“What’s my next move?”

A lot of people are going to be asking that question if the Federal Reserve follows through on its plan for three interest rate cuts next year.

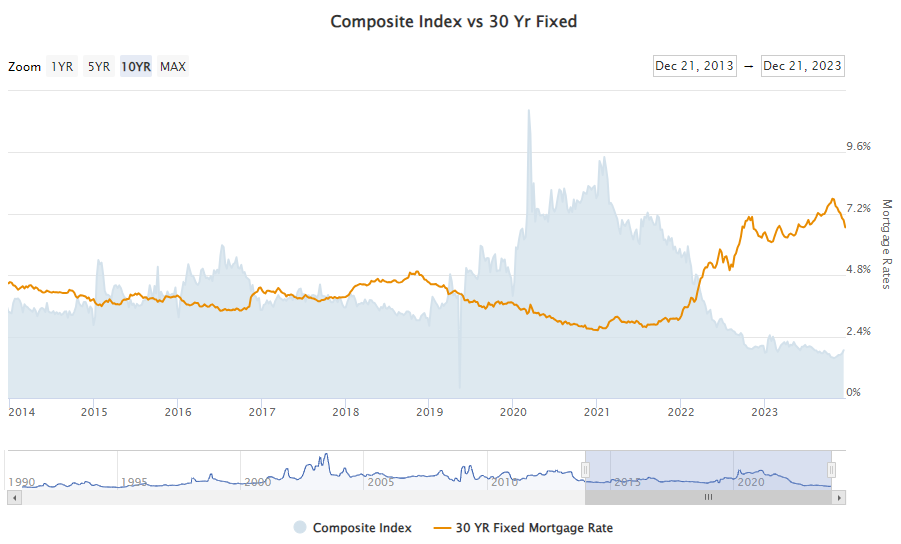

The housing market has been in a logjam for months now.

High mortgage rates paired with high prices have locked many potential buyers out. And potential sellers don’t want to let go of their current mortgage that’s likely locked at a much lower rate.

Mortgage demand is at its lowest point in more than a decade. Check out the chart from Mortgage News Daily below. But things are starting to turn around…

Last week, mortgage applications to purchase a home jumped 4% after the Fed’s interest rate projections for 2024. That’s still 18% lower than we were a year ago, and there was another slight 1% dip this week, but we’re seeing progress in the right direction.

I’m going to be watching the housing market closely throughout 2024. Certain homebuilders and other related companies are tuned in and working to convert potential buyers into homeowners.

And with Adam O’Dell’s proprietary Green Zone PowerRatings system, we can see if any of these stocks are investable before a new potential housing boom.

Let’s get into it…

DHI Crushed It by 3X

I started plugging homebuilder stocks into Adam’s system, and all signs point to this being a strong sector going forward.

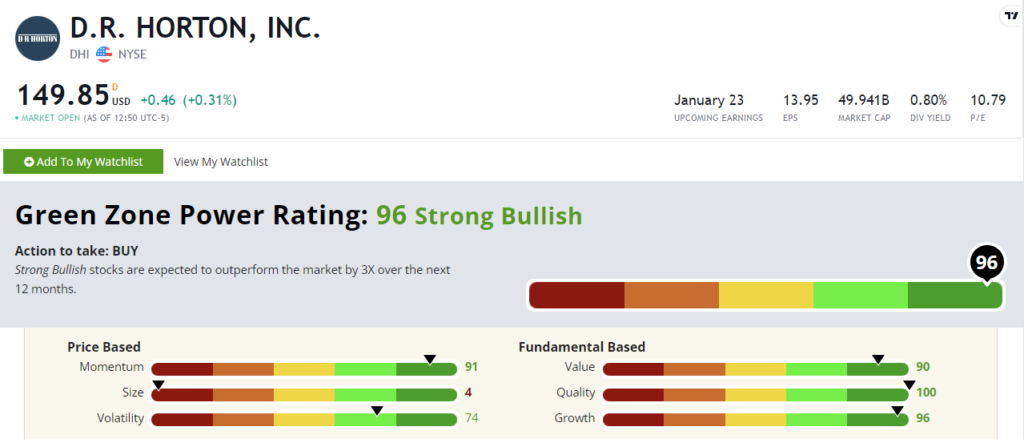

Case in point: D.R. Horton Inc. (NYSE: DHI)…

DHI rates a “Strong Bullish” 96 out of 100. Stocks in this category are expected to crush the broader market by 3X over the next 12 months.

Zooming in on that 91 Momentum rating, DHI stock is up more than 25% over the last six months. That’s more than 3X the S&P 500’s 8% gain over the same time frame. I love it when we find a stock that almost perfectly exemplifies the potential of Adam’s system!

D.R. Horton showed why it’s rated a 96 on Growth in its latest earnings call. DHI reported adjusted earnings at $4.45 per share, crushing the Zacks estimate of $3.98. Total revenue also grew 9% year over year to $10.5 billion for the third quarter of 2023.

The only drag on DHI is its massive size. With a market cap just shy of $50 billion, we can’t expect a huge small-cap bump like what may occur with a smaller stock with similar ratings on other factors.

But it’s hard to argue against D.R. Horton as a solid stock for 2024.

More of the Same

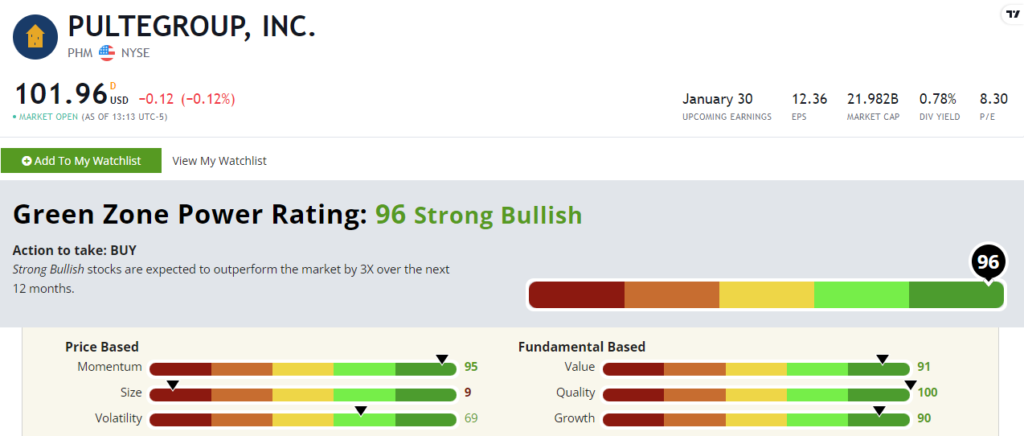

Like DHI, PulteGroup Inc. (NYSE: PHM) also rates a “Strong Bullish” 96 out of 100.

These two stocks almost look like mirror images in Green Zone Power Ratings!

Like D.R. Horton, PHM also has had incredible momentum in the second half of the year. The stock is up 34% over the last six months, including a 16% gain in the last month alone. That’s why it rates a 95 on Momentum.

And, like D.R. Horton, PulteGroup also just had an incredible quarter, despite higher interest rates. It posted record third-quarter profits of $639 million.

If PHI managed a record quarter in this logjammed housing market, imagine the potential as rates trend lower and buyers start coming out of the woodwork…

Adam Already Knew

I get a huge kick out of jumping into our Green Zone Power Ratings system and finding stocks to highlight for you here in Stock Power Daily each week.

And I believe the housing market is going to be a leading and investable mega trend in 2024.

But here’s the thing…

Adam was already tapped in long before things really started taking off.

He recommended a smaller homebuilder to his Green Zone Fortunes subscribers back in May, and they’re now sitting on a 73% open gain in just under seven months.

Out of respect for those who have joined his premium stock research service, I won’t reveal that ticker in today’s issue. (It’s already above Adam’s buy-up-to price anyways.)

I’m bragging on him a bit here because I truly believe that one of the best moves you can make before 2024 kicks off is to join Green Zone Fortunes now.

Whether it’s housing, energy, artificial intelligence or any other potential mega trend, Adam is tapped in and ready to guide you to the best ways to invest. Just click here for information on how to join.

Until next time,

Chad Stone

Managing Editor, Money & Markets