It’s almost impossible to talk about software without mentioning Oracle Corp. (NYSE: ORCL). Let’s see how Oracle stock rates as 2023 rolls on.

Founded in 1977, Oracle is one of the largest software companies in the world.

The company offers a range of products and services, including cloud computing, database management systems, enterprise resource planning software and e-commerce solutions.

But with tech stocks selling off, you want to know what’s worth a buy — or a pass.

Here’s what this company is all about and how Oracle stock scores on our proprietary Stock Power Ratings system.

Oracle’s Strengths

Oracle has several strengths that make it an attractive investment for any investor looking to diversify their portfolio.

First and foremost is its sheer size — as one of the largest software companies in the world, it has immense reach across many different industries and countries. This allows Oracle to develop new products quickly, as well as leverage existing ones to enter new markets with ease.

Additionally, Oracle has invested heavily in research & development — it spent $8 billion on R&D alone in 2022 — which helps ensure that it remains ahead of competitors when it comes to innovation.

Finally, Oracle has been quick to embrace cloud computing technologies which have allowed it to remain competitive in a rapidly changing technological landscape.

Oracle’s Outlook for 2023

Based on recent trends and projections from analysts, Oracle is expected to continue its growth trajectory into 2023.

Analysts predict that revenue could increase by 7% to 10% year over year due to strong demand for its cloud-based services such as Database as a Service (DBaaS), Platform as a Service (PaaS), Infrastructure as a Service (IaaS) and Software as a Service (SaaS) products.

These services are expected to be particularly popular among small businesses that need cost-effective options for managing data needs without having to invest heavily upfront in hardware or software licenses.

Analysts also predict that Oracle could benefit significantly from its investments into artificial intelligence (AI) technologies. This could help improve efficiency within organizations while also reducing costs associated with training employees on how to use these technologies properly.

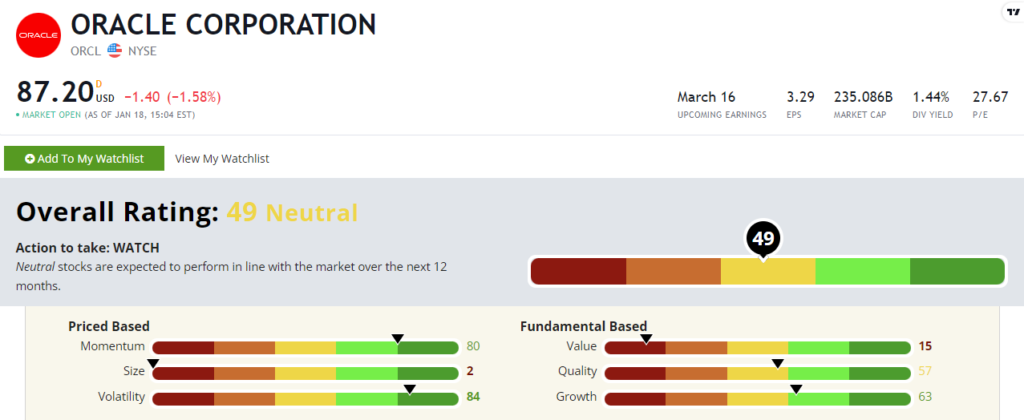

But our Stock Power Ratings system shows that Oracle stock may not wow investors in 2023.

Oracle Stock Power Ratings

Oracle stock rates a “Neutral” 49 out of 100. That means our system expects the stock to perform in line with the broader market over the next 12 months.

Oracle stock has bucked some of the broader tech sector trends of the last several months. ORCL shares are 18.6% higher over the previous six months. For comparison, the S&P 500 is down 1.5% during that same span of time.

That’s what we like to call “maximum momentum” here at Money & Markets. And its partly why Oracle stock rates an 80 out of 100 on our momentum factor.

But this is a tech stock, and investors are willing to pay for tech growth. That’s why ORCL sports a 15 on our value factor.

Bottom Line: Oracle is a massive software company with a lot of potential. But if you follow Stock Power Ratings, Oracle stock is only one to watch for now.