In case you haven’t noticed, the housing market is hot.

The Case-Shiller National Home Price Index was up 17% year-over-year through May, the last month for which we have data. Prices have nearly doubled nationwide since their 2012 lows, and they’ve only gone up further since. The National Association of Realtors reported that June existing home prices were up 22.9% from the previous year.

It’s not hard to see why prices have risen. New construction has lagged demand since the housing bubble burst in 2008. Meanwhile, millennials are aging out of the apartment phase of life and into the homeownership phase as they marry and settle down.

And then the pandemic hit. Urban living became all but intolerable. Demand shot through the roof for suburban homes, even as additional supply was crimped due to the off-and-on lockdowns affecting work. It didn’t help that pandemic disruptions caused materials prices to soar.

There’s an old saying among commodity traders that the cure for high prices is high prices. When prices get high enough, producers are incentivized to produce more, attracted by the potential for higher profits.

So, what does the housing boom mean for homebuilder stocks?

Homebuilder Stocks Are Up Big

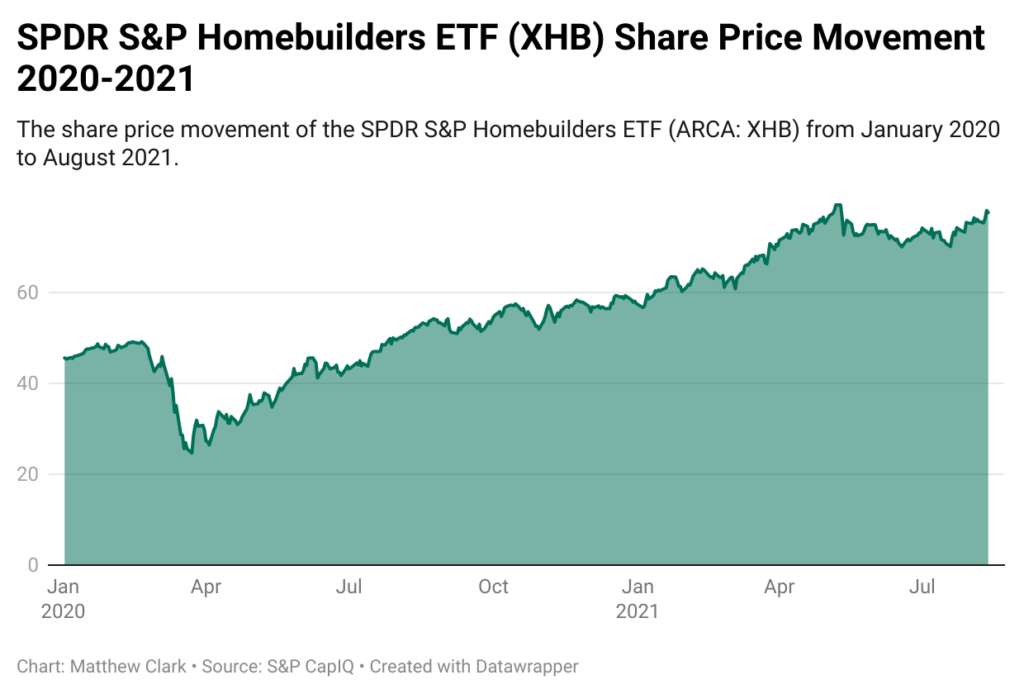

The SPDR S&P Homebuilder ETF (NYSE: XHB), which owns some of the biggest names in this space, has enjoyed a fantastic run. Over the past year, its shares are up by close to half and they’ve more than tripled off their pandemic lows.

Homebuilders face higher costs, but they seem to have no problem passing those costs on to their buyers.

Taking a look at two of the larger homebuilders in the index, D.R. Horton Inc. (NYSE: DHI) and Lennar Corp. (NYSE: LEN) rate at 76 and 82 in our Green Zone Ratings system, high enough to rate Horton as “Bullish” and Lennar as “Strong Bullish.” This suggests that either or both would be solid stocks to consider for the next year. As the biggest pure-play homebuilders, a continued housing boom should benefit them.

But why stop there?

These Stocks Go Beyond the Housing Boom

In Green Zone Fortunes, we dug a little deeper and recommended two companies that we believe are even better positioned to benefit from this housing boom trend.

The first, which we recommended in November, is a leading maker of the steel rebar used to reinforce concrete. Rebar is also extensively used in highway construction and other infrastructure projects, and it looks like the long-awaited infrastructure bill is finally reality. Our readers are already up 76% in this position. That’s almost double a 40% return in Lennar and almost triple a 29% return in D.R. Horton over the same period. And we believe there’s a lot more still to come.

In October, we also recommended the shares of an engineering and construction company that serves both residential and heavy civil engineering projects. The shares are up about 40%, and again, we believe the real move is just getting started.

The trends underlying this strength aren’t going away any time soon. In fact, they’re accelerating. But investors are only now starting to take notice.

These aren’t the only trends we track in Green Zone Fortunes. In fact, I’m adding my next stock recommendation in the August issue that will hit readers inboxes tomorrow. This stock is part of an essential and growing industry: health care.

It the latest in a hand-picked basket of health care and biotech stocks that includes the company behind a technology I call “Imperium.” To find out more about this stock mega trend, and how you can join my Green Zone Fortunes readers today, click here to watch my presentation now.

I hope you’ll join us!

To good profits,

Adam O’Dell

Chief investment strategist, Money & Markets