At first blush, trying to understand how to trade options may be like learning a new language, even for seasoned traders.

But at its core, trading options isn’t that difficult.

Yes, you do have to understand the basic terminology of options trading, but once you have that it simply comes down to deciding how you think a stock will perform. Put those two things together and options trading becomes relatively simple.

In this how-to guide, we’ll break down what options trading is, how options work, introduce you to options trading lingo and tell you about how to use options to mitigate risk.

Speaking of risk, you have to remember, just like with regular equities trading, there is a risk. The value of a company you buy into can go down, thus you lose money. But it can also go up, thus you make money.

With that, here is a comprehensive guide on how to trade options.

What is Options Trading?

Options trading is a great way for the beginning investor to get started with stock trading.

This is someone who does not use a financial adviser to manage their portfolio. But that doesn’t mean you can’t trade options if you are using an adviser. Basically, anyone can trade options.

The first thing you need to know about how to trade options is the different types of options you can trade. There are two:

- Call options: This is a contract that gives you the right to purchase 100 shares of an equity at a particular price at a particular time.

- Put option: This is a contract that gives you the right to sell 100 shares of an equity at a particular price at a particular time.

Remember, having a contract does not obligate you to exercise it. You are allowed to let the contract expire if you choose.

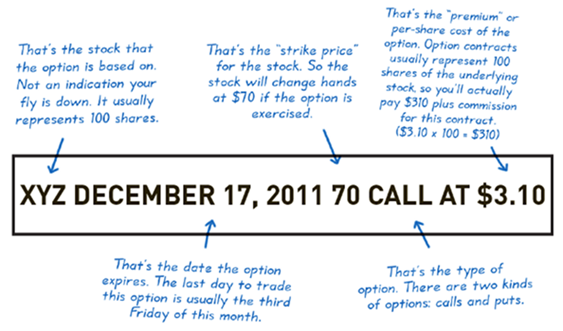

Next, you need to understand how to read a stock option quote. It may seem like a line of gibberish, but all the information on the line serves a purpose and gives the trader all of that information in one spot.

Courtesy of Ally Financial

Here’s some terminology to help guide you when looking at this line:

- Strike — The price at which you will buy/sell shares of the underlying stock.

- Expiration date — The date the contract ceases to exist.

- Premium — Price paid or received for the options contract.

As you can see, all the information you need related to the quote is right there.

Another thing to understand is just who you are trading options contract with. These are called market-makers.

When you purchase an options contract, the stock exchange will post the offer to other traders. The market-maker will accept the contract. It’s all done behind the scenes and you do not have to seek out the market-maker.

These market-makers are essentially betting against your contract. If your contract loses money, the market-maker wins. Vice-versa if the contract makes money.

To reiterate, you don’t need a financial adviser to trade options. You can use just about any online trading platform to trade options. In some cases, there is no fees charged per trade to do so.

Knowing what they are is vital in understanding how to trade options.

How Options Work

Let’s boil this down to the basics.

To explain how options work, we’ll use a fictional company.

Let’s say you have seen news that XYZ Co. is getting ready to release a widget you believe will revolutionize the widget industry. You think people will rush out to buy this new widget, leading the stock price of XYZ Co. to skyrocket.

Currently, XYZ Co. is trading at $130 per share. So, buying 10 shares will run you $1,300. That seems a little expensive and is perhaps more money than you are willing to lose.

Currently, XYZ Co. is trading at $130 per share. So, buying 10 shares will run you $1,300. That seems a little expensive and is perhaps more money than you are willing to lose.

Instead, you buy an option contract at the guaranteed price of $130 per share. That contract expires in 60 days. The cost of the option contract is $2.45 per share or $245 for the contract to buy XYZ Co.

Over the next 60 days, let’s say the share price of XYZ Co. takes off — as you predicted. The stock goes up $7.50 to $137.50 per share. Your option will increase by a percentage calculated by the stock exchange. Let’s say that the increase is $5.

After holding the contract for 30 days, you decide the company is going to fall back and you decide to sell. Be warned, because you are selling your contract with half the time left, half the value of that contract is subtracted. That leaves your initial contract valued at $1.22 per share ($2.45 divided by two).

But the increase in value is still calculated. That means you add the $5 increase to the $1.22 your contract is valued to give you a total price of $6.22 per share, or $622 for the entire contract.

You paid $245 when you purchased the contract. Now you are selling it for the new premium of $622. Your profit is $377, or 154%.

Remember, the contract can go the other way and you can lose money if the price of the stock you bought on contract for drops.

Understanding the outcome of an options contract goes a long way to know how to trade options.

The Lingo of How to Trade Options

When you start trading options, you will hear a lot of different terms thrown out. It’s important you understand what those mean to become a better trader.

We’ll break down each term and what it means for both put and call options:

Put Options

- Buy to open — You purchase the right to sell a stock at the exercise price on or before the contract expiration date.

- Sell to close — You give up the right to sell a stock at the exercise price on or before the contract expiration date.

- Sell to open — You take the obligation to buy a stock at the exercise price on or before the contract expiration date.

- Buy to close — You give up the right to buy a stock at the exercise price on or before the contract expiration date.

- Exercise — You exercise the right you purchased to sell a stock at the exercise price on or before the contract expiration date.

- Assigned — The market-maker exercises their right to sell you the stock at the exercise price on or before the contract expiration date.

- Expired — The option contract term has expired and you don’t have the right to sell (if you bought the put) or buy (if you sold the put) the stock at the strike price.

Call Options

- Buy to open — You purchase the right to buy a stock at the exercise price on or before the contract expiration date.

- Sell to close — You give up the right to buy a stock at the exercise price on or before the contract expiration date.

- Sell to open — You take the obligation to sell a stock at the exercise price on or before the contract expiration date.

- Buy to close — You give up the right to sell a stock at the exercise price on or before the contract expiration date.

- Exercise — You exercise the right you purchased to buy a stock at the exercise price on or before the contract expiration date.

- Assigned — The market-maker exercises their right to buy the stock at the exercise price on or before the contract expiration date.

- Expired — The option contract term has expired and you don’t have the right to buy (if you bought the call) or sell (if you sold the call) the stock at the strike price.

As you can see, there are a lot of terms to use. But like with anything else, the more you use them, the easier they are to understand. There’s actually more terminology, but we will keep it just to the basics for now.

So knowing the vocabulary is a key component to understanding how to trade options.

Mitigating Risk With Options Trading

With trading any equity, there is risk involved. The stock price can drop, causing you to lose money from your investment. Likewise, the price can shoot up and you gain on your investment.

This is no different with options.

However, with options, your financial loss can be a lot less because the price of a contract is less than if you were to buy the company stock outright.

However, with options, your financial loss can be a lot less because the price of a contract is less than if you were to buy the company stock outright.

That said, your actual dollar gain is also less because you are spending less money to invest. However, the percentage of your gain can be high.

One way to mitigate your risk is by what is called hedging. This is where options play a role.

Let’s say you have a full portfolio of stock, but you are concerned there could be a decline in the market. That pullback will likely cost you money on your investment.

You have three choices to consider at that point:

- Hold your stock, wait out the potential dip and wait for your shares to become profitable. Your risk here is that your positions fade and either don’t recover or take a long time to reach profitability.

- Sell your stock so that sleeping at night doesn’t become an effort. The deal here is that you may pay taxes on any profits you made on any of those positions. The risk here is that you could be wrong about a pullback and the stocks you sold actually gain.

- You can hedge your position with a put option.

If you are bullish on your positions, but you want to avoid paying out the nose in the event of a short-term dip, a hedge would be a solid bet.

Let’s use XYZ Co. as an example.

Six months ago, you purchased 100 shares of XYZ Co. outright for $20 per share. Your total investment is $2,000. Now, XYZ Co. is selling for $30 per share, making your position worth $3,000 — a 50% gain.

However, you sense a weak market that has the potential to pull back 25%.

But you have that bullish outlook for XYZ Co. and you don’t want to sell your shares. Then again, you don’t want to take a huge loss either.

So, you buy a put option on XYZ Co. with a strike price of $30 that expires in 90 days for $2 per share. The option will cost you $200 ($2 per share times 100 shares.

The thing to remember here is that put options see an increase in value when the stock price falls.

Move ahead 90 days and that market pullback happened. Shares of XYZ Co. have fallen 25% to $22.50 per share. That means your regular stock position is down $750, or 25% from its peak.

Here’s where the hedge helps.

That put option you bought has paid off. That put is now worth $7.50 and you can sell the position for $550 ($750 minus the $200 price of the initial contract). If you add that to your regular stock position value of $2,270, the value of your overall portfolio is $2,800.

Had you not purchased the hedge, you would only have a gain of 12.5% from the initial stock purchase of $20 per share. However, with the hedge, you gain 40% from that initial purchase.

If you were wrong about the dip and the share price of XYZ Co. holds firm at $30 in 90 days, you are only out the $200 you spent to buy the put option. To some investors, that $200 is worth the risk.

Understanding the risks and how to mitigate them is another key to how to trade options.

Make Sure to Watch the Cycles

Money & Markets Chief Investment Strategist Adam O’Dell has the perfect strategy for trading options, called Cycle 9 Alert.

As part of that strategy, O’Dell follows a tried and true system that includes a lot of math and a ton of analysis.

But, boiling down to the basics, O’Dell said options traders should start with sector rotation. He starts with the nine key sectors:

- Consumer Discretionary

- Consumer Staples

- Utilities

- Health Care

- Energy

- Materials

- Industrials

- Financials

- Technology

“These sectors are in constant motion, rotating in and out of favor,” O’Dell said. “Knowing which are powering up or powering down at any given time tells me where to focus my attention.”

He said using sector rotation indicates when some sectors perform best heading into market peaks, and other sectors do better when markets are down.

It’s using those cycles where investors can find profit.

“Countless studies have shown that momentum strategies work in the U.S. stock market and in emerging markets, on large-cap stocks and small-cap stocks, and consistently across all asset classes,” O’Dell said.

Where options come into play is due to the fact that because of how options are structured, when a stock moves by a few cents, the option play can change by a few dollars.

In addition, the type of options trading O’Dell does allow you to completely limit your risk while giving you unlimited profit potential.

Now, You Are Ready to Trade Options

There you have it.

It may seem a bit complex but once you get into options trading, it’s not that difficult. You just need to understand the different options and how you can profit from each one.

From there, you have to decide which option is in the best interest for you and which way you think a particular company is going to go.

Understanding these basic concepts should provide you a good foundation for how to trade options.

Have a financial topic you want to know about? Let us know by emailing us at feedback@moneyandmarket.com or by commenting below.