Panic is setting in among potential homebuyers according to many media reports.

NPR reported:

The average rate for a 30-year fixed rate mortgage has topped 7% for the first time in 20 years. Rates have more than doubled since the start of the year, making it much harder for would be homebuyers. The pace of home sales has declined for 8 consecutive months as frustrated buyers give up, unable to afford higher payments.

Higher rates limit what prospective buyers can buy. This might be the biggest shock in the market. Buyers who were shopping for $400,000 homes a few months ago might be looking at homes closer to $350,000 now. That’s painful.

Potential buyers wanted the upgrades that came with higher-priced homes. Now they feel like they lost something as they look at homes with fewer amenities.

But it seems like this is just a psychological shock.

Homebuyers Have Prepared for High Mortgage Rates

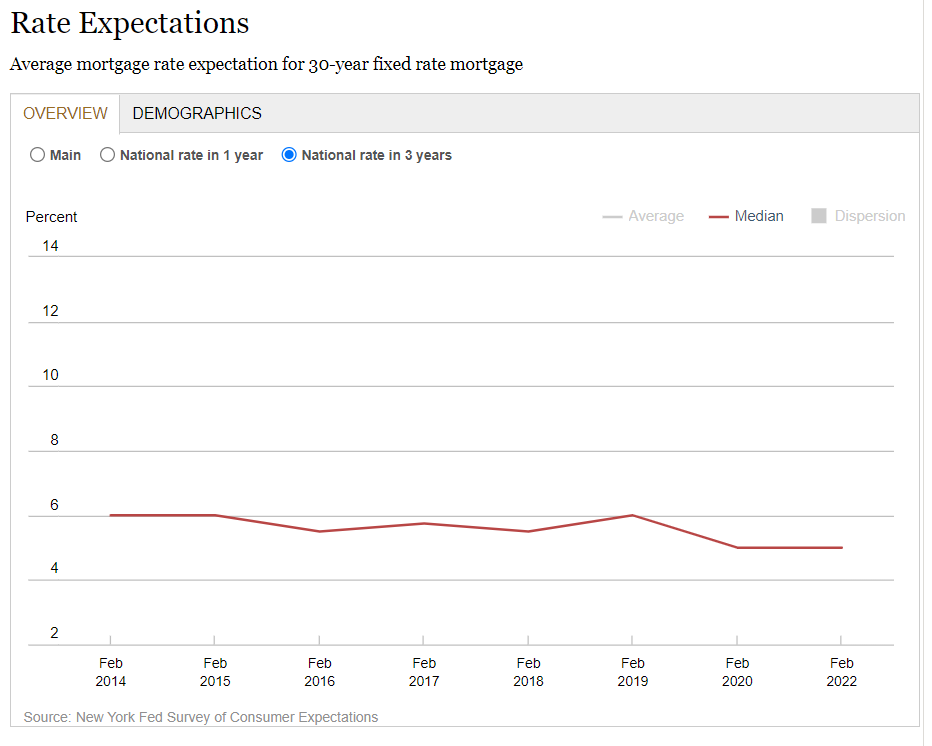

Potential buyers never expected rates to stay below 4%. They’ve been planning on mortgages at rates closer to 6% for most of the past decade. This is shown in the chart below.

This is a chart from the New York Federal Reserve’s Survey of Consumer Expectations. The median value of the responses is 5%. That tells us half the survey participants expect mortgage rates higher than 5% while half expect rates lower than that.

The median is unchanged from a year ago. It’s down 1% from three years ago.

This is good news for the housing market.

Buyers were happy to lock in low rates but they were planning for mortgages that are near the current level. Low rates distorted their perceptions of how much home they could afford but buyers should quickly adapt to the new reality.

Bottom line: This looks like a market ready to unleash a wave of homebuyers when mortgage rates dip. That’s a market where stable prices are likely.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.