I looked into selling my house recently.

My wife and I love the neighborhood. It’s lined with old-growth shade trees, our neighbors wave to us when we step outside to get the mail, and kids roam the streets on bicycles. It feels like a bygone era, and it’s great.

But we’re now a family of five, and the place is feeling cramped. Plus, if I’m honest, my two older boys have pretty well trashed the place.

It’s time for something new.

There’s just one problem. Inventory in the neighborhood has dried up. I could sell the house in a day, but there is nothing available to buy. So, we’re just going to sink a little money into the current house and make do for a while.

We’re not alone. All across America, the same scenario is playing out. Home inventories are at record lows, and the houses that Americans want to buy aren’t there — nobody’s built them. Mortgage application volume actually fell by 4% in late May, according to the Mortgage Bankers Association.

So, we’re all collectively doing the next-best thing: fixing and freshening up our current digs.

This was already a theme before the pandemic, but being stuck at home for a year spurred a lot more of it. And now that the pandemic is over, it continues, as the housing shortage is all the more apparent.

It’s bad news for you and me, as it means we’ll be paying a lot more in labor and materials costs. Apart from demand being much higher than usual, pandemic shutdowns also crimped supply.

But all of this should be music to the ears of Home Depot Inc. (NYSE: HD) shareholders. Home Depot has had a fantastic run. And if present trends are any indication, that run is nowhere close to over.

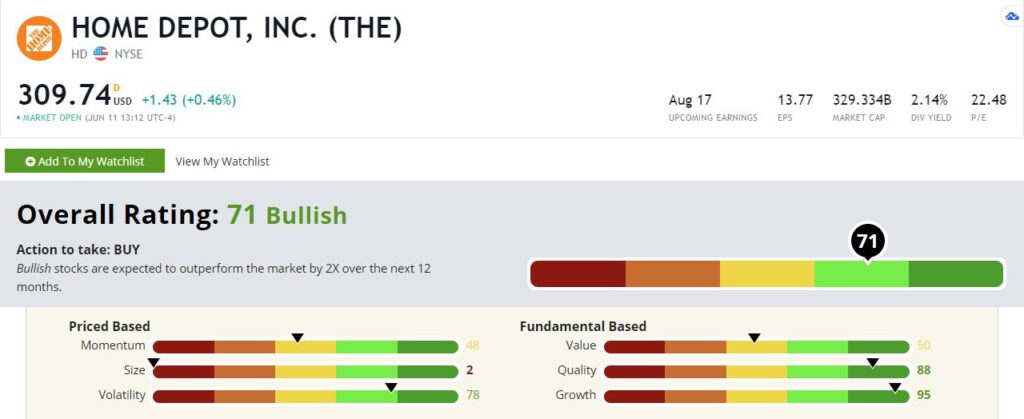

Home Depot’s Green Zone Rating

Our Green Zone Ratings system also suggests that Home Depot’s run is far from over. It rates a 71 overall, well within “Bullish” territory. In our rating system, any stock rating 61 to 80 is considered Bullish. Our backtesting suggests returns for these stocks double that of the S&P 500 in the following year.

Home Depot Inc.’s Green Zone Rating on June 11, 2021.

Let’s do a deeper dive to see what’s driving Home Depot’s Bullish rating.

Growth — Home Depot stock knocks the ball out of the park on our growth factor with a rating of 95. The company is growing faster than all but 5% of the companies in our universe. Last quarter, revenues were up 33% year over year, and earnings per share were up a whopping 85%. And if my plans to renovate my house are any indication, that growth won’t be slowing any time soon.

Quality — The company also rates exceptionally well on quality at 88. Home Depot generates very respectable margins and is a top performer on returns on equity, assets and investment. Over the trailing 12 months, these three sub-factors rated 99.9, 97.7, and 97.8, respectively, placing HD in the elite of the elite. Home Depot is a high-quality company, and the numbers confirm that.

Volatility — This is also a stock that isn’t likely to give you heartburn. It rates a 78 on volatility, meaning it’s less volatile than all but 22% of the stocks in our universe. While Home Depot is not immune to business cycle changes, demand for its products holds up well even in hard times as people opt to fix up their existing homes rather than buy new ones.

Value — Home Depot isn’t cheap at current prices, but it’s not expensive either. It rates a 50 on value, placing exactly in the middle of the pack. Its price-to-earnings ratio of 22 is well under the market average.

Momentum — Despite having a killer 2020, momentum has sagged a little. The stock rates a 48 on this factor. But this means its momentum is average in a market that, overall, is trending higher.

Size — Home Depot is a large company and one of the largest retailers in the world. Its market cap is just under $330 billion. Don’t expect any kind of small-cap bounce here. Home Depot rates a 2 on our size factor.

Bottom line: Home Depot is a fantastic company, and over its life has been a good stock to own. Given a tight labor and housing market, I expect that streak to continue for a while.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.