnings on March 2. In fiscal 2020, the company brought in $83.3 million in total revenue ($65.87 million USD) — a 123% increase from fiscal 2019.

That revenue is expected to grow to $268.1 million ($212 million USD) in 2022 — a 43% increase over 2021 and a 3,054% jump from 2018 figures.

That is a massive growth projection in just three years.

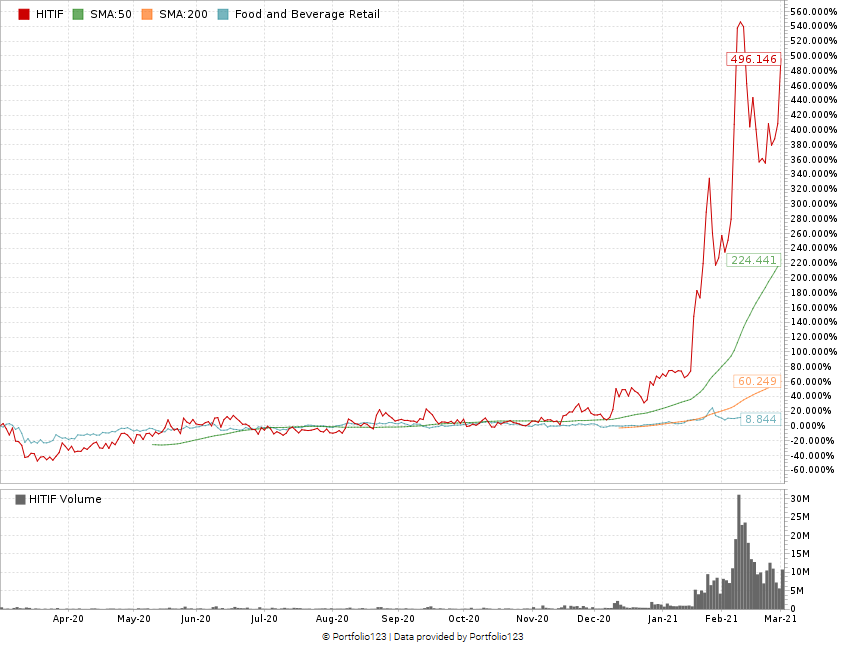

Since December 2020, High Tide’s stock price has jumped dramatically.

HITIF (Red) Jumps 1116% in 12 Months

HITIF took off in January and now sits at $0.59 per share after hitting $0.73 per share earlier this week, an 1,116% jump from the company’s March 2020 low.

Big industry names like Aurora Cannabis Inc. (NYSE: ACB) and Aphria Inc. (Nasdaq: APHA) are also involved in its operations.

It even partnered with famous rapper Snoop Dogg.

Cannabis Watchlist Performance

I like what High Tide is doing right now.

In fact, I added HITIF to our Cannabis Watchlist on Money & Markets.

Our watchlist is doing well, with average gains at 33.1%. The recent sell-off hit some stocks harder than others.

Here’s the breakdown for each pick:

- Planet 13 Holdings (OTC: PLNHF) — The Nevada-based cannabis company saw a decrease in short interest of more than 54% as fund managers see the potential for growth in the stock price. Planet 13 stock is now up 15% since January.

- Scotts Miracle-Gro Co. (NYSE: SMG) — The fertilizer company revised its earnings per share guidance to $8.40 per share. SMG is up 9% since September.

- GrowGeneration Corp. (NYSE: GRWG) — The pure cannabis play is still one of the best performers on our watchlist, gaining 45% since I added it in November.

- Turning Point Brands Inc. (NYSE: TPB) — In February, analysts with Cowen Inc. raised the price target of TPB from $45 to $65 while analysts at B. Riley increased its price target for the company from $59 to $63. Turning Point is up 56% since October.

- PerkinElmer Inc. (NYSE: PKI) — I’m still watching this stock after its recent decline. Optimum Investment Advisors, TFC Financial and Simon Quick Advisors raised their position in the company during the fourth quarter, leaving PKI stock up just over 4% since September.

- Schweitzer-Mauduit International (NYSE: SWM) — This company took off after a strong earnings report in the fourth quarter. The company recently wrapped a $350 million term loan to back the acquisition of Scapa Group PLC, which sells first aid and personal-care products. SWM stock has moved up nearly 60% since September.

Congratulations on your gains! If you followed my watchlist, I’d love to hear about it and how you’re doing. Email me at feedback@moneyandmarkets.com or leave a comment on our YouTube channel.

Where to Find Us

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel and get an alert when we release a new update.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.