In today’s market, high-yield dividend stocks aren’t easy to come by.

But if you’re willing to venture off the beaten path, you can still find some juicy yields.

The trick is finding yields that are sustainable. You don’t want to add a high dividend yield stock to your retirement portfolio, only to see it get slashed in the next quarter.

And I’m confident I’ve found a perfect candidate.

LyondellBasell Industries (NYSE: LYB), a global specialty chemicals company, is a high-yield dividend stock with a diversified product portfolio. Apart from its core petrochemicals businesses, Lyondell also operates a crude oil refining business that produces gasoline, diesel fuel, jet fuel and other products.

Lyondell, like most cyclical stocks tied even remotely to energy, got crushed during the COVID crash. From its late 2019 peak to its March 2020 low, Lyondell lost two-thirds of its value.

But shares have pushed higher ever since. And, barring another destabilizing bear market, I expect the shares to outperform, even if energy remains depressed for months — or years.

Note that Lyondell doesn’t sell oil; it buys it as a feedstock. Depressed energy prices lower the company’s production costs.

Lyondell remains economically sensitive. Demand for its products is highly cyclical. But the company made it through a very difficult string of months without incident.

And it’s hard to imagine anything more disruptive than the March and April lockdowns.

LyondellBasell Industries: A High-Yield Dividend Stock With Potential

Let’s talk dividends. At current prices, LyondellBasell sports a dividend yield of 5.7%. That’s attractive in a world where the 10-year Treasury Note yields less than 0.7%.

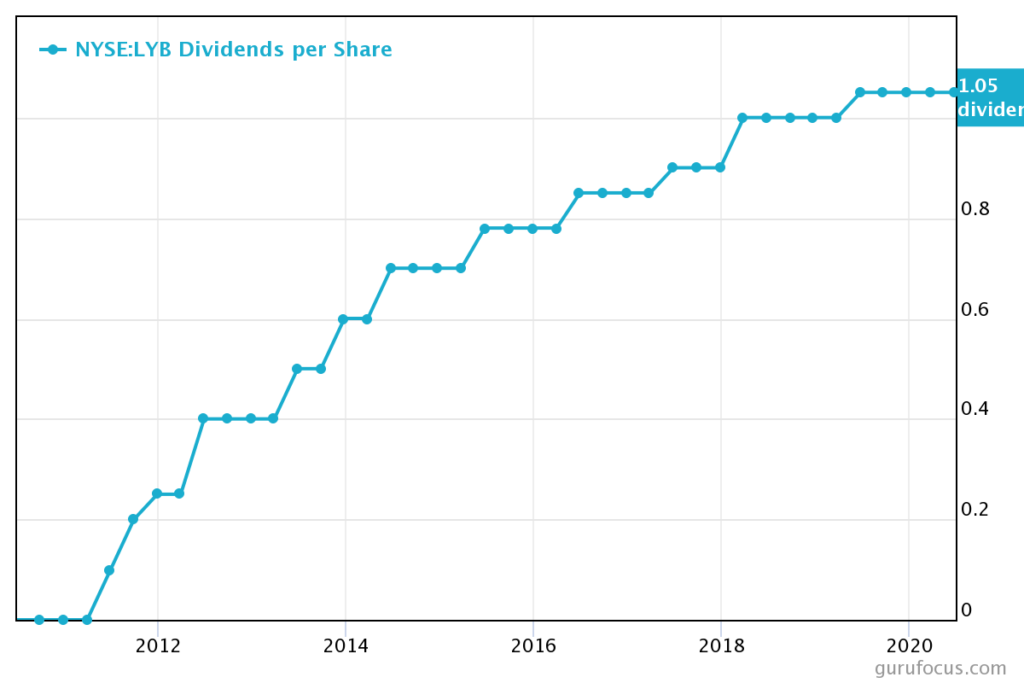

And Lyondell is a major dividend grower. Its quarterly payout has more than doubled since 2013.

LyondellBasell’s Dividend Growth Streak

Dividend growth may be sluggish for the next year or two as the company builds up case reserves in a difficult economic environment. But with a payout ratio of 69%, there’s enough wiggle room for at least a modest hike over the next few quarters.

Based on our Green Zone Ratings system, LyondellBasell is in the middle of the pack with a composite rating of 45. This suggests the stock will perform in line with the market over the next 12 months.

But let’s dig a little deeper.

Lyondell scores high on Quality and on Value, at 85 and 79, respectively. This means that just 15% of the stocks in our universe rate higher based on profitability, debt levels and other Quality metrics. And just 21% rate higher based on value.

As a baseline scenario, we should collect a high-yield dividend of 5.7% while also achieving stock returns in line with the S&P 500. That’s not too shabby.

But I also believe the shares could end up performing better than our model suggests.

Value investors have expected a large-scale rotation out of flashy growth stocks and into gritty value stocks for months. That’s not likely to happen while COVID cases are still rising, and the threat of new lockdowns looms over the market.

But if we get a working vaccine in the coming months, and life starts to look more normal, watch for that rotation into value stocks. That’s when we could see a pop for LyondellBasell.

So, think of it like this: Our baseline scenario has us pocketing high-yield dividends near 6% while enjoying market returns.

But if we get help from a recovery in value names, Lyondell could be a major outperformer.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.