The U.S. economy is booming, but that doesn’t mean all markets are flourishing as another housing market bubble that looks eerily similar to the one before the Great Recession is taking shape.

And it’s only going to get worse, according to a recent article in Bloomberg.

Per Bloomberg:

Home prices are highly cyclical and, as everyone discovered from the last recession, their movements can have material consequences for the broader economy. Yet, according to the minutes of the Federal Reserve’s Aug. 1 monetary policy meeting, policy makers are only starting to recognize the “possibility” of a significant weakening in the housing market as a “downside risk.”

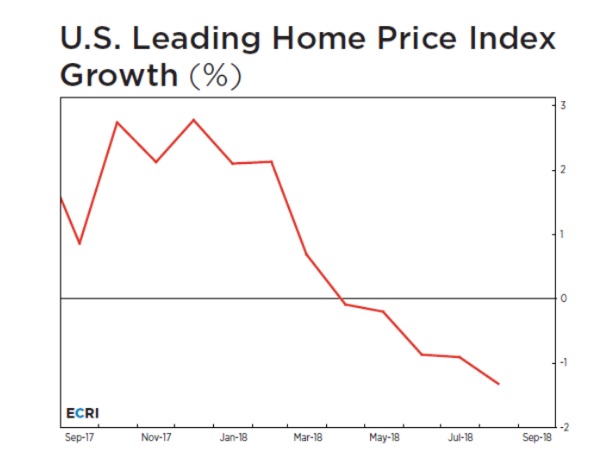

Our research suggests that real home price growth has already entered a cyclical downturn that is likely to intensify. Data this week is forecast to show a drop in housing starts and existing home sales.

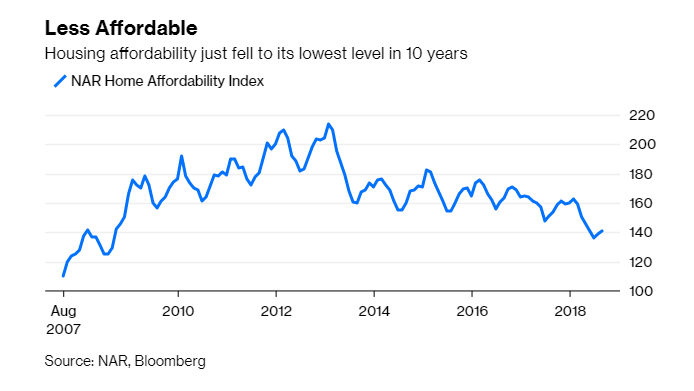

The reason for the price index’s dip is housing affordability as home prices continue to skyrocket. Housing affordability is the ability of a family with median income to buy a home at a median price. The metric is known as the National Association of Realtor’s Housing Affordability Index, and it is currently sitting at a 10-year low, partly due to rising mortgage rates because the Federal Reserve has been raising its benchmark interest rate.

But it’s not just about higher borrowing costs. Affordability has also been undercut by the steady rise in the ratio of median existing home prices to the median earnings of full-time wage and salary workers. This ratio recently reached a 10-year high, with the median cost of purchasing a home equaling almost six years of a worker’s earnings before easing slightly, according to our research.

According to the University of Michigan’s monthly consumer sentiment survey, housing market attitudes are at their lowest levels since the end of 2008 as the number of people who can’t afford them has exceeded the number of homes sold.

To add salt to the wound, residential building cost growth has ramped up to one of its highest readings on record, according to our calculations.

Steel tariffs, a shortage of available lots in some cities and delays in getting building permits also have contributed to the rising costs of buying a home.

Low unemployment also is having a negative affect on the housing market by pushing wages up as the jobless rate is at its lowest levels in a half-century.

And with the Fed seemingly determined to keep raising its interest rate, there doesn’t appear to be brighter days ahead, at least in the immediate future.