If your local grocery store looks anything like mine, you’ve noticed more empty shelves than ever before.

We can attribute some of the shortages to shoppers buying more essential items because we don’t know how much higher inflation — which just hit a 40-year high of 8.5% — will go.

Another reason is that grocery stores are struggling to get products from distribution centers to shelves. Blame distance, a lack of labor or other breakdowns in the supply chain.

In 2020, only 37% of business owners in the U.S. felt supply chain disruption was a significant risk to business.

By 2022, half of businesses felt that way — making supply chain disruptions the leading threat for businesses this year.

Today’s Power Stock is beating problematic supply chain issues: Ingles Markets Inc. (Nasdaq: IMKTA).

This regional grocery store chain operates in the southeastern United States. As of 2021, Ingles had 198 supermarkets under the Ingles brand and nine under the brand name Sav-Mor.

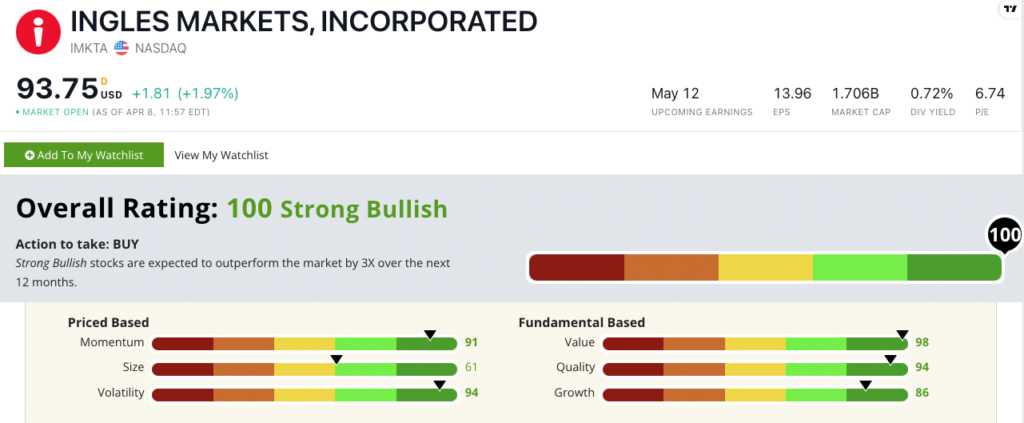

IMKTA scores a perfect “Strong Bullish” 100 on our Stock Power Rating system, and we expect it to beat the broader market by 3X in the next 12 months.

IMKTA Stock: Momentum, Value, Quality and Growth … All in One

Here’s what tells me that IMKTA is a top-notch grocery stock:

- All of its 198 supermarkets are located within 200 miles of its distribution facility in Asheville, North Carolina.

- In addition to grocery stores, Ingles operates its own milk and juice processing and packaging facility — cutting out the need for third-party suppliers for these critical goods.

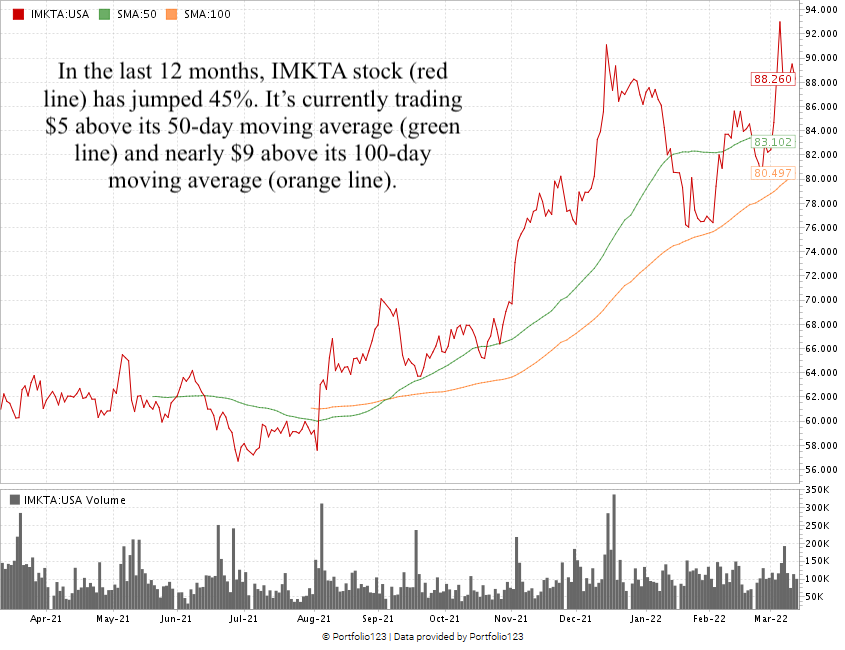

From 2019 to 2021, Ingles grew its total annual revenue by 10%.

This translated to a strong uptrend in its stock price:

During the COVID-19 pandemic, Ingles raised its total annual revenue from $4.2 billion in 2019 to $4.6 billion in 2020.

That jumped to $5 billion in 2021.

Remember how I said its stores’ proximity to the distribution center are a strength? While most groceries struggle to keep their shelves stocked, Ingles can get products the same day to meet consumer demand.

Ingles Markets Inc. stock scores a perfect 100 overall on our Stock Power Ratings system.

That means we are “Strong Bullish” on IMKTA and expect it to crush the broader market by at least three times in the next 12 months.

The stock scores in the green in all six metrics we use in our system, but it’s strongest on value, quality and momentum.

Its price-to ratios (sales, earnings, cash flow and book value) are at least half the food and beverage retail averages.

Ingles boasts double-digit returns on assets, earnings and investment, while its peers average in negative territory.

IMKTA also pays a 0.72% forward dividend yield, which is $0.66 per share, per year — just to own the stock.

Stay Tuned: Brazilian Ag Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue where I’ll share all the details on a terrific Brazilian agricultural stock.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.