Settling down and owning a home is part of the American dream.

It used to be the benchmark for making it in the United States.

When borrowing was tight, and interest rates were high, owning a home was reserved for those with strong credit and outstanding finances.

But times have changed.

Homeownership is still part of the American dream. And now it’s much easier to achieve.

People are taking advantage, hitting the housing market with vim and vigor.

I used Adam O’Dell’s six-factor Green Zone Rating system to find a stock in the homebuilding sector. It’s poised to take full advantage of this housing demand surge.

More on that in a bit.

First, I want to lay out some trends that make this a stock to own.

The Mortgage Rate Influence

Besides supply, mortgage rates are a big factor influencing home-buying decisions.

The lower the interest rate, the cheaper a loan for a new home is. That brings monthly payments down.

Mortgage Rates Hit Lows

According to the Federal Home Loan Mortgage Corp. (Freddie Mac), interest rates for the three most popular types of home loans (30-year fixed-rate, 15-year fixed-rate and 5/1 adjustable rate) hit new lows earlier this year.

It’s cheaper than ever to finance a new home.

That has translated into greater demand, especially for newly constructed homes.

New Home Starts Move Higher

In March 2021, there were 1.7 million new home starts recorded by the National Association of Home Builders.

That’s the highest monthly total in a year.

New Construction Propels This Homebuilder Stock

Interest rates are low. And new home construction is on the rise.

Century Communities Inc. (NYSE: CCS) capitalizes on this trend.

It develops real estate and constructs single-family homes across the United States.

And Century Communities’ bottom line has benefited from the real estate boom.

CCS Total Revenue Explodes by 330% From 2015 to 2020

In 2015, the company recorded $734.5 million in total revenue.

That ballooned to $3.16 billion in 2020.

Projections have the company’s total revenue hitting more than $4 billion by 2022. That’s a 447% jump since 2015!

The company’s stock price has followed this trend higher as well.

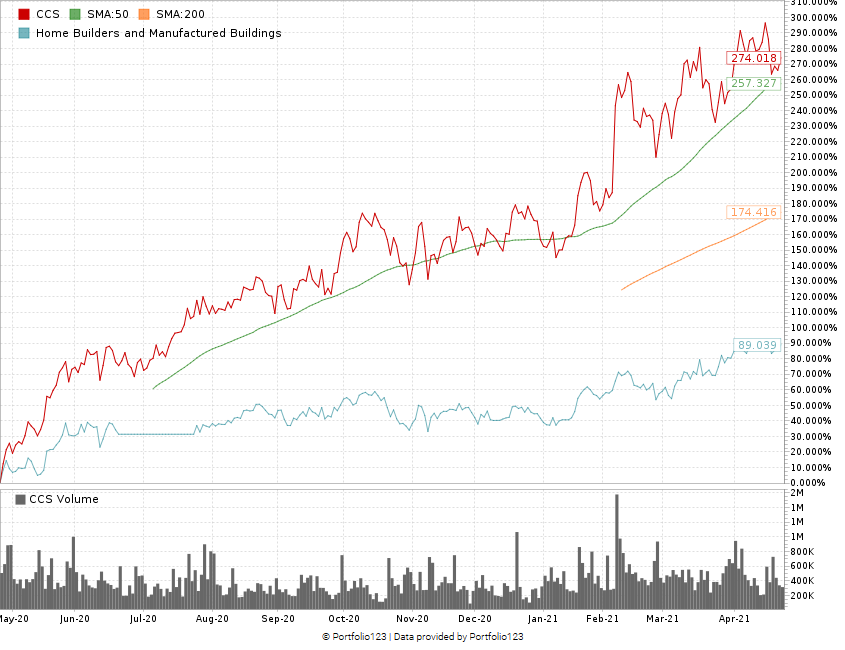

CCS Stock Increases 481% Off March 2020 Lows

After hitting a low of around $11 in March 2020, CCS stock soared 481% higher to where it is priced today.

That‘s much higher than the 90% average increase of the homebuilders and manufactured buildings sector.

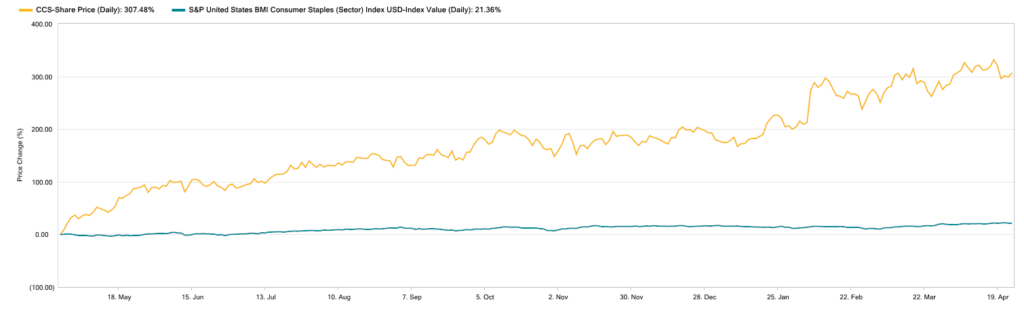

CCS Stock Outperforms Consumer Staples Sector

The consumer staples index (blue line) grew 21% in the last 12 months. CCS (yellow line) grew more than 300% during the same time.

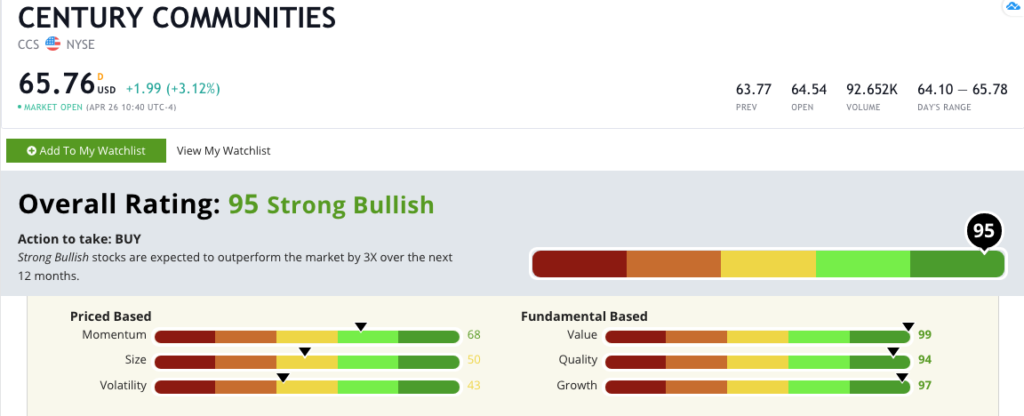

CCS scores a 95 overall in Adam’s Green Zone Ratings system. That means we are “Strong Bullish” on the stock. We expect it to outperform the broader market by three times over the next 12 months.

Century Communities Inc.’s Green Zone Rating on April 26, 2021.

The stock ranks in the green in four of our six metrics:

- Value (99) — The company’s price-to multiples are much lower than the industry average. If there is a pullback in housing stocks, CCS still has room to grow.

- Growth (97) — CCS has a one-year annual sales growth rate of 24.6% and a one-year annual earnings-per-share growth rate of nearly 70%.

- Quality (94) — Its returns on assets, equity and investments are all higher than the industry average.

- Momentum (68) — From its stock chart, you can see the stock has reached a new 52-week high and has topped its 50-day moving average.

CCS ranks in the yellow (neutral) in size (50) with a market cap of $2.1 billion and volatility (43) as the upward movement of the stock has come with some slight retracing.

Bottom line: Homebuilding continues to move higher as interest rates and a lack of existing home supply pushes buyers into the new-home market.

This trend shouldn’t slow down.

And even if it does, CCS is a strong value stock, even after its massive 12-month gain.

This is why Century Communities Inc. (NYSE: CCS) is a rock-solid homebuilder stock for your portfolio.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.