Today, I want to do something different. I want to assume the Federal Reserve is right about inflation. This would mean that inflation is transitory and will soon drop back below the Fed’s target of 2%. It would also mean the Fed’s policies can keep inflation at that 2% target.

Although no central bank has ever precisely managed to hold inflation steady for an extended period of time, I’ll assume the current Fed is capable of that.

Now for the bad news. Even if the Fed can achieve stable inflation at their desired target, long-term interest rates should almost triple.

The 10-year Treasury note currently pays investors about 1.3%. Historically, the yield on this note has been above the rate of inflation. That makes sense.

Rational investors expect to make money when they buy something. If they buy a 10-year Treasury, they expect their return to yield a small profit after inflation. If the return doesn’t keep up with inflation, they suffer a loss in real terms.

Interest Rates Are Below Inflation

At the current rate, buying a Treasury appears to lock in a loss. Inflation is above 5% based on the Consumer Price Index and is higher than the current Treasury yield of 1.3% by any measure.

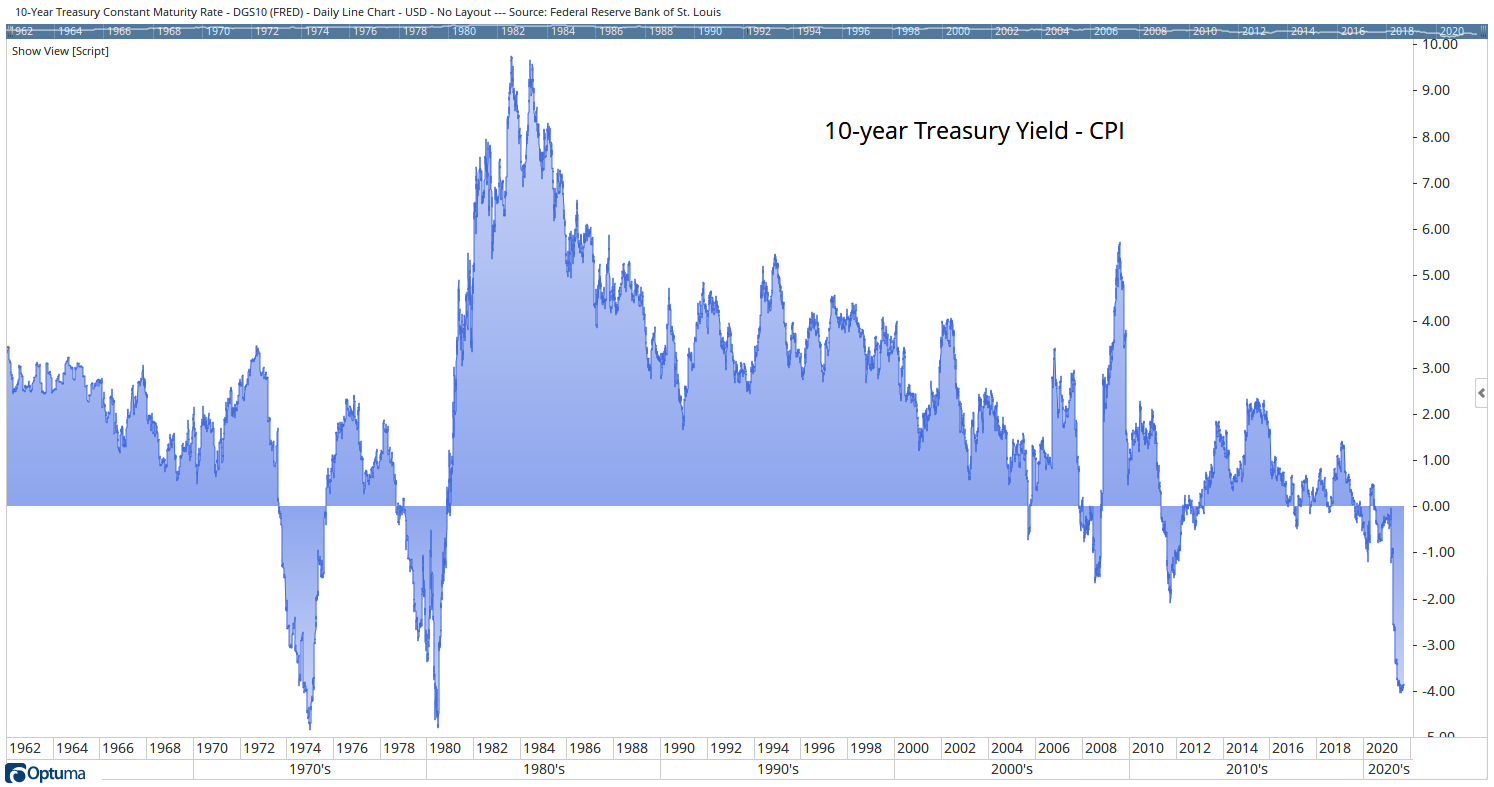

Based on history, it’s unusual for investors to buy 10-year Treasuries when the yield is less than the inflation rate. The chart below shows the rate on 10-years minus the annual rate of change in the Consumer Price Index. Positive values indicate investors earn more than inflation.

10-Year Treasury Rates

Source: Optuma.

Negative values are rare. They were seen briefly when inflation was high in the 1970s and early 1980s. Negative values also developed briefly when the Fed experimented with new policies in the past 15 years.

During Fed Chair Alan Greenspan’s tenure, often considered to be the Golden Age of monetary policy, the interest rate was an average of 1.3% above inflation. To get back to that level, rates on the 10-year would need to rise to 3.2%, assuming the Fed is right about inflation.

If the Fed is wrong, rates should be even higher.

P.S. If you haven’t reserved your spot for my colleague Adam O’Dell’s upcoming Wednesday Windfalls live event, you’re running out of time. During Thursday’s live event, Adam will show you how to target a triple-digit winner, each and every Wednesday. Sign up here.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.