Some of the biggest names on Wall Street were grilled Wednesday by House Democrats over whether their “too-big-to-fail” banks would end up crippling the U.S. economy should they … fail.

“Bulletproof vests covered with fire-retardant suits may not protect the banks. It’s just a question, unfortunately, of how much scrutiny and how bad it is.”

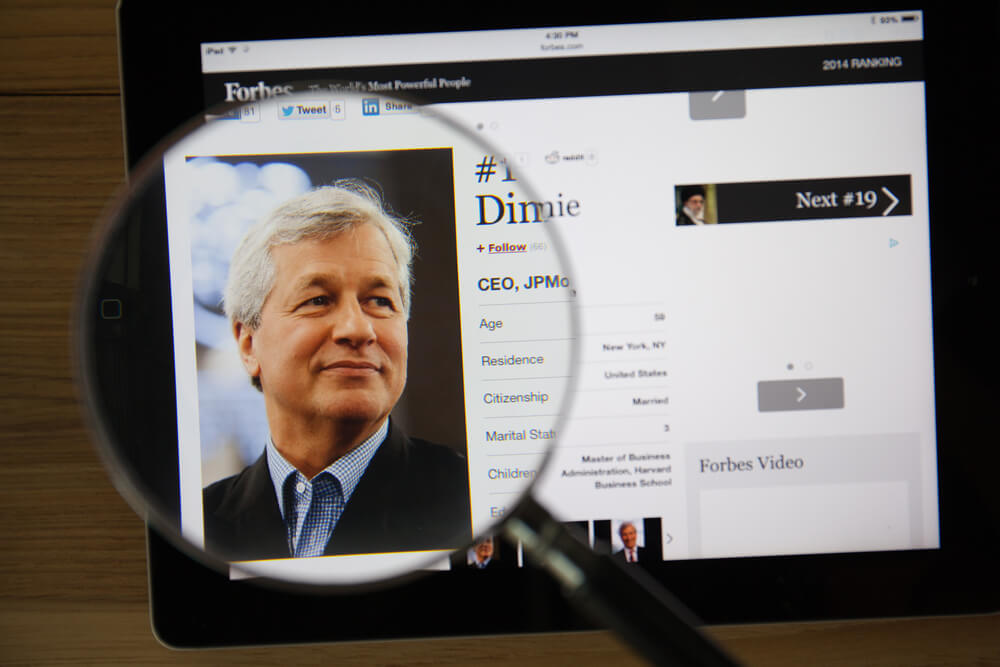

The CEOs of seven top U.S. financial giants, including JPMorgan & Chase CEO Jamie Dimon and Goldman Sachs’ David Solomon, faced off with lawmakers like Rep. Maxine Waters over systemic risks to the U.S. banking system. Waters also had a big day Tuesday in her new position of power as chair of the House Financial Services Committee, also grilling Treasury Secretary Steve Mnuchin over President Donald Trump’s Tax returns.

The CEOs’ strategy was simple heading in: Let Dimon, who has been on the congressional hot seat many times before, take the lead.

Wednesday’s hearing had consumed big banks’ lobbying and PR operations for weeks, and centered around small-business lending, minority hiring, pay and inequality.

“Bulletproof vests covered with fire-retardant suits may not protect the banks,” Jonice Gray Tucker, a partner at the Buckley law firm in Washington, said ahead of the grilling. “It’s just a question, unfortunately, of how much scrutiny and how bad it is.”

Wednesday’s hearing could turn out to be a preview of the battle leading into the 2020 presidential campaign, when critics like Sens. Elizabeth Warren, D-Mass., and Bernie Sanders, I-Vt., could call for the big banks to be broken up if they win the Democratic nomination.

I’m concerned that several of these (banks) are simply too big to manage,” US Rep. Maxine Waters, the chair of the House Financial Services Committee, said during her opening statement.

The CEOs testifying have almost entirely risen to their positions after the financial crisis, with the exception of Dimon, who’s headed JPMorgan Chase since the end of 2005. Solomon only rose to the helm of Goldman in October.

Other banks represented are Citigroup, Morgan Stanley, State Street, Bank of America and Bank of New York.

In his opening statement, Dimon said that the risks that led to the global financial crisis in 2008, like the bankruptcy of Lehman Brothers, wouldn’t happen today, but pointed to large, unregulated non-bank mortgage lenders as a risk.

“Lehman simply would not happen again,” he said.

Dimon, who has lately been sounding off about income inequality, pointed to money laundering, cybersecurity, privacy and global competitiveness as the main risks to the financial system, and pointed to the lack of infrastructure spending in the US as a problem holding back the economy.

“We do not have a divine right to success,” Dimon said.