Consumer spending accounts for a lion’s share of gross domestic product (GDP) in the U.S. — around 70% of it, in fact.

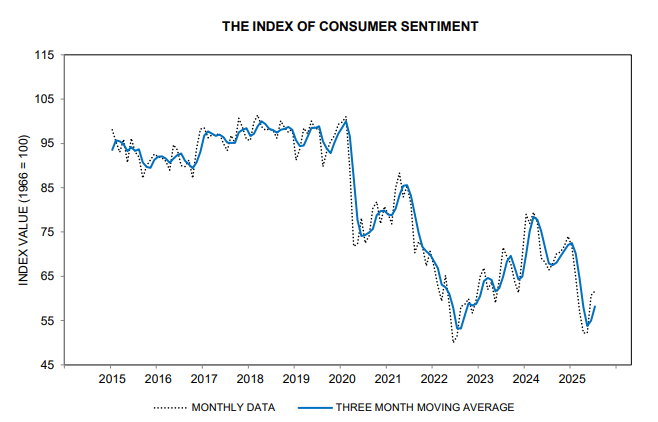

So it’s always helpful to get a gauge of how consumers are feeling … and the University of Michigan’s consumer sentiment index can do just that.

Take a look:

This chart shows the last 10 years of data, and you can see that the COVID-19 pandemic in early 2020 sparked a sinking trend. The index then made another low in the 2022 bear market, despite the broader economy not moving into a recession. More recently, sweeping tariff threats spooked consumers (and the market).

But now that we have a better idea of how President Trump’s tariff plan is playing out, confidence is climbing again. And consumer stocks are helping push the markets higher.

With that framework in place, we can use my Green Zone Power Rating system to find out how investable consumer stocks are right now.

Consumer Discretionary Sector X-Ray

As I showed you yesterday, the consumer staples and discretionary sectors ranked No. 3 and No. 1, respectively, in sector performance last week as the bull market bounced back.

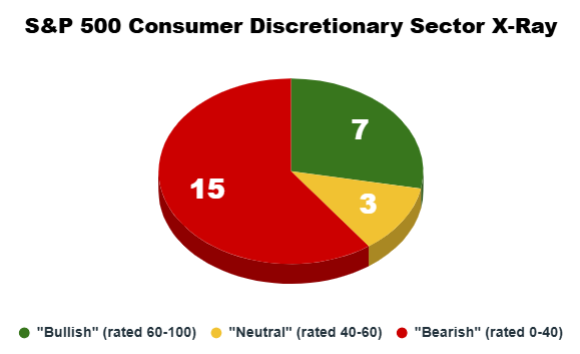

We’ll save staple stocks for another day and focus on the discretionary sector in today’s Green Zone Power Rating x-ray. As always, each stock in the sector lands in one of three categories:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

Seeing concentration like this, with 7 of 25 stocks rating “Bullish” in my system currently, tells me only a small group of consumer discretionary stocks have market-beating potential ahead.

As always, it tells me that broadly investing in the sector as a whole means we’re buying a basket of stocks that leans toward underperformance in the coming months. If we can be a little more selective, we can pinpoint stocks that are set to outperform and avoid holding so many laggards.

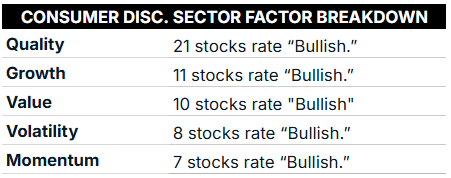

Looking at individual factors of my system points to this concentration as well…

Consumer Discretionary Sector Boasts High Quality

Looking at how consumer discretionary stocks stack up on my individual Green Zone Power Rating factors, I can confidently say one thing about this sector:

These are high-quality companies! With more than 80% rating “Bullish” on my quality factor, we can expect strong balance sheets and profit margins that support steady business.

But after that, we have a lower concentration of stocks that rate well on Growth, Value, Volatility and Momentum.

Let’s explore the Quality factor a little more using one of my submetrics that contribute to that composite Quality rating.

ROI Reveals a Critical Consumer Trend

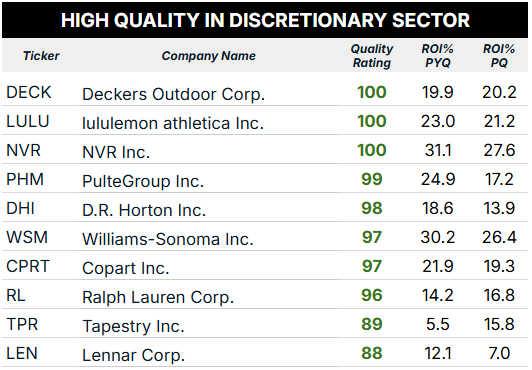

For today’s analysis, I found the Top 10 consumer discretionary stocks based on my Quality factor, while also zooming in on their return on investment (ROI).

Here’s how things shook out:

While I’ve left out overall Green Zone Power Ratings, I will say that four stocks rate “Bullish,” one stock is “Neutral,” and the other five stocks rate “Bearish.” If you’d like to roll up your sleeves and get the whole ratings picture for these and thousands of other stocks, click here to join Green Zone Fortunes today.

Looking at the Quality factor, all 10 of these stocks are rated “Strong Bullish,” which is excellent! It means these companies are managing their finances well to support the business.

However, comparing ROI from the previous quarter to the same quarter a year ago points to certain trends in the consumer market.

You see massive declines in ROI for homebuilders like PulteGroup Inc. (PHM) and Lennar Corp. (LEN), an industry that is dealing with tariff hikes on the supply side, while fashion conglomerates like Tapestry Inc. (TPR) and Ralph Lauren Corp. (RL) have boosted ROI over the last year.

One factor doesn’t make a stock — it’s why I’ve developed my system with six factors in mind — but this does highlight a tariff trend that’s worth considering as this administration’s economic plan plays out…

To good profits,

Editor, What My System Says Today