I used to love shopping.

Now, not so much.

When my wife and I looked for a dining room set for our home, we visited several different stores.

It took days and it was exhausting.

I would much rather have shopped online … in the comfort of my living room.

And I’m not alone in that sentiment:

The chart above shows the growth of furniture sales online (aka e-commerce).

From 2020 to 2025, Statista expects online sales revenue of furniture to rise 73.9% to more than $208 billion.

Today's Power Stock sells furniture in stores and online: Haverty Furniture Companies Inc. (NYSE: HVT).

In addition to branded furniture, HVT sells third-party bedding and offers internal credit to customers.

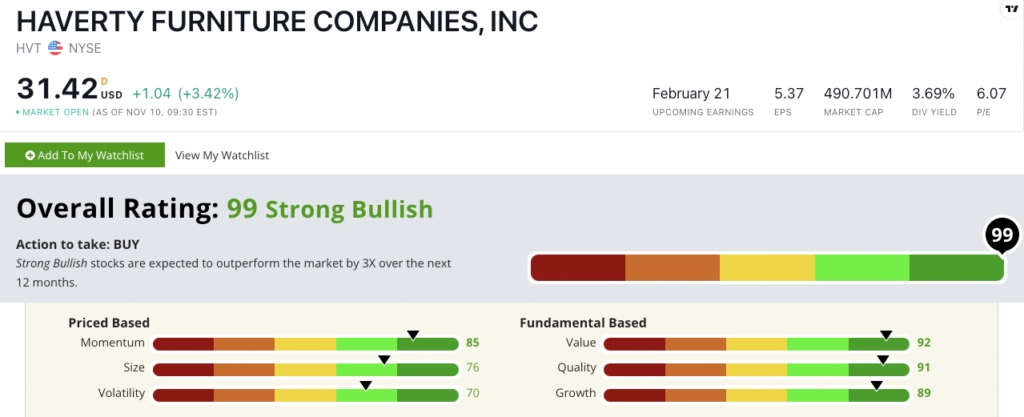

Haverty’s stock scores a "Strong Bullish" 99 out of 100 on our Stock Power Ratings system.

We expect it to beat the broader market by 3X in the next 12 months.

HVT Stock: All Factors Green

HVT just closed out an outstanding quarter:

- Sales were $274.5 million — a 5.4% bump from the same period a year ago!

- Its one-year annual sales growth rate is 35.4%, while its earnings-per-share growth rate is 56.7%!

Those numbers show why HVT scores an 89 on our growth factor.

It’s even stronger on our value and quality factors.

HVT’s price-to-earnings and price-to-book value ratios are almost half the industry average — earning it a 92 on value.

The company’s return on assets is double the home improvement retail average.

All of this tells us the stock is undervalued compared to its peers and company management continues to turn profits.

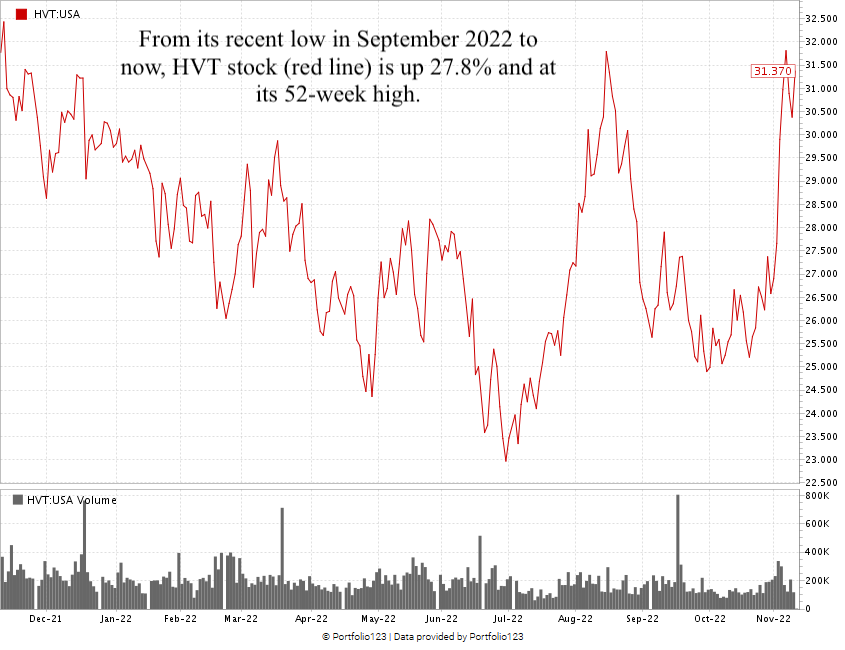

Created in November 2022.

From its low in September 2022 to its high last week, HVT raked in a 27.8% gain.

It’s showing the “maximum momentum” we love to see in stocks.

Haverty stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we're “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

We all need furniture.

Companies with e-commerce marketplaces make furnishing our homes even easier.

HVT is a great addition to your portfolio as a leader in providing top-of-the-line furniture — no matter your shopping preference.

Stay Tuned: A Massive Oil Co. Raking in Profits

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for tomorrow’s issue, where I’ll share all the details on a huge name in the oil game that is maximizing profits as oil demand remains elevated.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets